Lithia (LAD) Short-Term View Bearish Despite Buyouts & Buybacks

Lithia Motors LAD, one of the leading auto retailers in the United States, has been on an aggressive acquisition spree and remains committed to shareholder returns through buybacks and dividends. Despite its strategic moves, the company's stock performance has been lackluster of late, indicating potential challenges ahead.

In this write-up, we will discuss the reasons behind our near-term bearish outlook for Lithia, despite its aggressive growth strategies and share repurchase programs.

LAD’s Buyout Binge and Buyback Boost

Lithia Motors has significantly expanded its market share through a series of acquisitions. In 2022, the company acquired more than $3.5 billion in annualized revenues, followed by $3.8 billion in 2023. The current year has seen further expansion with the Pendragon and Carousel acquisitions, which are expected to add another $5.4 billion in revenues.

Moreover, Lithia's annualized cash flow growth rate of 32% over the past 3-5 years is impressive compared to the industry average of 17%. To enhance shareholder value, the company boosted its share buyback program by $350 million yesterday, bringing the remaining buyback authorization to $660 million. Additionally, Lithia has consistently increased its dividend, with the latest hike to 53 cents per share and a five-year annualized growth rate of 13.73%. With a payout ratio of just 6%, the dividend growth appears sustainable.

LAD Stock Down YTD

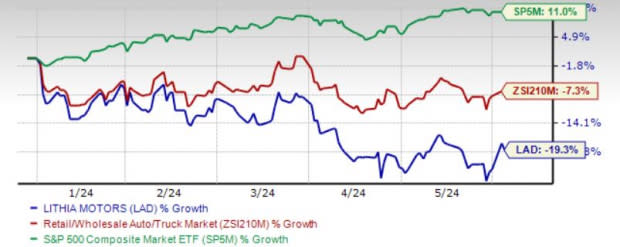

Despite these strategic buyouts, robust investor-friendly moves and an ambitious goal to achieve a ratio of 2:1 for EPS to every $1 billion in revenues generated in the long term, the stock seems to have failed to convince investors. Shares of LAD are down roughly 19% so far this year, significantly underperforming the industry and the S&P 500. There are several factors that are dragging down the company's performance.

Image Source: Zacks Investment Research

Near-Term Challenges for LAD

A deeper look into Lithia's revenue growth reveals a disparity between overall revenue growth and same-store sales. While new vehicle retail sales jumped 22.4% year over year in the first quarter of 2024, same-store new vehicle sales increased only 2.3%. This suggests that much of the growth is driven by acquisitions rather than organic sales.

The situation is even more concerning for used vehicle sales, where same-store revenues contracted 5%. Affordability challenges amid high costs of vehicle financing will continue to weigh on the demand for vehicles, thus limiting Lithia’s near-term prospects. Also, as much of the pent-up demand was released last year, the rate of vehicle sales growth is expected to decelerate this year in the United States.

Lithia's inventory levels have increased significantly. New vehicle inventory days at the end of the first quarter rose to 60 from last year's 51, while used car inventory days at 58 are up from 53 days a year ago. To move cars out of dealerships, Lithia is being forced to offer sweeter deals to buyers. This has led to a decrease in its average selling prices — new vehicle retail units are down 1.3% and used ones are down 3.5%. This has squeezed margins, with new vehicle retail gross profits per unit declining by 30% and used vehicle retail gross profits per unit dropping by 6.9% in the last reported quarter. The cost structure for new cars is rising faster than that for used cars, adding further pressure on the company’s profitability.

Margin compression poses a significant challenge for the company at present. Unfortunately, there are no indications that this situation will improve in the near future.The company foresees the downward trajectory of GPUs persisting through 2024.

Lithia Reports $2 Million Operating Losses

Lithia’s financing operations segment reported an operating loss of around $2 million in the last reported quarter and does not expect to break even until the latter half of 2024. Moreover, rising SG&A as a percent of gross profit also remains a concern.

Lithia must manage its expenses to avoid the need for price hikes, especially amid softening demand. Of course, slashing prices further would worsen margins more. The company should strive to maintain a balance and aim at reducing non-fixed costs and possibly renegotiating terms with its vehicle suppliers.

LAD’s debt remains high compared to its cash and cash equivalents, which were $404.6 million at the end of March 2024, down from $941.1 million as of Dec 31, 2023. Meanwhile, debt is increasing. High debt levels amid rising costs and squeezed margins present a risk to the company’s financials. LAD’s long-term debt-to-capitalization is higher than the industry's.

Image Source: Zacks Investment Research

From a valuation standpoint, Lithia’s stock is trading at higher levels compared to the industry. If we look at the price/earnings ratio, LAD shares currently trade at 8.37 forward earnings, above its 1-year low of 6.11 and median of 7.85.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for 2024 EPS implies a year-over-year decline of 22%. The company has been witnessing downward revisions in earnings estimates. With a Growth Score of C, the near-term outlook remains bleak.

Image Source: Zacks Investment Research

Conclusion

Investors should approach Lithia with caution, as the company faces significant short-term headwinds that could further impact its stock performance. While the long-term growth prospects remain promising, the near-term outlook is clouded by revenue growth disparities, margin compression, rising expenses and high debt levels.

The stock currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lithia Motors, Inc. (LAD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance