Market rally remains tentative as resistance appears

Markets may stay resilient as risk-free rates ease with 10-year SGS yield down to 3.11%

The Straits Times Index rose by a further 44 points in the week of Nov 14-18 to 3,272 after rising 98 points in the week of Nov 7-11. This move takes the STI above its 200-day moving average which is currently at 3,231. In the meantime, the index is also above the 50- and 100-day moving averages at 3,156 and 3,172 respectively.

While quarterly momentum appears poised for a breakout and directional movement indicators point to the rally continuing, there is resistance approaching at 3,292-3,300. Against this background, the upmove is likely to stall. Support should be at the 200-day moving average at 3,231.

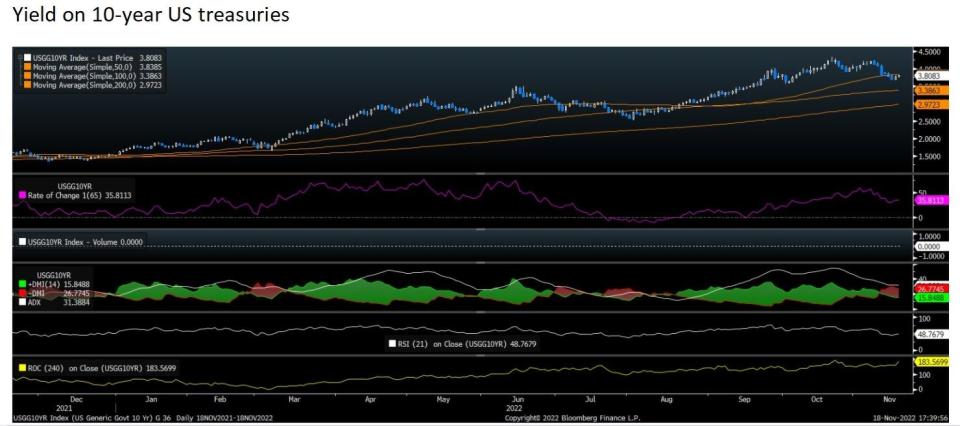

Risk-free rates continue to ease. Interestingly, the yield on 10 year Singapore Government Securities ended the week of 3.11%, the lowest level since Sept 13 this year. The yield on US 10-year treasuries continued to drift lower, to below 3.7% before rebounding. The 10-year treasuries yield has fallen marginally below its 50-day moving average which is currently at 3.83%.

The other point to highlight is that the 2-year gilt yield is below the 10-year gilt yield, which is already at 3.25%. The 10-year gilt yield had earlier dropped below 3.2% before rebounding.

All this suggests that the markets have a chance to rebound at the very least.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance