LifePoint Health (LPNT) Q4 Earnings Miss on Lower Revenues

LifePoint Health, Inc. LPNT reported earnings of 77 cents per share in fourth-quarter 2017 that missed the Zacks Consensus Estimate by 4.94%. Also, the figure declined 41.5% year over year, due to revenue decline and increase in expenses.

Operational Update

Revenues of $1.49 billion missed the Zacks Consensus Estimate by 5.3% and fell roughly 5.2% year over year.

Provision for doubtful accounts was $282.4 million in the reported quarter, up 22.7% year over year.

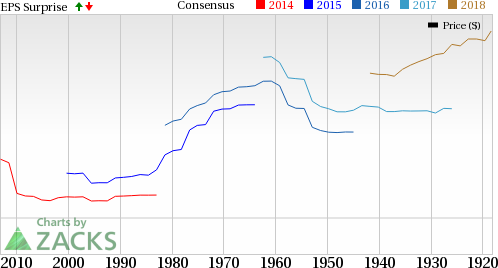

LifePoint Health, Inc. Price, Consensus and EPS Surprise

LifePoint Health, Inc. Price, Consensus and EPS Surprise | LifePoint Health, Inc. Quote

Equivalent admissions declined 3% year over year to 172,791 and revenue per equivalent admission was down 4.2% year over year to $8625.

Total expenses of $1.55 billion increased 1.3% year over year.

At the end of the fourth quarter, the company had 71 hospitals compared with 72 hospitals in the year-ago quarter.

Financial Update

As of Dec 31, 2017, the company had total assets of $6.29 billion, down 0.5% year over year.

Cash and cash equivalents totaled $112 million, up 16.5% year over year.

As of Dec 31, 2017, long-term debt declined 0.5% to $2.88 billion from year-end 2016.

Net cash provided by operating activities totaled $178.2 million, up 73.9% year over year.

2018 Guidance

The company expects earnings per share in the range of $4-$4.53, and adjusted EBITDA is expected within $725-$765 million.

Also, LifePoint Health projects revenues within $6.35-$6.43 billion, same hospital revenue growth of 1.4% to 2.7%, and capital expenditures of $475 million to $500 million.

Zacks Rank & Performance of Peers

LifePoint Health presently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among the other firms in the medical sector that have reported their fourth-quarter earnings so far, the bottom line at Centene Corp. CNC, Anthem Inc. ANTM and UnitedHealth Group Inc. UNH beat their respective Zacks Consensus Estimate.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Anthem, Inc. (ANTM) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

LifePoint Health, Inc. (LPNT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance