Matson (MATX) Rewards Shareholders With 6.3% Dividend Hike

Matson MATX recently announced a 6.3% hike in its quarterly dividend, taking the total to 34 cents per share (annualized $1.36). The first installment of the increased dividend will be paid out on Sep 5, 2024, to its shareholders of record as of Aug 1.

The upped dividend highlights this transportation company’s commitment to creating value for its shareholders. MATX’s dividend yield based on the new payout and Jun 27’s closing price is 1.06%. The current increase marks the seventh dividend hike by the company in the last five years.

Per chairman and CEO Matt Cox, “The increase reflects the strength of our business and confidence in our long-term free cash flow growth. As always, we remain committed to the return of excess capital to shareholders through the execution of share repurchases after funding our dividend, supporting our operations with maintenance capital, and investing in growth opportunities, while maintaining an investment grade balance sheet."

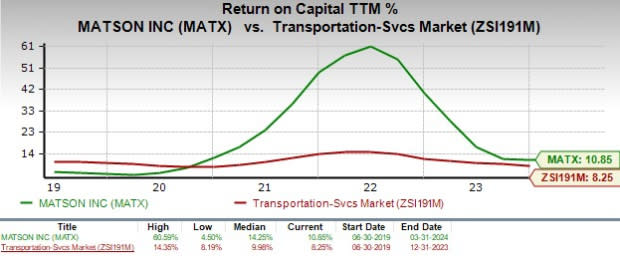

Matson, currently sporting a Zacks Rank #1 (Strong Buy), is also active on the buyback front. Investors should note that Matson has a 5-year median return on capital of 14.3%, which is higher than its industry’s 10%, depicting the company’s financial efficiency.

Image Source: Zacks Investment Research

You can see the complete list of today’s Zacks #1 Rank stocks here.

Matson is not the only player from the Zacks Transportation sector to have hiked quarterly dividends in 2024. In June, FedEx’s FDX board of directors approved a dividend hike of 10%, thereby raising its quarterly cash dividend to $1.38 per share ($5.52 annualized). In January, GATX Corporation's GATX board of directors announced a dividend hike of 5.5%, which raised its quarterly cash dividend to 58 cents per share. Notably, 2024 marks the 106th consecutive year of GATX paying out dividends.

Dividend-paying stocks provide a solid income stream and have fewer chances of experiencing wild price swings. Dividend stocks, like MATX, are safe bets for creating wealth, as the payouts generally act as a hedge against economic uncertainty like the current scenario.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FedEx Corporation (FDX) : Free Stock Analysis Report

Matson, Inc. (MATX) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance