Little Excitement Around Briscoe Group Limited's (NZSE:BGP) Earnings

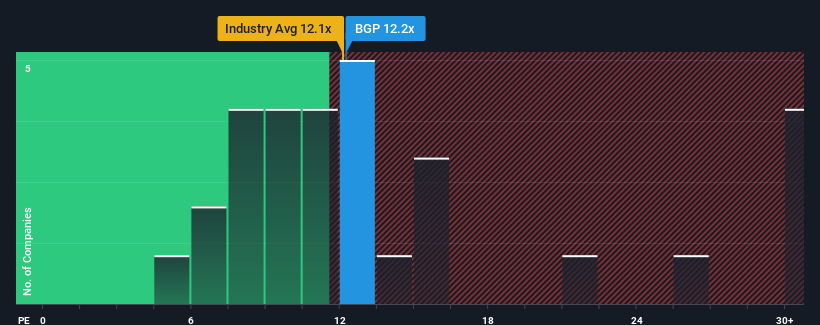

When close to half the companies in New Zealand have price-to-earnings ratios (or "P/E's") above 16x, you may consider Briscoe Group Limited (NZSE:BGP) as an attractive investment with its 12.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Briscoe Group has been doing a reasonable job lately as its earnings haven't declined as much as most other companies. One possibility is that the P/E is low because investors think this relatively better earnings performance might be about to deteriorate significantly. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. But at the very least, you'd be hoping that earnings don't fall off a cliff completely if your plan is to pick up some stock while it's out of favour.

View our latest analysis for Briscoe Group

Want the full picture on analyst estimates for the company? Then our free report on Briscoe Group will help you uncover what's on the horizon.

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Briscoe Group's is when the company's growth is on track to lag the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 37% overall rise in EPS, in spite of its uninspiring short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 3.4% per year during the coming three years according to the two analysts following the company. That's not great when the rest of the market is expected to grow by 21% per annum.

With this information, we are not surprised that Briscoe Group is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Briscoe Group maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Briscoe Group (1 is concerning!) that we have uncovered.

Of course, you might also be able to find a better stock than Briscoe Group. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance