May 2024's High Insider Ownership Growth Companies On Chinese Exchange

As global markets navigate through fluctuating conditions, China's recent initiatives to stabilize its housing sector and the broader economy have become focal points of investor attention. In this context, exploring growth companies with high insider ownership on Chinese exchanges offers a unique perspective on entities potentially poised for resilience and informed strategic navigation in these uncertain times.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Suzhou Sunmun Technology (SZSE:300522) | 37.6% | 63.4% |

Zhejiang Songyuan Automotive Safety SystemsLtd (SZSE:300893) | 20% | 24.2% |

Arctech Solar Holding (SHSE:688408) | 38.7% | 24.5% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

Jilin University Zhengyuan Information Technologies (SZSE:003029) | 12.1% | 58.6% |

Offcn Education Technology (SZSE:002607) | 26.1% | 65.3% |

We're going to check out a few of the best picks from our screener tool.

Zhongman Petroleum and Natural Gas GroupLtd

Simply Wall St Growth Rating: ★★★★★★

Overview: Zhongman Petroleum and Natural Gas Group Corp., Ltd. is an oil and gas company based in China, specializing in drilling and completion engineering services as well as petroleum equipment manufacturing, with a market capitalization of approximately CN¥10.61 billion.

Operations: Zhongman Petroleum and Natural Gas Group Corp., Ltd. primarily generates its revenue from drilling and completion engineering services alongside petroleum equipment manufacturing.

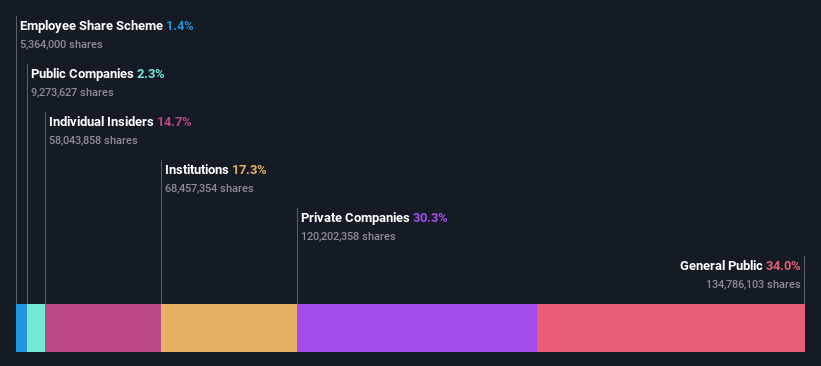

Insider Ownership: 14.7%

Zhongman Petroleum and Natural Gas Group Ltd., a player in China's energy sector, exhibits significant growth prospects with high insider ownership. Despite a recent dip in quarterly revenue and net income, the company is expected to see robust annual earnings growth of 30.84% over the next three years, outpacing the broader Chinese market. The firm's return on equity is also forecasted to remain very high at 47.9%. However, it faces challenges with a high level of debt and dividends that are not well covered by cash flows. Additionally, its recent share buyback indicates confidence from management regarding the company’s value.

Suzhou Novosense Microelectronics

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Novosense Microelectronics Co., Ltd. is a company specializing in the development and manufacturing of high-performance sensor chips, with a market capitalization of CN¥12.42 billion.

Operations: The revenue segments for the company are not specified in the provided text.

Insider Ownership: 25.1%

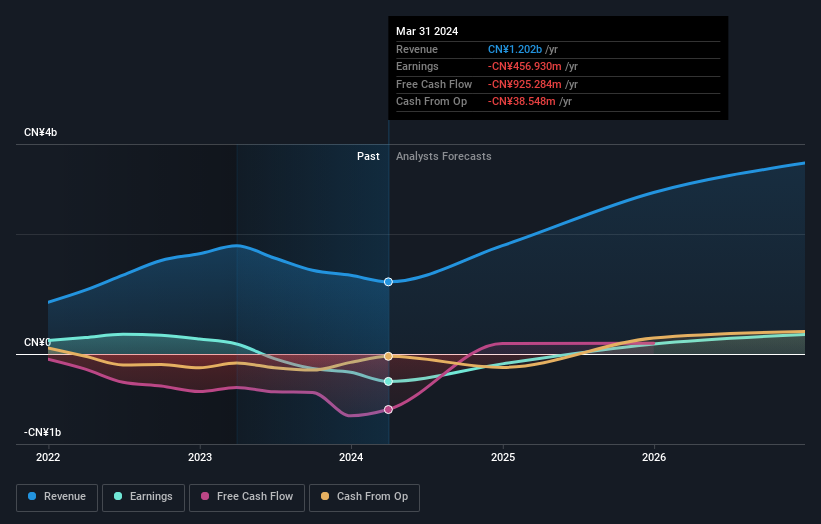

Suzhou Novosense Microelectronics, a Chinese growth company with high insider ownership, is poised for significant expansion. It's forecasted to shift from a net loss to profitability within three years, with anticipated revenue growth of 34.5% per year—surpassing the market average. However, its Return on Equity is expected to remain low at 2.3%. Recent product innovations in automotive microelectronics were highlighted at various expos, demonstrating its commitment to advancing automotive technology despite a recent quarterly revenue drop and increased net loss.

Shanghai Nenghui TechnologyLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Nenghui Technology Ltd (SZSE: 301046) specializes in the research, development, and design of photovoltaic power stations, along with system integration and operations, boasting a market capitalization of approximately CN¥3.57 billion.

Operations: Shanghai Nenghui TechnologyLtd's revenue is primarily derived from the research, development, design, system integration, investment, and operation of photovoltaic power stations.

Insider Ownership: 32.4%

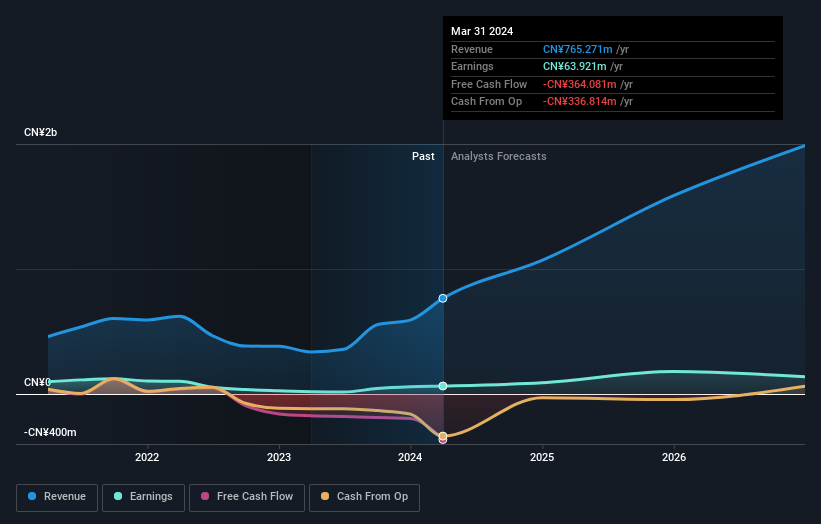

Shanghai Nenghui Technology Co., Ltd. showcases robust growth prospects with expected annual revenue and earnings growth surpassing the Chinese market average, at 33.6% each. Despite a low forecasted Return on Equity of 15.4% in three years and dividends not well covered by cash flows, the company's recent performance includes a significant increase in quarterly sales to CNY 245.22 million and net income to CNY 9.96 million, reflecting strong operational execution. However, no recent insider trading activity provides insights into internal confidence levels.

Seize The Opportunity

Click here to access our complete index of 407 Fast Growing Chinese Companies With High Insider Ownership.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:603619SHSE:688052 SZSE:301046 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance