Luxury condo market in 2023: Shaken and stirred by ABSD, money laundering

This year, the three best-selling luxury condos by volume are Klimt Cairnhill, Watten House and Cape Royale, says Mark Yip, CEO of Huttons Asia. He adds that these projects feature large-format units, which are in short supply in the market and are located in sought-after addresses in the Core Central Region (CCR).

Of the three, Watten House’s private preview on Nov 18 stood out, with 102 (57%) out of 180 units in the freehold condo sold within a day at an average price of $3,230 psf. Prices were said to start from $3 million on an absolute basis. As at Dec 13, 109 units (61%) have been sold.

Three of the eight penthouses at Watten House were sold during the private preview. One penthouse fetched $17 million, while the other two were sold for over $14 million each, says Ismail Gafoor, CEO of PropNex. Based on caveats lodged, both were 4,008 sq ft penthouses sold for $14.245 million ($3,484 psf) and nearly $14.5 million ($3,545 psf), respectively.

Read also: UOL-SingLand sells 57% of Watten House at an average price of $3,230 psf

Artist's impression of the 180-unit, five-storey, freehold Watten House, where the private preview was held on Nov 18 (Picture: UOL Group and Singapore Land Group)

“Watten House’s sales are all the more commendable if we consider the muted market sentiment and cooling measures introduced in April 2023,” adds Gafoor. The April 27 property cooling measures saw further hikes in additional buyer’s stamp duty (ABSD), the most significant of which was a doubling in ABSD for foreign residential property buyers to 60%.

The developer of Watten House, a joint venture between UOL Group and Singapore Land Group (SingLand), opted for a private preview with scheduled appointments for potential buyers.

“This strategy, commonly observed in the luxury property segment, allows the developer to create an intimate and personalised experience for potential buyers,” says Marcus Chu, CEO of ERA Singapore.

Watten House is a redevelopment of the former Watten Estate condo, which UOL and SingLand purchased en bloc for $550.8 million in October 2021. The freehold project is on Shelford Road, in the prime Bukit Timah area of District 11.

The 138-unit Klimt Cairnhill is 67% sold at an average price of $3,752 psf (Photo: Samuel Isaac Chua/EdgeProp Singapore)

Top-sellers

The other luxury project that stood out in 2023 was Low Keng Huat’s 138-unit Klimt Cairnhill. The freehold development in prime District 9 was previewed in August 2021 and relaunched in January 2023 following the lifting of Covid restrictions. Based on caveats lodged as at Dec 13, 92 units (67%) have been sold at an average price of $3,752 psf.

Eighty-three of the 92 units sold at Klimt Cairnhill were transacted this year, compared with five in 2022 and three in 2021. Prices of units sold this year ranged from $2.65 million ($3,197 psf) for an 829 sq ft two-bedder to $27.5 million ($4,645 psf) for the biggest penthouse of 5,920 sq ft, based on caveats lodged.

Read also: UOL’s 1HFY2023 earnings down 64% y-o-y to $135 mil mainly on lower fair value gains

PropNex’s Gafoor notes that 37 (45%) of the 83 units sold at Klimt Cairnhill were transacted after May when the cooling measures were already in effect.

At the 302-unit Cape Royale in Sentosa Cove, 85 units have been sold at an average price of $2,217 psf since the project was launched in June 2022. Units at the luxury, 99-year leasehold condo by Ho Bee Land and IOI Properties Group were sold at prices from $3.528 million ($2,101 psf) for a 1,679 sq ft, three-bedroom unit.

Cape Royale was one of the three top-selling luxury condos in 2023 (Photo: Samuel Isaac Chua/EdgeProp Singapore)

About 46 of the 85 units sold at Cape Royale were transacted in 2022, based on caveats lodged. Of the 39 units sold this year, 14 were transacted after the property cooling measures kicked in at the end of April, based on caveats lodged as at Dec 13.

When it comes to the top 10 transactions of 2023 — whether in terms of absolute or psf prices — Les Maisons Nassim topped the charts, accounting for four of the 10 biggest deals. The 14-unit luxury condo by Shun Tak Holdings, which features only large units above 6,000 sq ft, was entirely sold by the end of June, just over two years after its launch in May 2021.

The last two transactions at Les Maisons Nassim were for a four-bedroom unit of 6,092 sq ft on the first floor that fetched $30.765 million ($5,050 psf) and a 6,179 sq ft four-bedder on the second floor that was sold for $32.749 million ($5,300 psf), based on caveats lodged. The buyer of both units is said to be a permanent resident (PR).

Unlike foreigners who have to pay 60% for their residential property purchases, PRs buying their first home in Singapore need only pay 5% ABSD.

The 14-unit luxury condo Les Maisons Nassim is fully sold within two years of its launch in May 2021 and accounts for four of the top 10 luxury condo deals in 2023 (Picture: Les Maisons Nassim website)

Seeking residency

Huttons’ Yip notes that while the top three foreign nationalities (foreigners and PRs) in the luxury residential segment — Chinese, Indonesians and US citizens — remain unchanged after the cooling measures, most of them are now PRs. “This indicates that foreigners are either not buying or waiting for their PR application to be approved before doing so,” he says.

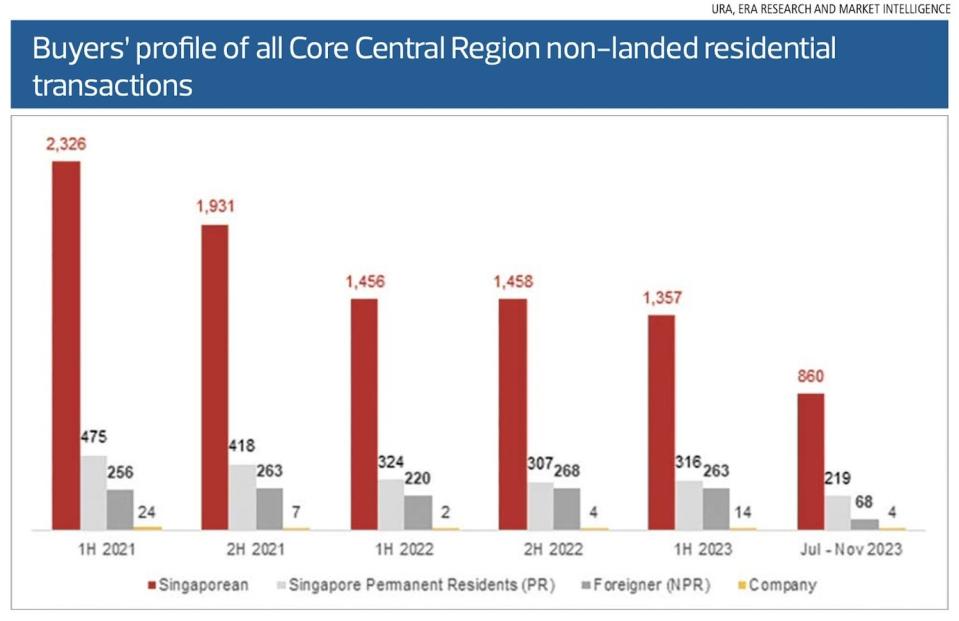

Looking ahead, ERA’s Chu expects Singaporeans to account for a larger proportion of buyers in luxury developments. A case in point is Watten House, where 96% of the 102 buyers at the private preview in November were Singaporeans and PRs.

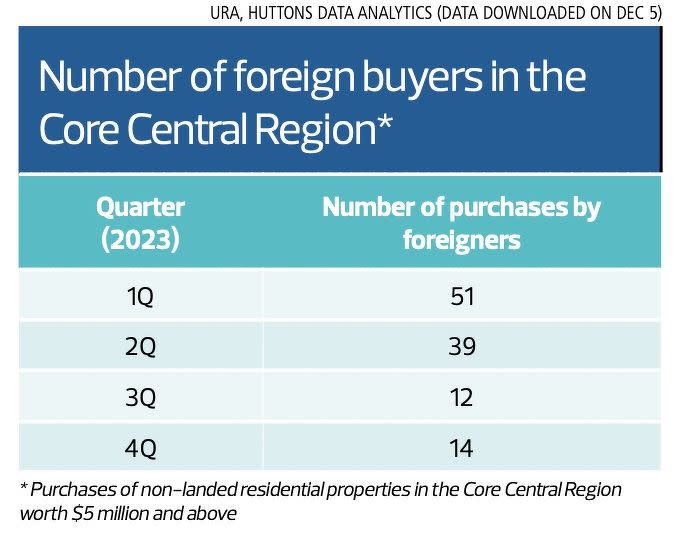

Following the property cooling measures, foreign buying activity plunged 73% from 1H2023 to July to November 2023, according to ERA. Still, foreigners have bought 334 private homes since April 2023, of which 77 (23%) were priced above $5 million each, says Chu. It implies that the higher ABSD has driven foreign investors towards smaller units or homes in less central areas, he adds.

Sentiment in the luxury condo market was further dampened by the money laundering scandal, which saw 10 foreigners of Chinese origin arrested in the middle of August. Over $2.8 billion in luxury properties, cars, cash and other valuables have since been seized.

“The case involved more than 100 properties,” says PropNex’s Gafoor. He explains that seized assets can be held for as long as the case requires. The assets will be confiscated if the accused are convicted, and the court will hold a disposal inquiry. The assets may then be sold via public auction, adds Gafoor. “Should the seized assets be sold, we do not expect them to impact the market much.”

In the meantime, the money laundering case has led to more stringent anti-money laundering checks on property buyers, says ERA’s Chu. “Especially for luxury developments, salespeople typically conduct thorough background assessments of potential buyers before allowing viewings.”

Looking ahead

According to Huttons’ Yip, some ultra-high-net-worth individuals (UNHWIs) held back their property purchases in Singapore after the money laundering case, preferring to await the outcome of the investigation.

In recent months, there have been signs that these UHNWIs are returning. “It may be due to the rising geopolitical conflicts pushing them to seek a safe haven,” says Yip. “The numbers are estimated to increase in the coming months.”

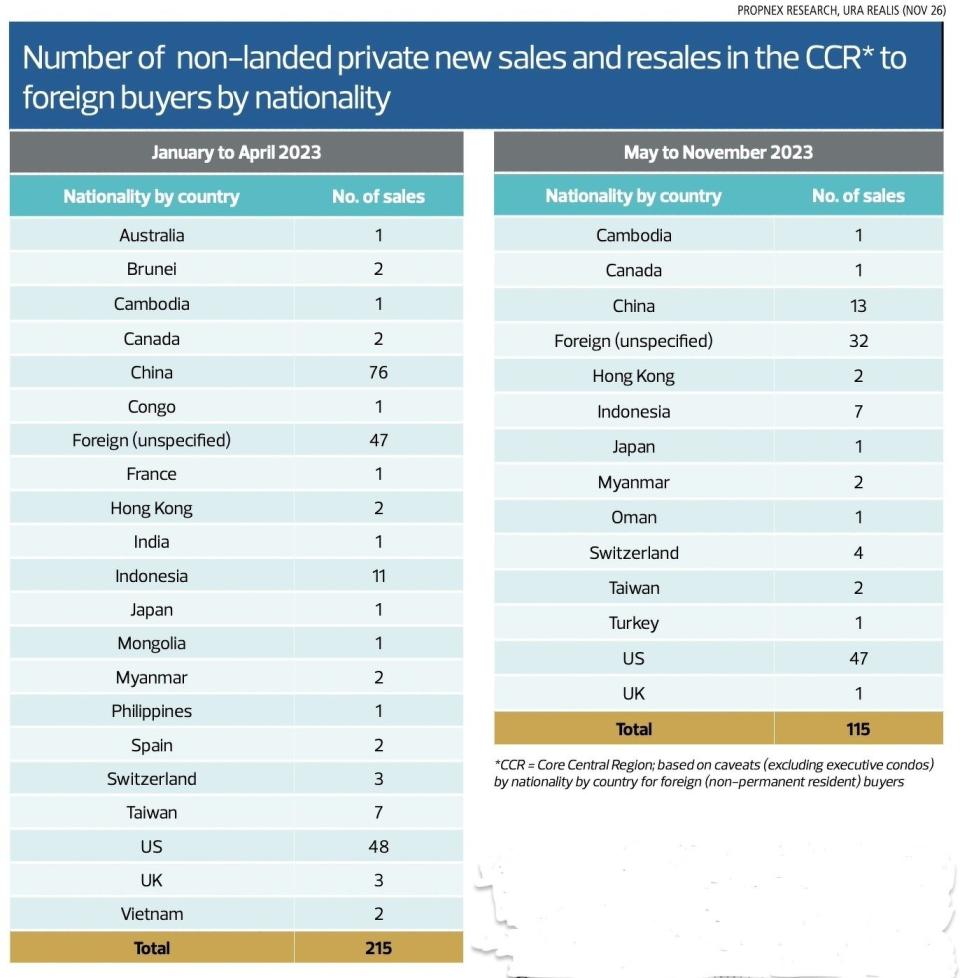

Compared with the fallout from the money laundering scandal, PropNex’s Gafoor believes that the cooling measures have a more significant influence on the buyers in the CCR. The number of caveats lodged for non-landed private new sales and resale properties in the CCR for the first four months of 2023 was 215. After the ABSD hikes, caveats dropped 46.5% to 115 from May to Nov 26.

The doubling in ABSD withered foreign investor interest in residential properties, particularly among those not from the five countries/territories that enjoy the same stamp duty treatment as Singaporeans, says Gafoor. The five countries that enjoy such stamp duty treatment are Norway, Liechtenstein, Iceland, Switzerland, and the US due to various free trade agreements (FTAs) with Singapore.

Residential property purchases by Chinese nationals plunged 83% to just 13 between May and November, from 76 transactions between January and April this year, according to PropNex. Similarly, there were fewer buyers from Indonesia, another key foreign market for Singapore properties, notes Gafoor.

“We will continue to see Singaporeans and Singapore PRs accounting for a majority of the home sales, including in the high-end segment,” he says. “The number of foreign buyers from the five countries with FTAs will likely remain stable.”

The redevelopment of the former Central Mall and Central Square into a new mixed-use development with 366 residential units by City Developments Ltd (Picture: CDL)

For 2024, the luxury projects with large-format homes in the CCR include the 215-unit Skywaters Residences (former 8 Shenton Way) by Perennial Holdings and Alibaba Group in the CBD as well as 32 Gilstead Road and 21 Anderson, both projects by Kheng Leong Co, notes Gafoor.

According to Huttons Asia, other major luxury projects in the CCR in the pipeline for launch next year with over 100 units include:

Frasers Property’s redevelopment of its mixed-use developments Valley Point (622 units) and Robertson Walk (414 units);

the 186-unit Aurea on Beach Road (en bloc of Golden Mile Complex) by Perennial Holdings, Far East Organization and Sino Land;

the 367-unit One Sophia (former Peace Centre/Peace Mansion) by Chip Eng Seng, SingHaiyi and KSH Holdings;

the 683-unit Marina View Residences by IOI Properties Group;

the 246-unit Newport Residences (redevelopment of FujiXerox Towers) by City Developments Ltd (CDL); and

the redevelopment of the former Central Mall and Central Square into a new mixed-use development with 366 residential units by CDL.

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance