Marriott (MAR) Sees Solid 2023 Unit Growth, Signings Grow Y/Y

Marriott International, Inc. MAR celebrated a remarkable year in 2023, setting a new record in global signings with a substantial 52% increase in organic rooms compared with 2022.

The company reported robust net room growth of 4.7%, reaching over 1.597 million rooms. The development pipeline at the end of 2023 stood at a record 573,000 rooms, marking a 15% year-over-year rise.

Throughout 2023, Marriott inked a record number of organic management and franchise agreements, averaging nearly 2.5 deals per day, totaling around 164,000 rooms on a global scale. The US & Canada, Marriott's largest region, saw a record-breaking 91,000 rooms signed, including 37,000 from a strategic licensing deal with MGM Resorts International. It also witnessed robust signings growth outside of the U.S. & Canada with nearly 73,000 organic rooms signed across 74 countries.

MAR’s global development pipeline comprised almost 3,400 hotels and approximately 573,000 rooms by the end of 2023, showcasing a remarkable 15% uptick compared with the prior year. The company's worldwide system boasted nearly 8,800 properties and over 1,597,000 rooms in 139 countries. It added 400 properties and almost 64,000 organic gross rooms during the year.

Additionally, MAR expanded its portfolio by increasing its presence in luxury, entering the affordable midscale segment globally and growing its branded residences. The acquisition of the City Express brand portfolio added 150 properties and approximately 17,500 rooms to its system.

Marriott’s president and CEO, Anthony Capuano, emphasized the company's commitment to meeting the evolving needs of travelers worldwide. With an enhanced global brand portfolio and continuous innovation, management aims to connect people through the power of travel, maintaining its momentum in the dynamic hospitality industry.

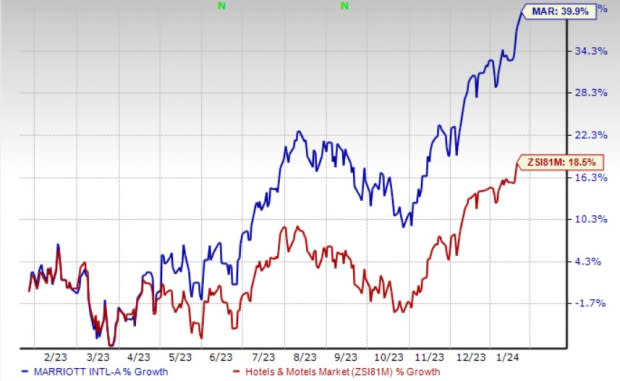

Shares of the Zacks Rank #3 (Hold) company have gained 39.9% in the past year compared with the Zacks Hotels and Motels industry’s 18.5% growth.

Image Source: Zacks Investment Research

Key Picks

Here are some better-ranked stocks from the Zacks Consumer Discretionary sector.

Virco Mfg. Corporation VIRC sports a Zacks Rank #1 (Strong Buy). VIRC has a trailing four-quarter earnings surprise of 188.6% on average. VIRC’s shares have surged 164.2% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for VIRC’s 2024 sales and earnings per share (EPS) indicates a rise of 15.7% and 32.4%, respectively, from the year-ago levels.

DraftKings Inc. DKNG carries a Zacks Rank #2 (Buy). It has a trailing four-quarter earnings surprise of 13.2% on average. Shares of DKNG have increased 154.3% in the past year.

The Zacks Consensus Estimate for DKNG’s 2024 sales and EPS suggests 28% and 85.1% growth, respectively, from the year-ago levels.

Skechers U.S.A., Inc. SKX carries a Zacks Rank #2. It has a trailing four-quarter earnings surprise of 50.3% on average. Shares of SKX have rallied 31% in the past year.

The Zacks Consensus Estimate for SKX’s 2024 sales and EPS implies an improvement of 10.3% and 16.7%, respectively, from the year-ago levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marriott International, Inc. (MAR) : Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Virco Manufacturing Corporation (VIRC) : Free Stock Analysis Report

DraftKings Inc. (DKNG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance