Masco Lost 16% in 3 Months: Should You Buy MAS Stock on the Dip?

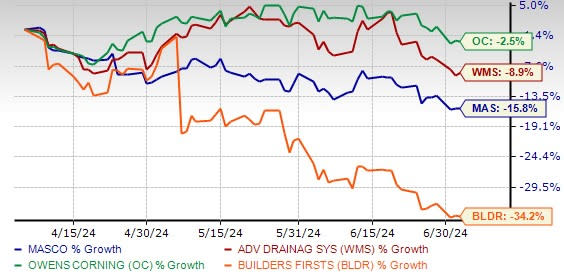

Masco Corporation MAS shares have lost 15.8%% in the past three months compared with the Zacks Building Products – Miscellaneous industry’s 10.9% decline and the broader Zacks Construction sector’s 9.3% dip. It has also lagged the S&P 500’s rise of 6.6%. This home improvement and building products manufacturer has been grappling with weak demand and high expenses.

Image Source: Zacks Investment Research

Meanwhile, Masco has traded better than its peers like Builders FirstSource, Inc. BLDR but lagged Advanced Drainage Systems, Inc. WMS and Owens Corning OC in the past three months.

Image Source: Zacks Investment Research

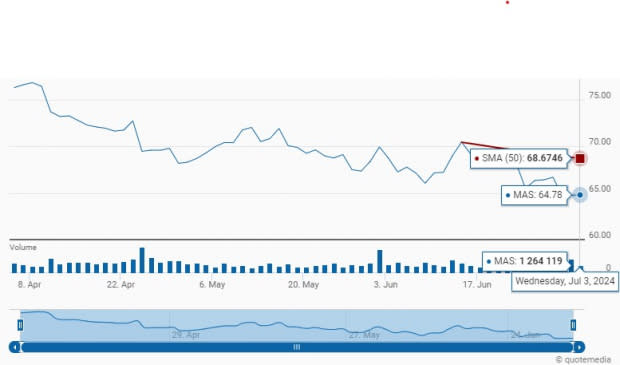

MAS Trading Below 50-Day Moving Average

Masco shares are trading well below the 50-day moving average, indicating a bearish trend. As of Jul 3, the stock closed at $64.78, which is below its 52-week high of $65.48 but significantly close to its 52-week low of $64.53.

MAS Price Movement vs 50-Day Moving Average

Image Source: Zacks Investment Research

What's Holding Masco Back?

Weak Demand: Masco’s top line decreased 3% in the first quarter of 2024, aligning with the company’s expectations. Volume dropped 4%, but this was partially offset by a 1% increase in pricing and the positive impact of its recent acquisition of Sauna360, finalized in the third quarter of the previous year. Masco has been witnessing slowness in demand for many of its products for quite some time now. The trend remains the same. The company believes that markets will stabilize toward the end of 2024 and return to typical growth rates in 2025 and 2026. Demand in Europe and China is still challenged, and appears to be stabilizing in later 2024. This trend is likely to continue because of high mortgage/interest rates, continuing inflation and tighter consumer spending. The company maintains cautious optimism for the remainder of 2024.

For 2024, Masco expects sales to remain up/down by low single digits. Sales are anticipated to decline slightly in the first half of the year, with modest growth expected in the latter half.

Meanwhile, consumer confidence fell slightly in June and reflected the ongoing uncertainty among Americans about the future of the economy. Again, as Masco’s business prospects are highly correlated with U.S. housing market conditions and repair and remodeling activity, with higher interest/ mortgage rates, affordability continues to be a concern for homebuyers.

High Expenses: Adjusted selling, general and administrative (SG&A) expenses — as a percentage of net sales — rose 120 basis points (bps) to 19.1% in the first quarter of 2024. This was due to high employee-related costs, including incentive compensation.

Can Masco Make a Comeback?

Improved Operating Efficiency: Masco's diligent cost-saving efforts have significantly bolstered its performance. Through strategic measures such as consolidating businesses, implementing efficient systems, closing plants and branches, optimizing the global supply chain, and reducing headcount, Masco has achieved substantial annual savings while simplifying its organizational structure.

To combat challenges like raw material inflation and tariffs, Masco has taken proactive steps, including implementing pricing adjustments and collaborating with suppliers and internal teams to identify cost-saving opportunities. Moreover, the company has initiated the relocation of some production out of China for long-term sustainability.

The tangible results of these efforts are evident in Masco's financial performance. Operating profit improved in the quarter by $10 million to $322 million, and operating margin grew 90 bps to 16.7%. The improvement in its operational performance was primarily driven by cost savings initiatives and a favorable price/cost relationship, partially offset by lower volume. For 2024, the company expects adjusted operating margin to be 17%, up from 16.8% in 2023. It expects an adjusted operating margin of 18.5% for the Plumbing Products segment and 18% for the Decorative Architectural Products unit, up from 18% and 17.8%, respectively, a year ago.

The company expects to achieve long-term full-year margin targets of nearly 18.5% in 2026, where Plumbing Products are likely to grow approximately 20% and Decorative Architectural Products are likely to rise 19-20%. This apart, it plans to return shareholders 1-2% above earnings per share (EPS) growth via dividends and 2-4% through repurchases.

Masco reported adjusted EPS of 93 cents in the first quarter of 2024, which marks an 8.1% increase from the previous year's 86 cents. The growth was fueled by enhanced operational efficiencies, strong execution, and the robust performance of its repair and remodel product lineup. The company continues its strategic focus on expanding market share through customer engagement, the introduction of innovative products, and strengthening brand value.

Focus on New Products: With its superior repair and remodel-focused products dominating multiple distribution channels, alongside its robust financial position and prudent capital management, Masco is well-positioned to consistently generate lasting value for its shareholders in the foreseeable future. For example, Hansgrohe's AXOR brand showcased new products like the Citterio C bathroom collection and AXOR ShowerSelect ID at the Milan Furniture Fair. These innovations underscore Hansgrohe's leadership in premium, energy-efficient bathroom solutions, bolstering its Plumbing segment's global market position through strong brands and innovative offerings. Again, Masco's growth in North American Plumbing is propelled by Delta Faucet's new offerings like the Brizo Mystix steam shower and tankless water filtration systems, expanding into retail and online categories. Watkins Wellness' FreshWater IQ enhances spa ownership with smart monitoring, affirming its innovation leadership.

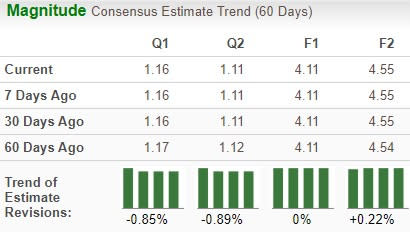

Estimate Revision: The Zacks Consensus Estimate for 2024 EPS has remained unchanged but increased for 2025 over the past 60 days. Although there is limited upside potential for the stock for this year as of now, owing to low demand, the positive estimate revision for 2025 depicts optimism about the stock’s growth potential. The estimated figure indicates 6.5% and 10.6% year-over-year growth for 2024 and 2025, respectively.

The stock has a long-term earnings growth rate of 9.3%, which speaks of its inherent strength.

Image Source: Zacks Investment Research

Acquisitions: Masco's portfolio expansion through acquisitions persists with the recent acquisition of all share capital of Sauna360 Group Oy in the third quarter of 2023. Sauna360 offers a diverse product portfolio, including traditional, infrared, and wood-burning saunas, as well as steam showers. This acquisition has been integrated into Masco's Plumbing Products segment. The company foresees robust growth, expecting to achieve an average annual organic sales growth of 3-5% over the long term. Acquisitions are projected to contribute 1-3% annually to sales.

Higher ROE: Masco’s trailing 12-month Return on Equity (ROE) is indicative of its growth potential. ROE for the trailing 12 months is 865.4%, much higher than the industry’s 14.4%, reflecting the company’s efficient usage of shareholders’ funds.

Again, Masco’s Return on Assets stands at 16.6%, surpassing the industry's 6.6%, showcasing the company's efficient utilization of its assets to generate returns.

Driving Shareholders’ Value: During the first quarter, Masco returned $212 million to shareholders through the repurchase of 2.1 million shares for $148 million and a dividend payment of $64 million.

Again, the company increased its dividend six times in the past five years, and its payout has increased 24.1% over the same period. It has been consistently focusing on sharing its cash flows with shareholders and maintaining a solid financial position. MAS is currently paying an annual cash dividend of $1.16 per share, which translates to a payout ratio of around 29%, higher than the industry’s average of 19.9%. Its current dividend yield of 1.79% is higher than the industry’s 1.17%, S&P 500’s 1.26% and the sector’s 1%. Check MAS’ dividend history here.

Right Time to Buy MAS?

Although weak demand continues to pose challenges, Masco remains confident that 2024 adjusted EPS will be in the range of $4-$4.25 per share (indicating an increase from $3.86 reported in 2023). While it expects a relatively flat top line for the year, its focus on cost savings initiatives, disciplined pricing, and operational efficiencies will help the company continue to drive operating margin improvement and EPS growth in 2024.

From the valuation perspective, with a forward 12-month price-to-earnings ratio of 14.95X, slightly below the industry average of 15.63X, the stock presents a potentially attractive valuation for investors seeking exposure to the stock.

Given the above-mentioned tailwinds and strong returns, investors may consider to accumulate this Zacks Rank #2 (Buy) stock to their portfolio. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Masco Corporation (MAS) : Free Stock Analysis Report

Advanced Drainage Systems, Inc. (WMS) : Free Stock Analysis Report

Builders FirstSource, Inc. (BLDR) : Free Stock Analysis Report

Owens Corning Inc (OC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance