Matter of time before Straits Times Index stages rally

With US markets having rallied strongly, the STI should be able to follow suit this month

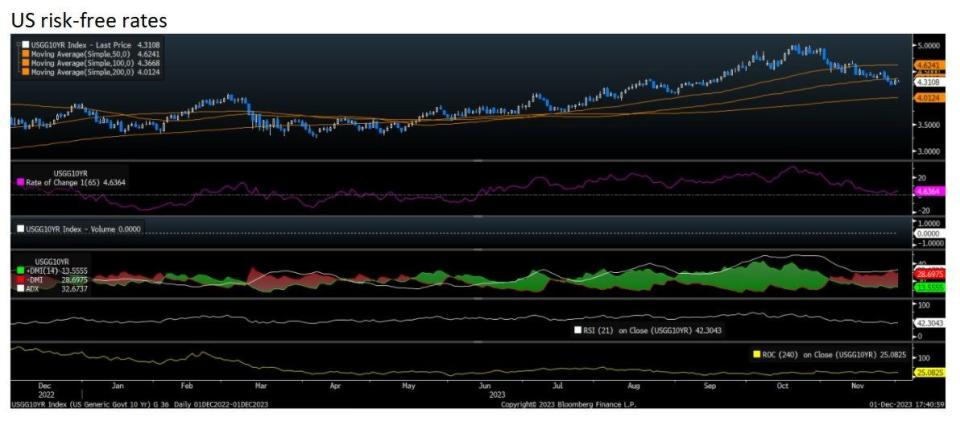

The most notable move during the week of Nov 27 - Dec 1 was the decline by the 10-year US treasury yield (UST10Y) below its 100-day moving average 4.366% and a support area at 3.35%. The UST10Y is also the risk-free rate and as it eases, equities tend to rise. As at Dec 1, the UST10Y is at 3.3108%. The chart pattern looks a trifle negative, suggesting that the UST10Y has the potential to move lower over time.

The UST10Y’s decline from near 5% to current levels has triggered something of a rally in the S&P 500 Index (SPX). In November alone, the SPX is up 9.6%. While the year was volatile for the SPX, since the start of the year, this broad market barometer for the US market is up more than 19%.

By contrast, the Straits Times Index has fallen a tad under 5% this year. Week-on-week, the STI is down 4 points. Interestingly, the pass through from the US interest rate cycle to Singapore’s has been very well correlated. The main divergence is the absolute level, where local market interest rates as represented by Sora have remained lower that the Federal Funds Rate. Local risk-free rates are more than 100 basis points lower with the yield on the 10-year Singapore Government bond at 2.96% as at Dec 1.

Since short term indicators have formed positive divergences with the STI, and quarterly momentum is also forming higher lows below its equilibriume line it may well be just a matter of time before the STI stages a proper rebound, leading to a more sustained rally. Volume levels would need to expand for this to materialise.

Support has been established at 3,000. But if the index is able to hold at 3,050 in the next few sessions, it should be able to start moving higher by mid-December. The resistance-breakout level is at 3,150, with a breakout pointing to an upside target.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Decline in risk-free rates boosts S&P 500 as STI’s rebound fades

November remains noisy, but it is time for some Thanksgiving

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance