The Market Lifts loanDepot, Inc. (NYSE:LDI) Shares 60% But It Can Do More

The loanDepot, Inc. (NYSE:LDI) share price has done very well over the last month, posting an excellent gain of 60%. The last 30 days bring the annual gain to a very sharp 78%.

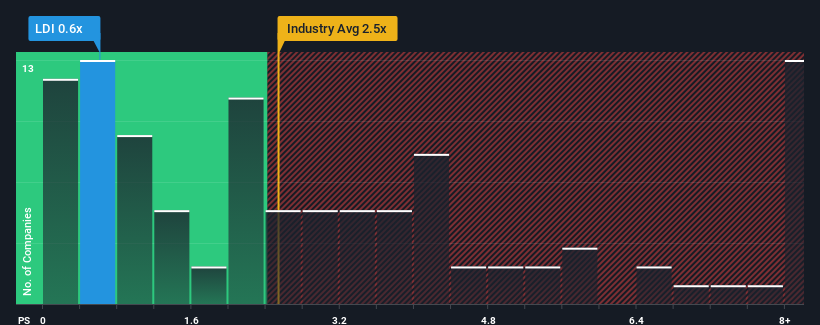

Even after such a large jump in price, loanDepot's price-to-sales (or "P/S") ratio of 0.6x might still make it look like a buy right now compared to the Diversified Financial industry in the United States, where around half of the companies have P/S ratios above 2.5x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for loanDepot

How Has loanDepot Performed Recently?

loanDepot could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think loanDepot's future stacks up against the industry? In that case, our free report is a great place to start.

Is There Any Revenue Growth Forecasted For loanDepot?

There's an inherent assumption that a company should underperform the industry for P/S ratios like loanDepot's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 50%. As a result, revenue from three years ago have also fallen 77% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 40% as estimated by the six analysts watching the company. That's shaping up to be materially higher than the 5.1% growth forecast for the broader industry.

With this in consideration, we find it intriguing that loanDepot's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

The latest share price surge wasn't enough to lift loanDepot's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at loanDepot's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for loanDepot that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance