Lvmh Moet Hennessy Louis Vuitton SE's Dividend Analysis

An In-Depth Look at LVMUY's Dividend Sustainability and Growth

Lvmh Moet Hennessy Louis Vuitton SE (LVMUY) recently announced a dividend of $1.61 per share, payable on 2024-05-10, with the ex-dividend date set for 2024-04-19. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Utilizing the data from GuruFocus, let's delve into Lvmh Moet Hennessy Louis Vuitton SE's dividend performance and evaluate its sustainability.

What Does Lvmh Moet Hennessy Louis Vuitton SE Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

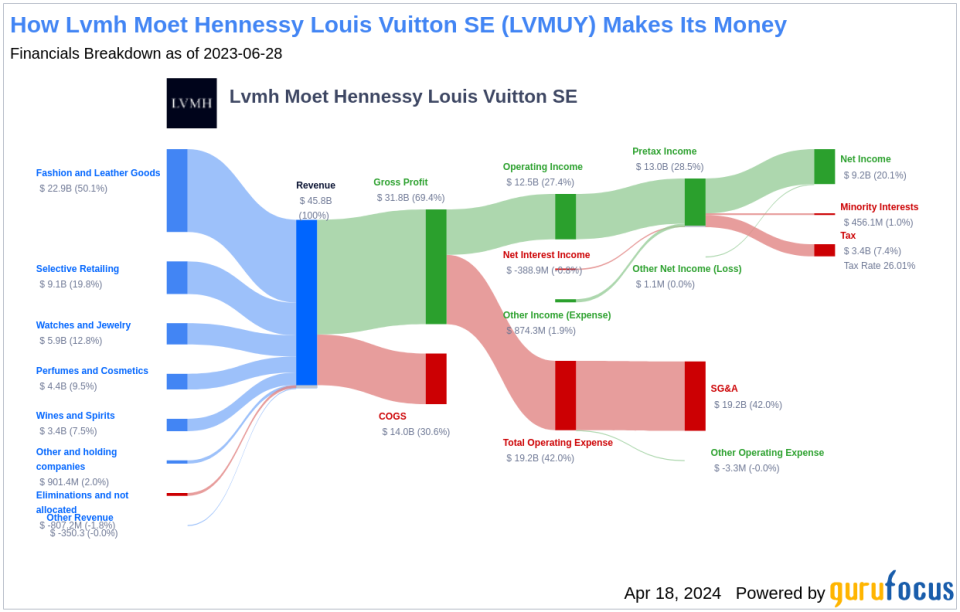

LVMH is a renowned global producer and distributor of luxury goods, with a vast portfolio that spans six segments. These include fashion and leather goods, watches and jewelry, wines and spirits, perfumes and cosmetics, selective retailing, and other activities such as publishing. The company boasts high-profile brands like Louis Vuitton, Bulgari, Fendi, Givenchy, Tag Heuer, Hennessy, Moet & Chandon, Glenmorangie, Sephora, and Benefit. With a strong global presence, LVMH operates over 5,000 stores worldwide, catering to an upscale market with its diverse range of luxury products.

A Glimpse at Lvmh Moet Hennessy Louis Vuitton SE's Dividend History

Lvmh Moet Hennessy Louis Vuitton SE has established a solid track record of consistent dividend payments since 2003, with distributions occurring bi-annually. This history reflects the company's commitment to returning value to its shareholders. Below is a chart illustrating the annual Dividends Per Share to track historical trends.

Breaking Down Lvmh Moet Hennessy Louis Vuitton SE's Dividend Yield and Growth

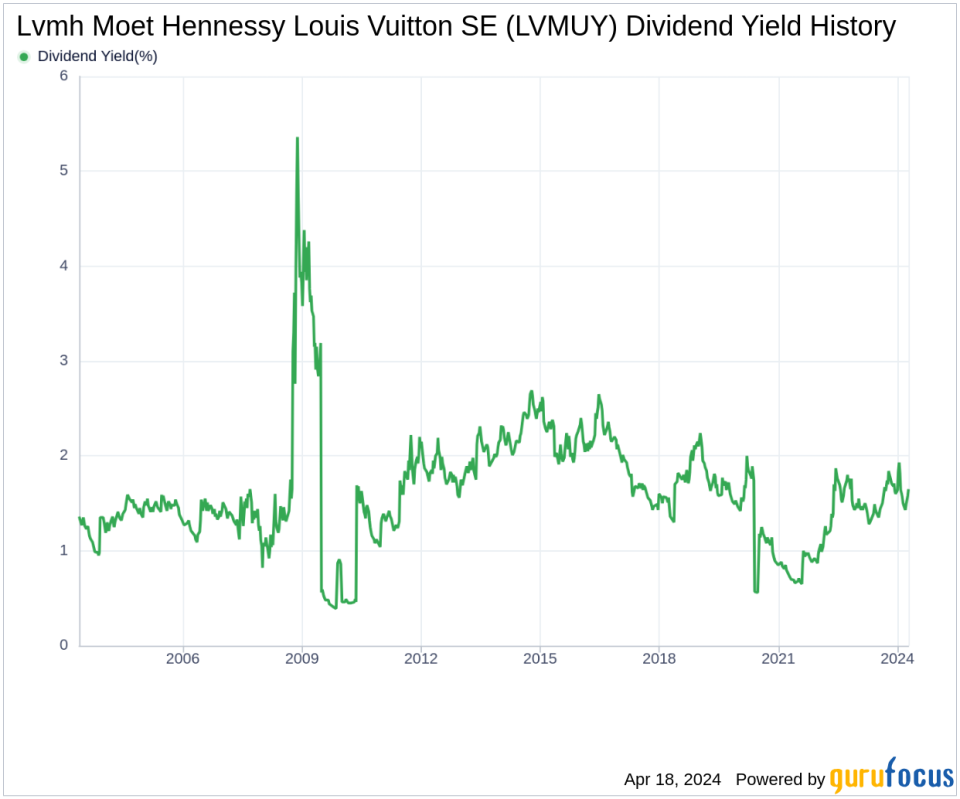

As of today, Lvmh Moet Hennessy Louis Vuitton SE boasts a 12-month trailing dividend yield of 1.62% and a 12-month forward dividend yield of 1.66%. This indicates an anticipated increase in dividend payments over the next year. Over the past three years, the company's annual dividend growth rate was 39.50%, which slows to 20.70% over a five-year period. However, the long-term view is still robust, with an annual dividends per share growth rate of 15.30% over the past decade. The 5-year yield on cost for Lvmh Moet Hennessy Louis Vuitton SE stock is approximately 4.15% as of today.

The Sustainability Question: Payout Ratio and Profitability

The sustainability of Lvmh Moet Hennessy Louis Vuitton SE's dividend is partly determined by its dividend payout ratio, which currently stands at 0.40. This indicates that the company retains a majority of its earnings, which could be used for future growth or to buffer against economic downturns. Furthermore, Lvmh Moet Hennessy Louis Vuitton SE's profitability rank is an impressive 9 out of 10, reflecting strong earnings potential. The company has also consistently reported positive net income over the past decade, reinforcing its financial stability.

Growth Metrics: The Future Outlook

Lvmh Moet Hennessy Louis Vuitton SE's future dividend sustainability is underpinned by its growth metrics, with a growth rank of 9 out of 10 indicating a strong growth trajectory. The company's revenue per share and 3-year revenue growth rate of 24.80% per year outperform approximately 86.59% of global competitors. Additionally, Lvmh Moet Hennessy Louis Vuitton SE's 3-year EPS growth rate of 45.30% per year and a 5-year EBITDA growth rate of 22.60% further demonstrate its ability to expand earnings, crucial for maintaining and growing dividend payments.

Next Steps

Considering Lvmh Moet Hennessy Louis Vuitton SE's consistent dividend payments, solid dividend growth rate, prudent payout ratio, and robust profitability and growth metrics, the company presents as a potentially attractive option for value investors focused on dividend income. The key question for investors is whether these positive trends will continue, supporting ongoing dividend growth. For those seeking to diversify their portfolio with high-dividend yield stocks, GuruFocus Premium users can utilize the High Dividend Yield Screener for further research and investment opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance