Manulife US REIT units fall over 40% on debt restructuring plans, DBS downgrades to 'hold'

“The journey to resolving MUST’s debt issue is lengthy with execution risks.”

Units in Manulife US REIT (MUST) closed 3.9 US cents lower, nearly 43% down, at 5.2 US cents on Nov 30, a day after its management unveiled a long-awaited debt structuring plan to reduce gearing.

DBS Group Research analysts Rachel Tan and Derek Tan have turned cautious after hearing MUST’s plan to resolve its debt, particularly the “hefty price” of the interest on the sponsor’s loan.

In a Nov 30 note, the DBS analysts reversed an upgrade issued earlier this month, downgrading MUST to “hold” from “buy” while keeping the target price at 10 US cents.

During a trading halt on Nov 29, the REIT’s managers announced a proposed recapitalisation plan in three parts. MUST will be seeking unitholders approval on three resolutions via an EGM to be held on Dec 14.

First, MUST will receive support of US$235.7 million ($314.59 million) from the sponsor, involving the sale of Park Place in Arizona for US$98.7 million to the sponsor and a six-year sponsor loan of US$137 million.

The divestment price is 5% higher than the most recent valuation of US$94.0 million provided by a second appointed independent valuer.

The manager acquired Park Place less than two years ago. MUST's manager undertook debt financing and launched a US$100 million private placement to acquire Park Place and Diablo Technology Park in Arizona and Tanasbourne in Oregon for a total of US$201.6 million in December 2021.

The proposed sale of Park Place comes as a surprise to DBS. “This asset swap should be well-received by investors, given the original intention to divest the Phipps building, which we consider to be one of buildings with relatively stronger attributes out of its initial portfolio.”

The manager had announced in May the proposed sale of Phipps in Atlanta. As of Nov 29, the deal is off the table, with the property classified as “Tranche 3”, a property that MUST is required to retain under the plan.

Together with the planned sale of Park Place, the sponsor is also showing its commitment to unitholders and lenders with the extension of a six-year loan amounting to US$137 million. The loan will come with an annual interest rate of 7.25% and an exit premium of up to 21.2% upon maturity.

Along with the show of support from the sponsor, the lenders have also shown their support by extending the loan maturities by one year and also temporarily relaxing the facilities’ financial covenants.

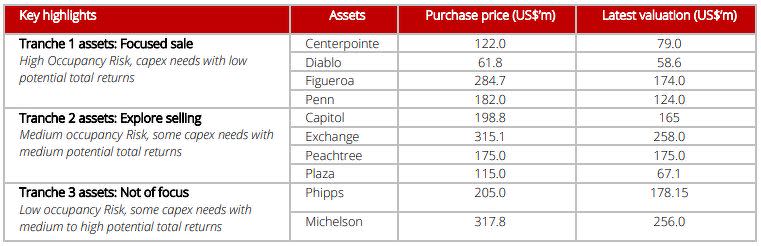

Finally, the manager is also seeking a deposition mandate from unitholders to bring its gearing under 50% in the medium term. It has bucketed its portfolio into three tranches of properties, with “Tranche 1” assets on the chopping block for “low potential total returns”.

The four target properties have a collective value of US$435.6 million as of June. In the pro forma estimates, the manager is assuming that the sale of all four properties for US$328 million, at 25% below the last valuation, will bring its gearing level towards 49.5%, if it materialises.

US$100 mil needed to bring gearing under 45%

While the steps above may bring MUST’s gearing below 50%, DBS believes management needs another US$100 million to bring gearing below 45%.

Based on the pro forma numbers of 1H2023, gearing will drop to 52.8% after a number of steps: the divestment of Park Place, and Tanasbourne, which was disposed of in April; repayment of the loan via the sponsor-lender loan; and US$50 million in cash from MUST.

Assuming the divestment of “Tranche 1” assets is successful, gearing will land at 49.4%, says DBS.

“Based on our estimates, MUST requires a further US$100 million and more, either via a further asset disposition or equity fundraising, to bring gearing down further to 45%,” add the analysts.

Distributions were suspended in 2QFY2023 ended June and will remain suspended until the end of 2025. According to DBS, distribution per unit (DPU) will reduce by 13% after the Park Place divestment and sponsor loan, and halve after the “Tranche 1” sale, landing at 2.12 US cents.

The debt restructuring plan is a first step to moving forward and ensures MUST has two years of time to execute its asset divestment plan or possibly its last resort of equity fundraising, says DBS. “With the sponsor-lender loan, we believe that the sponsor is behind MUST to ensure it is sustainable until 2025. However, we believe this comes at a hefty price [of] sponsor loan interest, and the journey to resolving MUST’s debt issue is lengthy with execution risks.”

Meanwhile, CGS-CIMB Research analysts Lock Mun Yee and Natalie Ong maintain "add" on MUST in a Nov 29 note, along with an unchanged target price of 25 US cents, much higher than DBS's 10 US cents target.

CGS-CIMB's forecast may change "pending the outcome of the EGM". "We believe the earlier-than-expected announcement of a recapitalisation plan could provide some support for its share price while the recapitalisation exercise is being executed."

More on Manulife US REIT this year:

Manulife US REIT's aggregate leverage falls slightly in 3QFY2023 to 56.0% from 56.7% (November)

MUST appoints Marc Feliciano as chairman of the board of directors (October)

‘Absolutely’ possible to save Manulife US REIT, says sponsor but time not on its side (August)

Manulife US REIT halts DPUs in 1HFY2023; unencumbered gearing ratio down to 59.7% (August)

MUST’s portfolio valuation falls by 14.6% to US$1.63 bil; aggregate leverage breaches 50% limit (July)

Manulife US REIT announces proposed divestment of Phipps to sponsor (May)

Manulife US REIT's gearing rises further to 49.5%, Mirae proposal expected in 2Q2023 (May)

Potential rescue by acquirer Mirae could dilute Manulife US REIT's DPU; DBS halves TP to 24 US cents (May)

Manulife US REIT continues talks with bidder Mirae, divests property for US$0.35 mil loss (April)

'Rewards for the brave' who dare to bet on US office S-REITs now: DBS (March)

US office REITs continue to face challenges (February)

Manulife US REIT reports 18.6% lower 2HFY2022 DPU of 2.14 US cents after capital retention (February)

Manulife US REIT's aggregate leverage now at 49% based on updated asset valuations (December 2022)

Infographics: DBS Group Research

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance