LMIRT upsizes term loan facility limit to 4.5 trillion rupiah

Units in LMIRT closed flat at 1.2 cents on June 26.

Lippo Malls Indonesia Retail Trust (LMIRT) has upsized its term loan facility limit to 4.5 trillion rupiah ($371.8 million) from 2.5 trillion rupiah previously.

The REIT had already secured amortizing term loan facilities of up to 2.5 trillion rupiah, which was granted under a facility agreement dated May 28. The facility has an average life of about eight years.

As at June 27, some 2.32 trillion rupiah under the facility had been drawndown and used to prepay the trust’s Singapore dollar (SGD)-denominated secured bank loans on June 7.

According to LMIRT’s manager, the proceeds from the upsized facility will be used to finance the purchase of the outstanding 7.5% senior notes due 2026, the payment of the consent fee under a consent solicitation in relation to the 2026 notes as well as other fees and expenses.

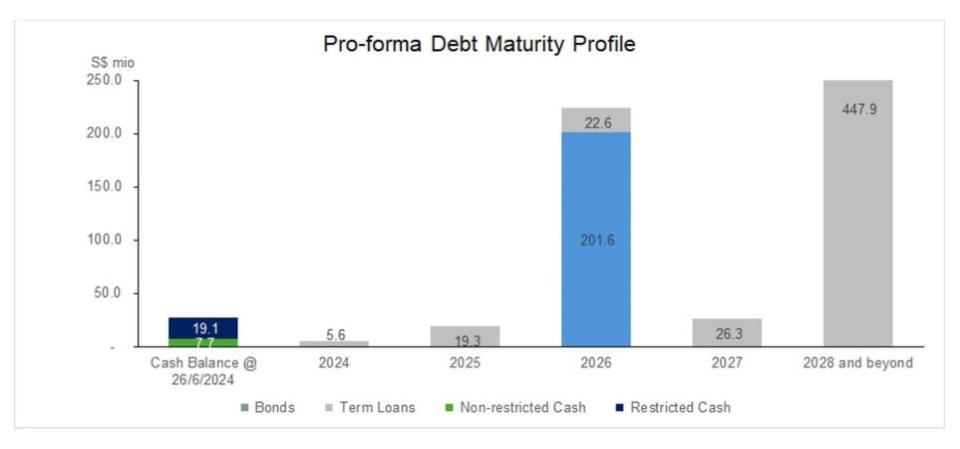

LMIRT's pro-forma debt maturity profile. Chart: LMIRT

The notes are issued by LMIRT Capital and unconditionally and irrevocably guaranteed by LMIRT’s trustee, Perpetual (Asia) Limited.

Under the listing manual rules, a mandatory prepayment event will occur if PT Lippo Karawaci Tbk ceases to be the single largest unitholder of LMIRT and is no longer the ultimate shareholder of LMIRT’s manager. Should that occur, LMIRT’s aggregate level of loan facilities is at around $260 million.

The aggregate level of loan facilities of LMIRT Capital and other subsidiaries of the trust that may be affected is around $723.4 million.

Units in LMIRT closed flat at 1.2 cents on June 26.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

LMIRT issues US$16.2 mil worth of guaranteed senior notes due 2026

Lippo Malls Indonesia Retail Trust holds back on DPU for fifth consecutive quarter

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance