Mastercard (MA), Equity Bank Partner to Ease Cross-Border Transfers

Mastercard Incorporated MA recently teamed up with Kenya’s Equity Bank in a bid to impart to the bank’s customers the capability of safely sending money to 30 countries. This will be made possible by leveraging the Mastercard Cross-Border Services platform, which comes with exclusive benefits such as accelerated transaction times, improved security measures and competitive pricing.

As a result, customers in the extensive market network of Equity Bank need to visit any Equity Branch Location in Kenya from where they can send funds. Both the senders and receivers of a cross-border transaction are likely to benefit from the recent move.

The charges associated with availing the new service are relatively lower than traditional international payments. Therefore, customers will benefit from lower costs and access to a secure and formal platform rather than relying on informal and less regulated channels for sending remittances. Meanwhile, receivers of the transaction will not have to bear any landing expense and can realize the entire value of the transferred money.

The recent partnership bears testament to Mastercard’s sincere efforts to address the evolving customers’ demand for affordable and systematic international transactions and cater to migrants and beneficiaries. The presence of the Mastercard brand and an expansive delivery network allow the latest tie-up to infuse an element of security within remittances, thereby offering peace of mind for customers.

With the increased usage of the Cross-Border Services platform, Mastercard is expected to benefit on the back of growth in revenues derived from the utilization of its value-added services and solutions suite. A stronger foothold across Kenya and an expanding nationwide customer base may also be counted as the benefits of the tech giant out of the recent collaboration.

This tie-up between Mastercard and Equity Bank also forms part of the decade-long partnership forged between the partners in the form of a Customer Business Agreement inked in September 2023. The ulterior motive of the deal remains to bring about enhanced payment experiences for consumers with the help of a varied suite of MA’s payment solutions being made available across six African countries, one of which is Kenya. The recent move, therefore, reflects the fruition of one of the promises made by the agreement to equip consumers to engage in seamless cross-border remittances.

Meanwhile, Mastercard also focuses on infusing greater digitization across Kenya by bringing more occupants of the underserved communities within the ambit of a digital economy and therefore, capturing a significant share of Africa’s payments market. The tech giant has frequently resorted to tie-ups with regional financial institutions or undertaken significant investments across the digitally booming continent.

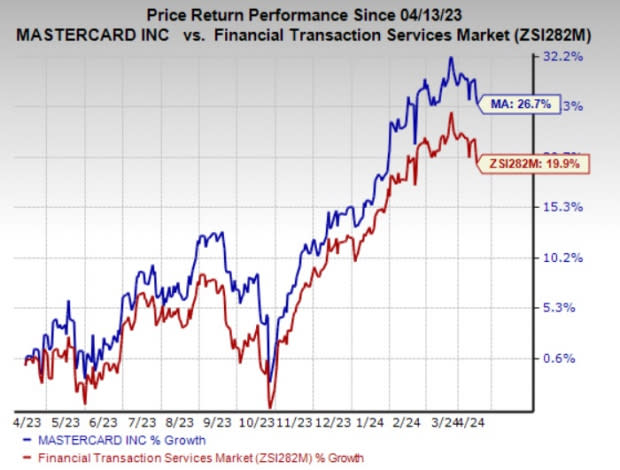

Shares of Mastercard have gained 26.7% in the past year compared with the industry’s 19.9% growth. MA currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the Business Services space are Distribution Solutions Group, Inc. DSGR, CompoSecure, Inc. CMPO and Huron Consulting Group Inc. HURN. While Distribution Solutions sports a Zacks Rank #1 (Strong Buy), CompoSecure and Huron Consulting carry a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of Distribution Solutions outpaced estimates in two of the last four quarters and missed the mark twice, the average surprise being 13.31%. The Zacks Consensus Estimate for DSGR’s 2024 earnings suggests an improvement of 4.9% from the year-ago reported figure. The consensus mark for revenues suggests growth of 13.4% from the year-ago reported number. The consensus mark for DSGR’s 2024 earnings has moved 36.7% north in the past 30 days.

CompoSecure’s earnings outpaced estimates in three of the trailing four quarters and matched the mark once, the average surprise being 7.97%. The Zacks Consensus Estimate for CMPO’s 2024 earnings suggests an improvement of 12.4% from the year-ago reported figure. The consensus mark for revenues suggests growth of 6.5% from the prior-year reading. The consensus mark for CMPO’s 2024 earnings has moved 0.9% north in the past 60 days.

The bottom line of Huron Consulting outpaced estimates in each of the last four quarters, the average surprise being 25.91%. The Zacks Consensus Estimate for HURN’s 2024 earnings suggests an improvement of 14.9% from the year-ago reported figure. The consensus mark for revenues suggests growth of 9.9% from the year-ago reported number. The consensus mark for HURN’s 2024 earnings has moved 1.8% north in the past 60 days.

Shares of Distribution Solutions and Huron Consulting have gained 58.7% and 12.3%, respectively, in the past year. However, the CompoSecure stock has declined 14.1% in the same time frame.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mastercard Incorporated (MA) : Free Stock Analysis Report

Huron Consulting Group Inc. (HURN) : Free Stock Analysis Report

CompoSecure, Inc. (CMPO) : Free Stock Analysis Report

Distribution Solutions Group, Inc. (DSGR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance