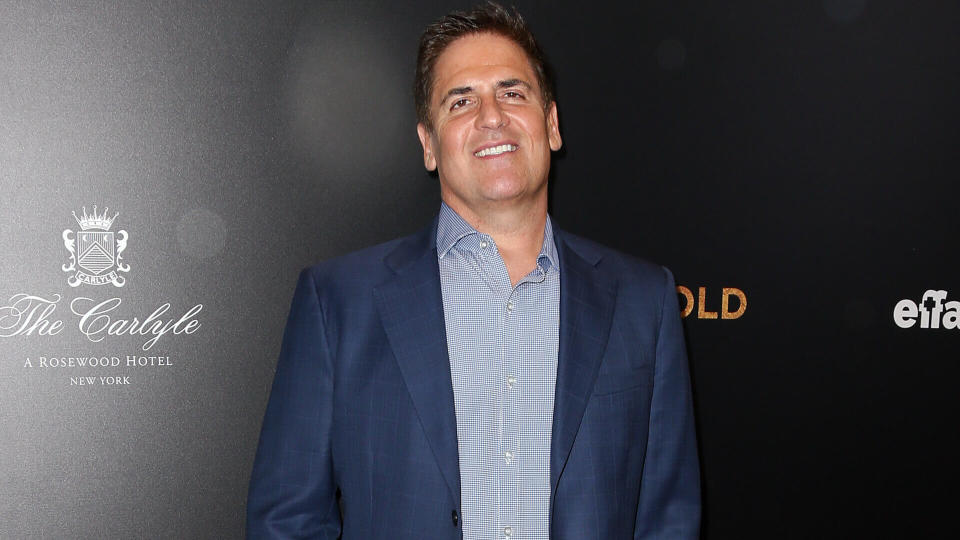

Mark Cuban: The Secret To Building Wealth Isn’t Following Your Passions

In a recent Fortune interview, billionaire investor and businessman Mark Cuban stated that you shouldn’t start a business based on your passion. Instead, his view is that you should keep your eye on how you can make money and build wealth.

“You have to be on a mission, whatever that mission is,” Cuban stated. “My mission was to retire by 35.”

Find Out: Ramit Sethi: 5 Easy Steps To Getting Rich in 2024

Learn More: 5 Genius Things All Wealthy People Do With Their Money

But that’s not the first time Cuban stated that particular opinion. In another interview on Adam Grant’s ReThinking podcast in late 2022, Cuban said, “Follow your effort. No one quits anything they’re good at. If I followed my passions, I’d still be trying to play professional basketball.”

Here’s why the secret to building wealth isn’t based on following your passions.

Focusing On What You’re Good at for Financial Success

Mark Stewart, an in-house certified public accountant for Step By Step Business, said that he understands the rationale behind Mark Cuban’s perspective.

“The essence of building wealth often lies not solely in following one’s passions but in leveraging skills and expertise where one has a competitive advantage,” Stewart said. “When individuals engage in activities or careers where they excel, they’re more likely to persist, innovate and ultimately succeed financially. This is because proficiency can lead to higher efficiency, greater opportunities for monetization and the ability to capitalize on demand in the marketplace.”

Stewart said that passion is undeniably important because it fuels motivation, but proficiency ensures sustainability and growth.

“In essence, the interplay between finding what you’re good at and gradually integrating your passions can create a powerful formula for building wealth,” he said. “This approach fosters professional satisfaction and maximizes the potential for financial success by aligning skills with market needs.”

Read More: 12 Key Ways the Rich Multiply Their Wealth

Strategies for Building Wealth

Here are some secrets to wealth building, according to Stewart and other financial experts.

Make the Necessary Sacrifices

Gene Caballero, co-founder of GreenPal, said the cornerstone of his financial success has been sacrifice.

“This means prioritizing long-term wealth over immediate gratification, investing time and resources back into my ventures instead of pursuing short-lived pleasures,” he explained. “It’s about choosing to do what’s necessary, even when it’s challenging, to set the foundation for future success. Sacrifice involves a commitment to your goals that transcends the allure of quick rewards, focusing instead on the bigger picture. In my journey, embracing sacrifice has been instrumental in overcoming obstacles and achieving lasting wealth.”

Automate Your Savings and Investments

Stewart said to consider the power of automating your savings and investments.

“This strategy involves setting up automatic transfers from your checking account to your savings and investment accounts, ensuring that a portion of your income is consistently being saved or invested before you have the chance to spend it,” he said. “This set-it-and-forget-it approach leverages the concept of paying yourself first, prioritizing your future financial well-being over immediate gratification.”

Stewart explained that automating your savings and investment contributions helps in building discipline and ensures that you’re consistently making contributions without having to rely on will power or manual intervention.

“Over time, even small automated contributions can grow significantly due to the compounding effect, gradually building a substantial nest egg,” he said.

Never Stop Learning

Shawn Carpenter, chairman and CEO of Stock Alarm, said that staying ahead in this constantly changing world requires you to be a lifelong learner.

“Whether it’s new market trends, technologies or skills, keeping your knowledge fresh opens up opportunities you wouldn’t see otherwise,” he said. “I make it a point to learn something new every day, even if it’s as simple as a new word or a concept.”

Grit Is Your Best Friend

Carpenter acknowledged that the road to wealth isn’t easy, and there will be times that you will want to throw in the towel.

“Don’t,” he said. “Resilience is what separates the successful from the rest. Each setback is a lesson, not a failure.”

Network Like Your Wealth Depends on It

“Because it does,” Carpenter said. “The people you know and connect with can open doors you didn’t even know existed. And I’m not just talking about the high and mighty. Sometimes, a casual chat with someone from a different field can spark the next big idea. So, get out there and make genuine connections.”

Focus On What Matters

Carpenter also said that time is limited, and if you spread yourself too thin, it’s a surefire way to slow progress.

“Identify activities that have the most significant impact on your goals and prioritize them. It’s about working smarter, not harder. This one took me a while to get right, but once I did, the difference was night and day.”

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Mark Cuban: The Secret To Building Wealth Isn’t Following Your Passions

Yahoo Finance

Yahoo Finance