Lower Volume & Price to Hurt US Steel's (X) Flat-Rolled in Q4

United States Steel Corporation X released its fourth-quarter 2023 adjusted net earnings per share guidance in the range of 20-25 cents, with an expected adjusted EBITDA of nearly $250 million.

The company highlighted that the projected fourth-quarter performance aligns with the commentary from the October earnings call. Despite challenges, such as the impact of the autoworkers' strike on the domestic flat-rolled order book, the company successfully managed to redirect affected tons to other customers due to its diverse order book. In the Tubular segment, increased shipments are anticipated to compensate for lower selling prices.

U.S. Steel emphasized its focus on controllable factors, expecting a strong quarter in safety, environmental and operational aspects. Looking forward, the company expressed optimism about the improving domestic steel markets, growing customer demand and rising spot selling prices.

The company stated that it is concluding 2023 in a strong position. The guidance reflects robust performance, ongoing negotiations for annual auto contracts with increased volumes and better pricing and progress in Best for All strategic projects. The Keetac direct reduced-grade pellet investment produced its first pellets on schedule. Further strategic investments, including a dual coating line at Big River Steel and the new state-of-the-art Big River 2 mini mill, are expected to be completed in 2024.

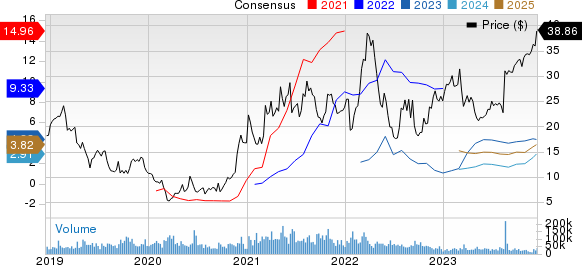

United States Steel Corporation Price and Consensus

United States Steel Corporation price-consensus-chart | United States Steel Corporation Quote

The Flat-Rolled segment is projected to experience a decline in adjusted EBITDA from third-quarter levels. The downside will likely be caused by lower volumes stemming from the idled blast furnace 'B' at Granite City Works and planned maintenance at other facilities. Average selling prices are likely to register a sequential fall due to lower spot selling prices in the third quarter, impacting lagging index-based contracts in the fourth quarter. Despite these challenges, the segment is expected to counteract these headwinds through an improved product mix partially. Approximately $10 million in anticipated start-up costs related to the Keetac direct reduced-grade pellet investment are factored into the segment's adjusted results.

The Mini Mill segment is also forecast to report lower adjusted EBITDA compared with third-quarter levels. This is likely to be due to an expected sequential decline in average selling prices, influenced by the segment's exposure to majority market-based monthly contracts and spot pricing. Costs incurred during a planned maintenance outage in October contribute to these headwinds. The segment anticipates partial mitigation through benefits derived from lower raw material costs. Around $10 million in anticipated construction-related costs for ongoing strategic projects at Big River Steel are included in the segment's adjusted results.

The European segment is projected to maintain adjusted EBITDA in line with third-quarter levels. This is expected despite pricing challenges, as lower raw material costs, increased shipment volumes and the absence of planned outage spending from the third quarter are anticipated to offset pricing headwinds. The Tubular segment is projected to achieve slightly higher adjusted EBITDA than third-quarter levels. This upside can be attributed to increased shipments as distributor inventory rebalances, which are expected to more than compensate for the impact of lower selling prices.

Shares of U.S. Steel have surged 54.6% in the past year compared with a 27.2% rise of its industry.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

U.S. Steel currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the Basic Materials space are Axalta Coating Systems Ltd. AXTA, sporting a Zacks Rank #1 (Strong Buy), and Hawkins, Inc HWKN and Alamos Gold Inc. AGI, each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for AXTA’s current-year earnings is pegged at $1.58, indicating year-over-year growth of 6.8%. AXTA beat the Zacks Consensus Estimate in three of the last four quarters and missed one, with the average earnings surprise being 6.7%. The company’s shares have increased 23.8% in the past year.

The Zacks Consensus Estimate for HWKN’s current-year earnings has been revised upward by 1.8% in the past 60 days. HWKN beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 27.5% on average. The stock has rallied around 61.4% in a year.

The consensus estimate for Alamos’ current fiscal year earnings is pegged at 53 cents, indicating a year-over-year surge of 89.3%. AGI beat the Zacks Consensus Estimate in all of the last four quarters, with the average earnings surprise being 25.6%. The company’s shares have surged 33% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United States Steel Corporation (X) : Free Stock Analysis Report

Alamos Gold Inc. (AGI) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance