It May Be Possible That W T K Holdings Berhad's (KLSE:WTK) CEO Compensation Could Get Bumped Up

Key Insights

W T K Holdings Berhad to hold its Annual General Meeting on 24th of June

Salary of RM403.2k is part of CEO Patrick Wong's total remuneration

The overall pay is 44% below the industry average

Over the past three years, W T K Holdings Berhad's EPS grew by 86% and over the past three years, the total shareholder return was 19%

Shareholders will probably not be disappointed by the robust results at W T K Holdings Berhad (KLSE:WTK) recently and they will be keeping this in mind as they go into the AGM on 24th of June. This would also be a chance for them to hear the board review the financial results, discuss future company strategy to further improve the business and vote on any resolutions such as executive remuneration. Here is our take on why we think CEO compensation is fair and may even warrant a raise.

View our latest analysis for W T K Holdings Berhad

How Does Total Compensation For Patrick Wong Compare With Other Companies In The Industry?

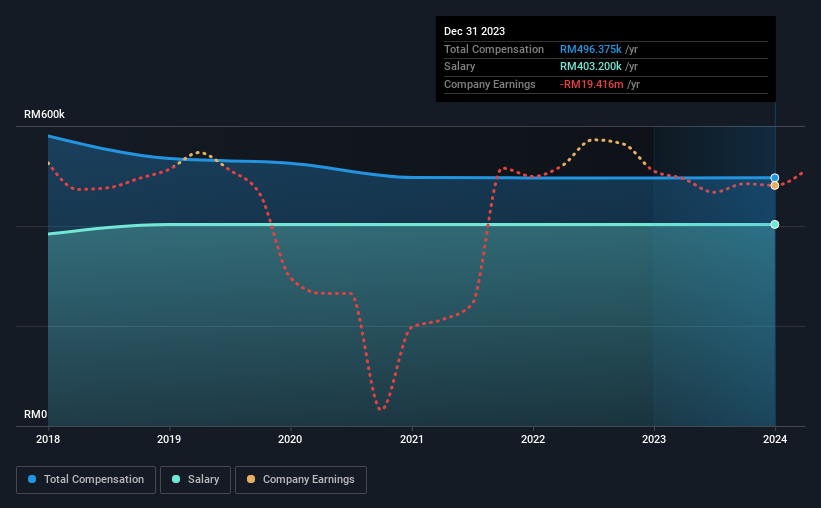

According to our data, W T K Holdings Berhad has a market capitalization of RM234m, and paid its CEO total annual compensation worth RM496k over the year to December 2023. That's mostly flat as compared to the prior year's compensation. We note that the salary portion, which stands at RM403.2k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the Malaysia Forestry industry with market capitalizations under RM944m, the reported median total CEO compensation was RM886k. In other words, W T K Holdings Berhad pays its CEO lower than the industry median. What's more, Patrick Wong holds RM4.6m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2023 | 2022 | Proportion (2023) |

Salary | RM403k | RM403k | 81% |

Other | RM93k | RM93k | 19% |

Total Compensation | RM496k | RM496k | 100% |

On an industry level, roughly 78% of total compensation represents salary and 22% is other remuneration. There isn't a significant difference between W T K Holdings Berhad and the broader market, in terms of salary allocation in the overall compensation package. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

W T K Holdings Berhad's Growth

Over the past three years, W T K Holdings Berhad has seen its earnings per share (EPS) grow by 86% per year. It achieved revenue growth of 28% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has W T K Holdings Berhad Been A Good Investment?

With a total shareholder return of 19% over three years, W T K Holdings Berhad shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

The company's overall performance, while not bad, could be better. If it manages to keep up the current streak, CEO remuneration could well be one of shareholders' least concerns. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 2 warning signs for W T K Holdings Berhad that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance