Leonardo DRS Inc (DRS) Surpasses Analyst Revenue Forecasts with Strong Q1 2024 Performance

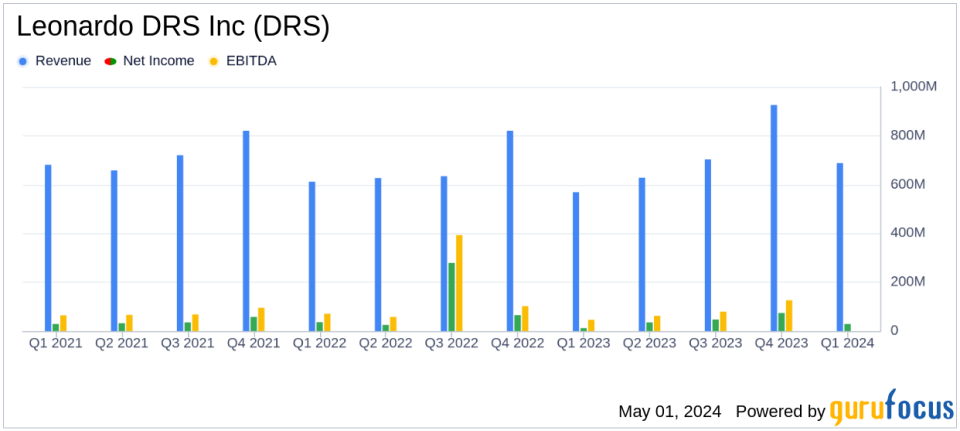

Revenue: Reported $688 million, a 21% increase year-over-year, surpassing the estimate of $642.86 million.

Net Earnings: Achieved $29 million, up 142% year-over-year, exceeding the estimate of $27.26 million.

Diluted EPS: Recorded at $0.11, up 120% year-over-year, meeting the estimated earnings per share of $0.11.

Adjusted EBITDA: Reached $70 million, marking a 43% increase from the previous year.

Bookings: Totaled $815 million with a book-to-bill ratio of 1.2x, indicating strong demand and future revenue potential.

Backlog: Grew significantly to $7.8 billion, an 84% increase year-over-year, highlighting robust future earnings potential.

2024 Guidance: Confirmed solid with revenue projections between $2,925 million to $3,025 million and adjusted diluted EPS forecasted at $0.74 to $0.82.

Leonardo DRS Inc (NASDAQ:DRS) released its 8-K filing on May 1, 2024, announcing a significant year-over-year increase in its financial metrics for the first quarter of 2024, which ended on March 31, 2024. The company reported a revenue of $688 million, marking a 21% increase from the previous year, substantially surpassing analyst expectations of $642.86 million. Net earnings also saw a dramatic rise to $29 million, up 142% from the prior year, slightly above the estimated $27.26 million.

Headquartered in Arlington, VA, Leonardo DRS is a prominent provider of advanced defense technologies, catering to U.S. national security customers and allies globally. The company specializes in the design, development, and manufacture of cutting-edge sensing, network computing, force protection, and electric power and propulsion technologies. With its operations segmented into Advanced Sensing and Computing, which is the major revenue contributor, and Integrated Mission Systems, Leonardo DRS continues to lead with innovative solutions across multiple domains.

Operational Highlights and Financial Metrics

The first quarter results were driven by solid bookings and robust double-digit organic growth, particularly in naval power, ground systems integration, advanced infrared sensing, and naval network computing programs. The adjusted EBITDA increased by 43% to $70 million, with the adjusted EBITDA margin expanding by 160 basis points to 10.2%. The diluted earnings per share (EPS) stood at $0.11, aligning perfectly with analyst projections, and showing a substantial increase from the previous year's $0.05.

Leonardo DRS's backlog increased impressively to $7.8 billion, up 84% year-over-year, fueled by heightened international demand and robust domestic awards. This backlog secures a solid foundation for future revenue streams and reflects the company's strong market position and ongoing customer trust.

Challenges and Strategic Moves

Despite the positive outcomes, Leonardo DRS faced challenges such as managing increased demand alongside maintaining operational efficiency and cost control. The company's strategic focus on innovation and market expansion has been crucial in addressing these challenges and driving growth. Additionally, the company confirmed its 2024 guidance, projecting revenues between $2,925 million and $3,025 million and adjusted EBITDA between $365 million and $390 million, which underscores management's confidence in sustained operational performance.

Investor and Analyst Perspectives

Leonardo DRS delivered exceptional first quarter 2024 results, highlighted by solid bookings, robust double-digit organic growth, significant profit growth and margin expansion. This incredible start to the year continues to demonstrate the strength of our portfolio and is foundational to the confidence we have in our ability to deliver on our growth and margin expansion commitments. I am pleased with how our team continues to build on our market-leading positions by executing with excellence for our customers and driving innovation to help solve complex mission requirements, said Bill Lynn, Chairman and CEO of Leonardo DRS.

Leonardo DRS's financial stability is further evidenced by its healthy balance sheet, with $160 million in cash and a manageable debt level, providing ample capacity for future growth investments. The company's performance not only demonstrates its operational excellence but also its strategic foresight in a competitive and dynamic industry.

For detailed insights and further information, refer to the company's full earnings release and join the upcoming conference call scheduled for 10:00 a.m. ET on May 1, 2024. The call will be broadcasted live and can be accessed via the Leonardo DRS Investor Relations website.

For more financial analysis and news updates on Leonardo DRS Inc (NASDAQ:DRS) and other leading stocks, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Leonardo DRS Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance