Local banks 'resilient' in 2023, but MAS warns of deteriorating asset quality, climate transition risks

Listcos, especially those with larger absolute debt and leverage ratios, have adequately hedged against interest rate risks.

Banks in Singapore have remained resilient over the past year despite heightened risks, with strong capital and liquidity positions supported by healthy profits. That said, higher credit costs in 2024 could be an issue for banks as borrowers cope with “persistently high” interest rates, says the Monetary Authority of Singapore (MAS) in its latest Financial Stability Review, released on Nov 27.

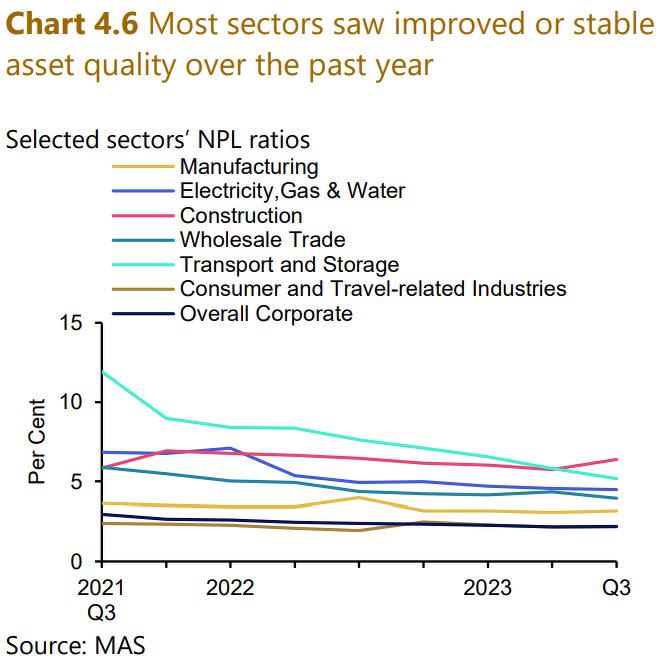

Higher interest rates have had limited impact on asset quality so far, as seen from “persistently low” non-performing loan (NPL) ratios, says the central bank and regulator in its annual assessment of the resilience of Singapore's financial system.

Compared to a year ago, most sectors registered either unchanged or better asset quality. In particular, NPL ratios for the construction; transport and storage; and electricity, gas and water sectors have improved, although they remain relatively high at 6.4%, 5.2% and 4.5% respectively, says MAS.

Looking ahead, however, MAS warns of early signs that asset quality could deteriorate. The special mention ratio, which refers to credit facilities that exhibit potential weaknesses but are not yet classified as NPLs, has ticked up slightly to 3.3% in 3Q2023, largely driven by corporate loans.

“Still-elevated inflation and persistent high interest rates could weigh on corporate profitability and debt repayment ability, placing pressure on banks’ asset quality,” says MAS.

To manage this risk, banks continue to maintain adequate provisioning against a potential decline in credit quality. According to MAS. banks have steadily increased provisioning coverage since 3Q2022 as a “pre-emptive response” to the potential rise in credit cost, bringing total provisioning coverage to 111.2% in 3Q2023.

Provisioning coverage among local banking groups was “particularly high”, says MAS, rising to 229% in 3Q2023 even as NPL ratios remain low.

Banks were aided by strengthening profitability over 2023, such as DBS posting consecutive quarters of record net profit, for example. This explains ample coverage and “strong capital positions”, says MAS, with aggregate common equity tier-1 (CET1) ratios “well above regulatory requirements” at 14.0% as at 3Q2023.

“Nevertheless, as interest rates are likely to stay high for some time, rising credit costs coupled with the levelling off in net interest margins could adversely impact banks’ profitability and capital positions,” says MAS. “Against these challenges, banks should continue to manage credit risk prudently and maintain adequate provisioning buffers.”

Money laundering, terrorist financing risks

Another issue flagged by MAS is that of growing money laundering and related risks. According to the central bank, chief risk officers (CROs) at Singapore financial institutions (FIs) say monetary laundering and terrorist financing (ML and TF) risks are more prominent today, perhaps as a result of the major money laundering crackdown in August involving some $2.8 billion worth of assets.

“They noted that ML and TF risk would continue to be a major challenge for global financial hubs given their open capital accounts and large gross capital flows. It is therefore important for MAS to continue working closely with the industry to identify and disrupt illicit activities, in order to maintain a trusted and thriving financial system in Singapore,” says MAS in its report.

MAS introduced the half-yearly Systemic Rsk Survey in April to gather views from CROs of major banks, insurers, fund managers, exchanges and broker-dealers. Over two polls in April and October, ML and TF risks rose from seventh to fourth place, while macrofinancial risk from tightening monetary policy and slower growth remained most pertinent in bankers’ minds, placing first both times.

Geopolitical risk maintained its second position, and so did technology and cyber risk in third place.

Come 2024, MAS will launch the Collaborative Sharing of ML/TF Information and Cases (COSMIC), a digital platform co-developed with participating banks in Singapore that will allow them to share information on customers whose profile or behaviour exhibits “potential financial crime concerns”.

Climate transition risks

MAS selects a few topical areas to feature in each year’s review. Following last year’s special feature on climate-related physical risks to FIs, one of three special features this year assesses the impact of climate transition risk on the financial system.

MAS worked with FIs to segment their end-2022 credit and market exposures. An analysis of the banks’ credit portfolio reveals that 27.6% of their total credit exposures are to counterparties in climate policy relevant sectors (CPRS). For the banks’ market portfolio, 5.1% of bond exposures and 54.1% of equity exposures are to CPRS.

The CPRS encompasses 27 sectors, including coal, gas, oil, cement, waste, building and construction and forestry, among others.

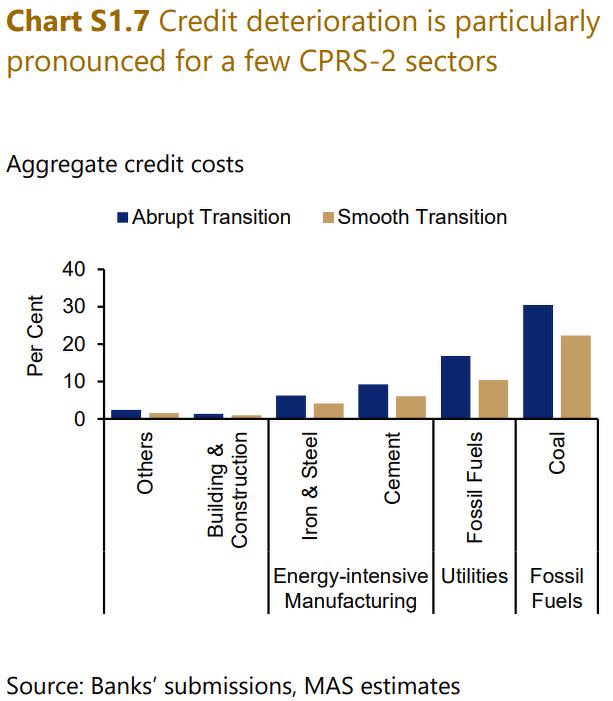

The building and construction sector is the single largest contributor to banks’ projected credit losses. That said, the sector is projected to experience relatively mild credit deterioration under MAS’s projected scenarios.

MAS’s analysis of banks and insurers explored two scenarios over the period 2023 to 2030 — an early and orderly transition, called a “smooth transition”; and a late and disorderly transition, or an “abrupt transition”.

For banks, credit costs are projected to increase across both scenarios. However, the aggregate credit costs (2.43%) incurred under the abrupt transition scenario are 50% higher than that under the smooth transition scenario (1.63%).

Annualised, these credit costs amount to approximately 14.2% and 6.0% of banks’ FY2022 net profits under the abrupt and smooth transition scenarios respectively.

The top-down analytical exercise shows that a disorderly transition could be “potentially destabilising and disruptive” for the financial system and could result in “significant” financial losses for FIs, says MAS.

The results suggest an urgent need for FIs to engage their corporate clients to develop and execute “credible” transition plans to enable an early and orderly transition, MAS adds. “MAS has sought to support FIs in this process by setting clear supervisory expectations on transition planning, and has recently issued a set of consultation papers proposing relevant guidelines for banks, insurers and asset managers.”

MAS updated its transition-related supervisory expectations for FIs on Oct 18, calling for banks, insurers and asset managers to discuss climate-related risks with their customers and investee companies instead of divesting from them.

The transition planning guidelines follow MAS’s guidelines on environmental risk management for banks, insurers and asset managers, which came into effect in June 2022.

Listcos largely well-hedged against rising rates

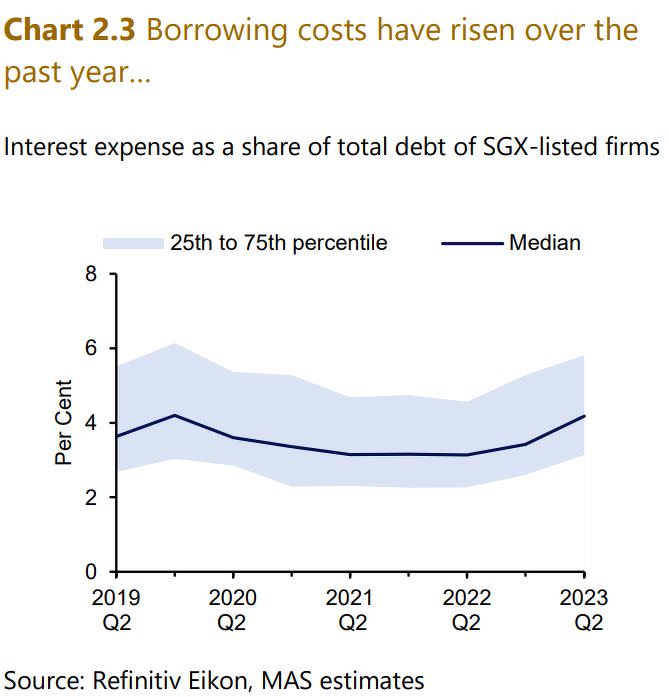

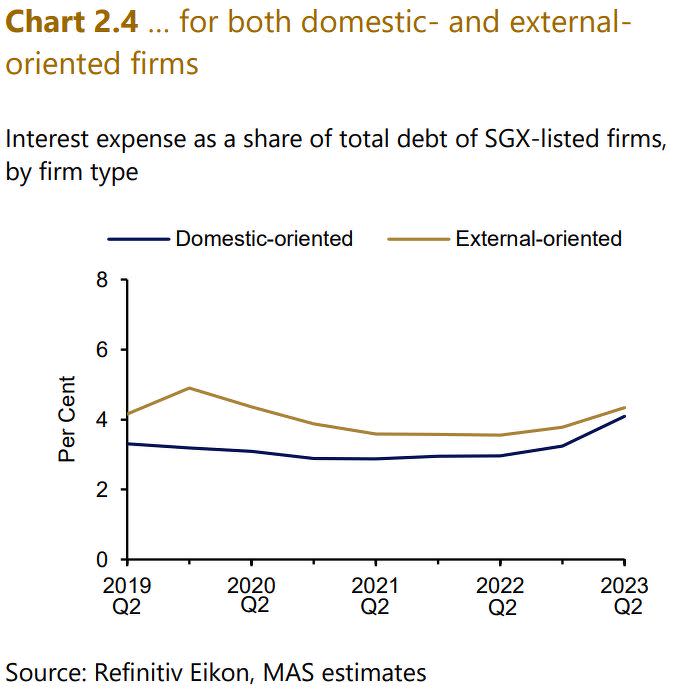

Firms here have seen their borrowing costs rise “moderately” with the continued pass-through of high interest rates, says MAS. Looking at companies listed on the Singapore Exchange S68 (SGX) in particular, borrowing costs have risen in the past year, though at a slower pace than the broader increase in interbank interest rates.

Median borrowing costs for both domestic- and external-oriented firms rose by about 100 basis points (bps) from 2Q2022 to 2Q2023, well below the 300 bps rise in 3-month compounded SORA (3M SORA) over the same period.

Interest rate hedging may partly account for the moderate borrowing cost increases, says MAS. Listed companies (listcos), especially those with larger absolute debt holdings and relatively higher leverage ratios, were hedged against interest rate risks through interest rate derivatives or fixed-rate borrowing, MAS adds.

Naturally, S-REITs had the highest proportion of firms that hedged their interest rate risk exposure given their highly-leveraged positions.

In addition to hedging, firms have been actively deleveraging and slowing the pace of investments since the start of the monetary tightening cycle, says MAS. Corporate debt as a share of GDP fell from its peak in 1Q2021 and reached a decade-low in 1Q2023, before ticking up slightly in 2Q2023 due to a firm-specific M&A.

Banks noted that some firms have drawn on cash holdings to pay down existing debt or fund their operations, while others have held back on taking on new debt to fund expansion or refresh their capital stock.

Firms are expected to be resilient to further shocks but should remain vigilant to downside risks, says MAS. “Following a sharp increase in 2H2022, Singapore dollar interest rates rose further in 2023 but at a slower pace in line with the global rate hike cycle. In the coming year, Singdollar interest rates are likely to remain at elevated levels based on market forward pricing.”

Households deleverage as wealth accumulates

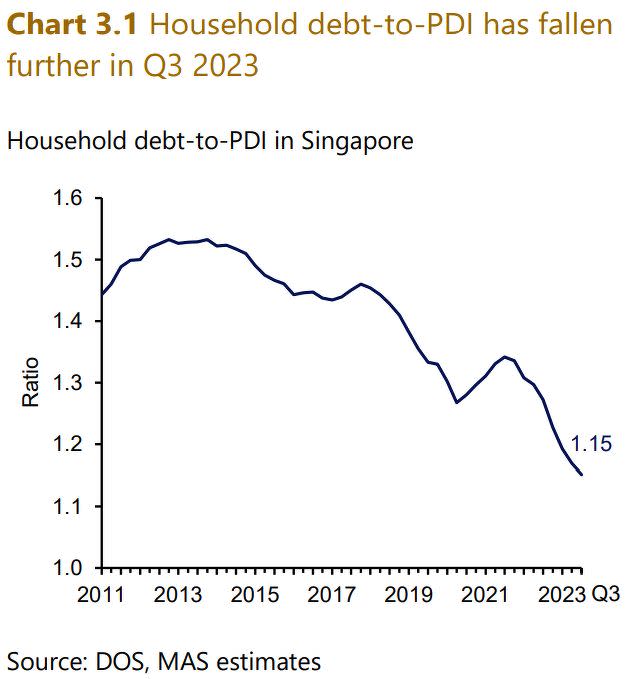

Households continue to pare down debt in the face of higher interest rates, says MAS. In 3Q2023, aggregate household debt as a share of personal disposable income (PDI) fell for the eighth consecutive quarter to a decade-low multiple of 1.2.

Households have exercised caution in taking on additional loans in view of the increase in interest rates since 2H2022, says MAS, resulting in a decline in the household debt level from a year ago. This was led by the drop in personal loans.

The denominator of household sector net wealth, too, has grown. This figure rose 7.6% y-o-y to $2.7 trillion in 3Q2023, largely supported by sustained growth in liquid assets and in the value of residential property assets.

Liquid assets, such as cash and deposits — comprising about 20% of total assets as of 3Q2023 — continued to exceed total liabilities, with growth of the former outpacing that of the latter since 1Q2022, says MAS.

The personal saving rate, while still “relatively high”, has trended down slightly from 35.1% in 3Q2022 to 34.6% in 3Q2023 on the back of higher travel and domestic retail spending, says MAS.

Most households with existing mortgage loans are “well-placed” to manage the impact of higher interest rates, says MAS. This reflects “conservative” credit assessment by banks which were part of macroprudential policies put in place earlier. Measures like the total debt servicing ratio (TDSR), which sets property loans at a maximum of 55% of the borrower’s monthly income, were introduced in December 2021.

“Looking ahead, households should continue to ensure that they have sufficient funds to handle emergencies,” says MAS.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Establishing a family office in Singapore will now take as long as 18 months: FT

Singapore steps up cross-border payment linkages with Malaysia and Indonesia

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance