Low Commodity Prices & High Costs Affect Lindsay (LNN)

Lindsay Corporation LNN has been witnessing supply-chain constraints for the past few quarters. Due to the limited availability of raw materials, labor and trucking resources, delivery lead times have increased. This is likely to persist and keep denting its performance. Low commodity prices will weigh on farm income and may influence the investment decision-making for farmers.

However, a strong balance sheet and acquisitions will aid growth. Increased concerns around food security will drive growth in the international irrigation markets. Moreover, the need to replace aging equipment will sustain industry demand.

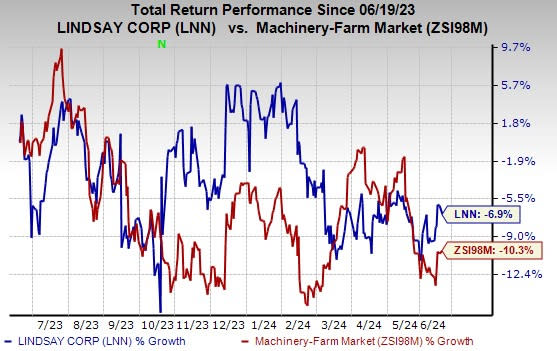

Shares of this Zacks Rank #4 (Sell) company have lost 6.9% in the past year compared with the industry’s decline of 10.3%.

Image Source: Zacks Investment Research

Low Commodity Prices to Weigh on Farm Income: The USDA (U.S. Department of Agriculture) projects net farm income at $116.1 billion for 2024, indicating a decline of 27.1% from that reported in 2023. Moreover, the estimated net farm income for 2024 is 1.7% below its 20-year average (2003-2022) of $118.2 billion. The decline has mainly been resulting from elevated production expenses and lower direct government payments.

High interest rates and a strong dollar took a toll on agricultural commodity prices last year. Soybean, corn and wheat prices have dipped lately as supply prospects from South America have improved due to favorable weather conditions in the backdrop of low demand.

Demand in China for soybeans is expected to go down due to the government's efforts to reduce and substitute the use of soybeans in animal feed to decrease reliance on imports. Low commodity prices will weigh on farm income and might influence farmers’ investment decision-making.

Supply-chain Constraints & High Costs Persist: Lindsay has been witnessing supply-chain constraints, particularly in electronics. Constraints on the availability of raw materials, labor and trucking resources have led to higher lead times for deliveries.

The has also been facing higher input costs. These factors will impact margins in the short term.

Robust International Irrigation Markets to Aid Growth

Despite the odds, the need to replace aging equipment will sustain industry demand. Farm sizes have been on the rise in the United States, requiring more laborers. Given the escalation in labor costs every year, farmers are resorting to farming equipment to replace labor.

In the years to come, the demand for agricultural equipment will be fueled by increased global demand for food, both from population growth and a rising proportion of the population aspiring for better living standards. Drought and water scarcity issues in the United States and other parts of the world support the need for efficient irrigation.

Strong Balance Sheet Bodes Well

Lindsay has a strong balance sheet that will help it navigate the current global economic uncertainty. As of Feb 29, 2024, the company had available liquidity of $200.6 million, with $150.6 million in cash, cash equivalents and marketable securities, and $50 million available under the revolving credit facility.

Lindsay’s capital allocation plan is to continue investing in organic growth and make synergistic acquisitions, while enhancing returns to shareholders. Capital expenditure for fiscal 2024 is expected between $35 million and $40 million, including equipment replacement, productivity improvements and commercial growth investments.

Stocks to Consider

Some better-ranked stocks from the Industrial Products sector are Intellicheck, Inc. IDN, Applied Industrial Technologies AIT and Cintas Corporation CTAS. IDN currently sports a Zacks Rank #1 (Strong Buy), and AIT and CTAS carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Intellicheck’s 2024 earnings is pegged at 2 cents per share. The consensus estimate for 2024 earnings has been unchanged in the past 60 days. The company has a trailing four-quarter average earnings surprise of 28.9%. IDN shares have gained 84.2% in a year.

Applied Industrial has an average trailing four-quarter earnings surprise of 8.2%. The Zacks Consensus Estimate for AIT’s 2024 earnings is pinned at $9.62 per share, which indicates year-over-year growth of 9.9%. Estimates have moved north by 2% in the past 60 days. The company’s shares have gained 8.8% in a year.

The Zacks Consensus Estimate for Cintas’s 2024 earnings is pegged at $14.95 per share. The consensus estimate for 2024 earnings has been unchanged in the past 60 days. The company has a trailing four-quarter average earnings surprise of 4.3%. CTAS shares have gained 13.7% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lindsay Corporation (LNN) : Free Stock Analysis Report

Cintas Corporation (CTAS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Intellicheck Mobilisa, Inc. (IDN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance