Manulife US REIT distributable income falls 15.5% y-o-y in FY2023, targets US$100 mil asset sales by 3Q2024

MUST has halted its distributions since 1HFY2023 ended June 30, 2023.

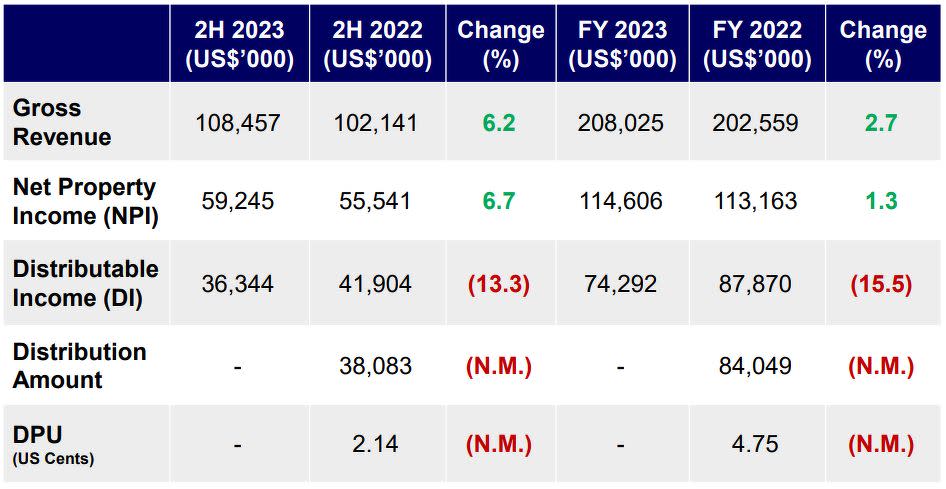

Manulife US REIT (MUST) reported gross revenue of US$208.0 million ($279.48 million) for FY2023 ended Dec 31, 2023, 2.7% higher y-o-y. Net property income (NPI) rose 1.3% y-o-y in tandem to US$114.6 million, but distributable income declined 15.5% y-o-y to US$74.3 million.

In a Feb 8 announcement, the REIT’s manager says this was mainly attributable to lower rental and recoveries income due to higher vacancies and higher property expenses, higher finance costs as a result of rising interest rates and the divestment of Tanasbourne in April 2023 and Park Place in December 2023. This was partially offset by higher lease termination fees and carpark income.

The manager says it is prioritising dispositions in 2024 and targets asset sales of some US$100 million by 2Q2024 or 3Q2024.

MUST has halted its distributions since 1HFY2023 ended June 30, 2023, after it breached a financial covenant due to falling portfolio valuation, which resulted in the REIT’s loans being reclassified as current liabilities.

Prior to the halt, MUST had paid distributions half-yearly. For 1HFY2023, MUST posted a net loss of US$247.6 million, down from earnings of US$62.8 million in 1HFY2022, while distributable income fell 17.4% y-o-y to US$37.9 million.

As at Dec 31, 2023, MUST’s aggregate leverage ratio is 58.3%.

According to the Monetary Authority of Singapore’s (MAS) Property Funds Appendix, the aggregate leverage limit is not considered to be breached if exceeding the limit is due to a decline in portfolio valuation, which is beyond the manager’s control, says MUST.

“However, the manager will not be able to incur additional indebtedness and will have to fund capex, tenant improvement allowance and leasing costs with available cash, cash from operations and any disposition proceeds.”

Recapitalisation plan

This is the first set of results since MUST’s unitholders voted at an EGM in December 2023 to approve a recapitalisation plan and save the REIT from liquidation.

Unitholders voted overwhelmingly for all three resolutions. Resolution 1 was the sale of Park Place to the sponsor for US$98.7 million.

Resolution 2 — over which there was much debate — was to approve the sponsor loan of US$137 million at an interest rate of 7.25% a year with a success fee of 21.1%. This was the most contentious of the three resolutions.

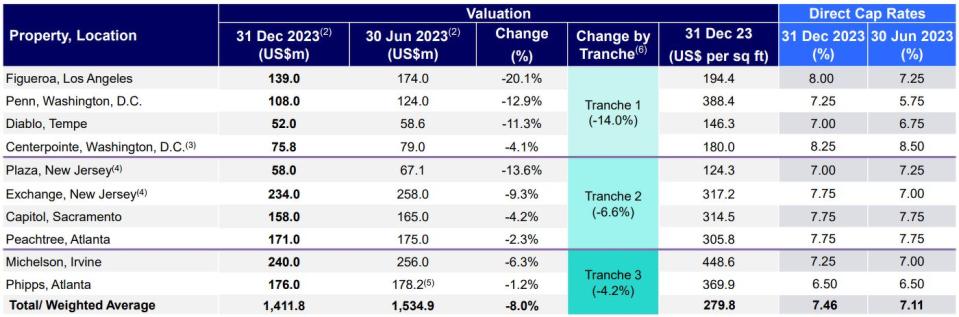

Resolution 3 provides the manager and lenders with the authority to divest “non-core”, “Tranche 1” properties, albeit at a minimum sum of US$328.7 million. Tranche 1 assets include the REIT's Centerpointe, Diablo, Figueroa and Penn properties.

The resolutions were interdependent and all three had to be passed for MUST to survive.

Following the sale of Park Place, US$98.0 million from divestment proceeds and US$137.0 million from the sponsor-lender loan were used to repay existing debt on Dec 22, 2023.

MUST will also be using its cash holdings to pay down an additional US$50.0 million of debt by March 31.

With the loan maturities extended by one year under the master restructuring agreement, MUST does not have any refinancing requirements in 2024.

The manager says MUST’s debt maturity profile remains “well-staggered” over five years, with a weighted average debt maturity of 3.3 years as at Dec 31, 2023.

MUST’s bank and MAS interest coverage ratio (ICR) stand at 2.7x and 2.4x respectively, while its weighted average interest cost has eased to 4.15% as at Dec 31, 2023, from 4.38% as at Sept 30, 2023.

The percentage of its fixed rate loans has increased to 91.3% as at Dec 31, 2023 from 69.2% as at Sept 30, 2023.

Net asset value per unit has declined to 33 US cents as at Dec 31, 2023 from US$0.40 as at June 30 2023, “mainly due to its fair value loss on investment properties”, says the manager.

Leasing volume doubled

MUST’s portfolio valuation declined to US$1.41 billion as at Dec 31, 2023, 8.0% lower than the US$1.53 billion valuation as at June 30, 2023, following a 14.6% decline over the first six months of 2023.

Notably, Tranche 1 assets, which the manager has prioritised for sale, contributed to about half of MUST’s valuation decline.

MUST’s same-store occupancy remained relatively stable at 84.4% as at Dec 31, 2023 from 83.9% three months ago.

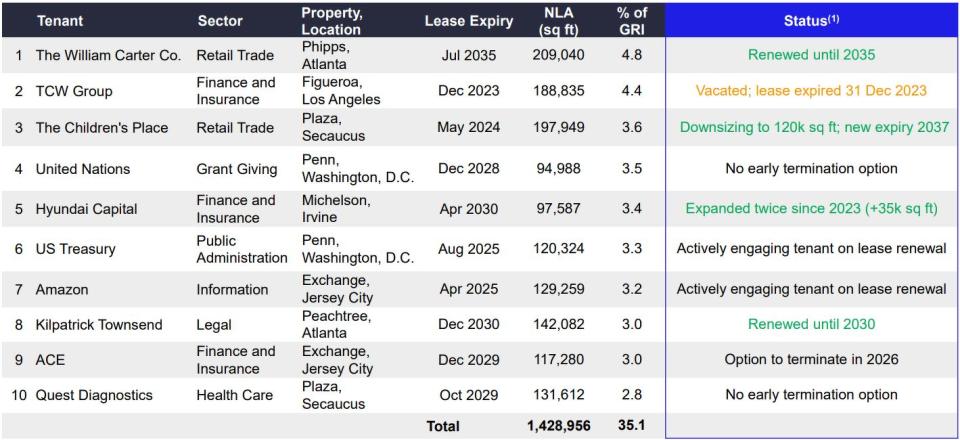

The portfolio also saw positive rent reversions of +8.2% in 2023. 104,000 sq ft of leases were signed in the fourth quarter, including an insurance firm at Capitol for 14,000 sq ft and more than nine years and a public administration tenant at Figueroa for 42,000 sq ft and 11 years.

This brings the full-year tally to 740,000 sq ft of leases signed, representing 14.7% of the portfolio net lettable area (NLA) and nearly double FY2022’s leasing volume.

Renewals made up about three-quarters (76.8%) of leasing in 2023, with new leases making up 20.1%, and expansions the remaining 3.1%.

MUST’s lease expiry remains well-spread, says the manager, with 18.5% of leases by NLA expiring in 2024, and another 11.6% coming due in 2025.

Long leases with weighted average lease expiry (WALE) averaging 8.9 years were signed in 4Q2023. As at end-December 2023, the portfolio WALE by NLA stood at 5.0 years, compared to 4.7 years in end-2022.

Tripp Gantt, chief executive officer of MUST, says: “Now that the recapitalisation plan has been approved by our lenders and unitholders, our priorities in 2024 will be on asset dispositions and maximising proceeds to further reduce indebtedness and fund capital expenditure.”

Gantt adds: “To improve the operational performance of the portfolio, we will aim to maximise the returns of our Tranche 2 and 3 assets through our leasing and portfolio optimisation efforts, including the US$18 million modernisation of Peachtree. On the capital management front, we will also continue to maintain efficient spending on our essential capex, while managing liquidity to address our 2025 debt maturities.”

Units in Manulife US REIT closed 0.3 US cents higher, or 5.36% up, at 5.9 US cents on Feb 8. The unit price has declined by some 82% over the past year.

Infographics: Manulife US REIT

More on Manulife US REIT by The Edge Singapore:

Manulife US REIT’s portfolio valuation declines by 8.0% to US$1.41 bil (January)

Manulife US REIT lives to fight another day following EGM vote (December 2023)

Proxy advisor says vote FOR for all three resolutions at Manulife US REIT’s EGM (December 2023)

Manulife US REIT units fall over 40% on debt restructuring plans, DBS downgrades to 'hold' (November)

Manulife US REIT’s lifeline in the hands of EGM (November 2023)

Manulife US REIT's aggregate leverage falls slightly in 3QFY2023 to 56.0% from 56.7% (November 2023)

MUST appoints Marc Feliciano as chairman of the board of directors (October 2023)

‘Absolutely’ possible to save Manulife US REIT, says sponsor but time not on its side (August 2023)

Manulife US REIT halts DPUs in 1HFY2023; unencumbered gearing ratio down to 59.7% (August 2023)

MUST’s portfolio valuation falls by 14.6% to US$1.63 bil; aggregate leverage breaches 50% limit (July 2023)

Manulife US REIT announces proposed divestment of Phipps to sponsor (May 2023)

Manulife US REIT's gearing rises further to 49.5%, Mirae proposal expected in 2Q2023 (May 2023)

Potential rescue by acquirer Mirae could dilute Manulife US REIT's DPU; DBS halves TP to 24 US cents (May 2023)

Manulife US REIT continues talks with bidder Mirae, divests property for US$0.35 mil loss (April 2023)

'Rewards for the brave' who dare to bet on US office S-REITs now: DBS (March 2023)

What are MUST’s options as gearing nears 50%? (February 2023)

US office REITs continue to face challenges (February 2023)

Manulife US REIT reports 18.6% lower 2HFY2022 DPU of 2.14 US cents after capital retention (February 2023)

Manulife US REIT's aggregate leverage now at 49% based on updated asset valuations (December 2022)

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Manulife US REIT’s portfolio valuation declines by 8.0% to US$1.41 bil

Manulife US REIT enters into master restructuring agreement, secures lender approval

Manulife US REIT units fall over 40% on debt restructuring plans, DBS downgrades to 'hold'

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance