Kunshan Huguang Auto HarnessLtd Leads Trio Of Stocks Estimated To Be Undervalued On Chinese Exchange

Amidst a backdrop of mixed economic signals from China, where industrial production and fixed asset investment have shown signs of slowing, the Chinese stock market has experienced fluctuations. In such an environment, identifying stocks that appear undervalued could offer potential opportunities for investors looking for value in less obvious places.

Top 10 Undervalued Stocks Based On Cash Flows In China

Name | Current Price | Fair Value (Est) | Discount (Est) |

Xiamen Amoytop Biotech (SHSE:688278) | CN¥57.61 | CN¥110.65 | 47.9% |

Xi'an Manareco New MaterialsLtd (SHSE:688550) | CN¥24.83 | CN¥47.34 | 47.6% |

DaShenLin Pharmaceutical Group (SHSE:603233) | CN¥15.41 | CN¥30.33 | 49.2% |

ShenZhen Click TechnologyLTD (SZSE:002782) | CN¥11.14 | CN¥22.01 | 49.4% |

Zhejiang Taihua New Material Group (SHSE:603055) | CN¥10.46 | CN¥20.03 | 47.8% |

TianJin 712 Communication & Broadcasting (SHSE:603712) | CN¥19.70 | CN¥38.36 | 48.6% |

China Film (SHSE:600977) | CN¥11.05 | CN¥20.15 | 45.2% |

Shandong Weigao Orthopaedic Device (SHSE:688161) | CN¥21.21 | CN¥40.72 | 47.9% |

Quectel Wireless Solutions (SHSE:603236) | CN¥50.06 | CN¥90.62 | 44.8% |

Levima Advanced Materials (SZSE:003022) | CN¥14.39 | CN¥25.76 | 44.1% |

We're going to check out a few of the best picks from our screener tool

Kunshan Huguang Auto HarnessLtd

Overview: Kunshan Huguang Auto Harness Co., Ltd. specializes in the R&D, production, and sales of automotive high and low voltage wiring harness assembly products both domestically and internationally, with a market capitalization of CN¥12.64 billion.

Operations: The company generates revenue primarily through the development, production, and sales of high and low voltage wiring harness assemblies for the automotive industry in China and abroad.

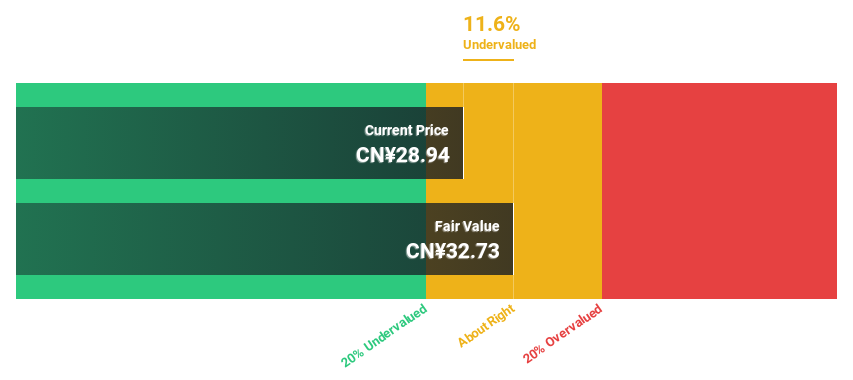

Estimated Discount To Fair Value: 11.6%

Kunshan Huguang Auto Harness Co., Ltd. has shown robust financial growth with a 1904.9% increase in earnings over the past year and is forecasted to expand its earnings by 43.52% annually. Despite trading at CN¥28.94, below the estimated fair value of CN¥32.73, it remains modestly undervalued based on discounted cash flow analysis. The company's debt is not well-covered by operating cash flow, posing a financial risk despite high expected revenue growth of 28.8% per year, outpacing the Chinese market average.

Hunan Jiudian Pharmaceutical

Overview: Hunan Jiudian Pharmaceutical Co., Ltd. is a company engaged in researching, developing, producing, and selling pharmaceutical products both domestically and internationally, with a market capitalization of approximately CN¥13.42 billion.

Operations: The company generates its revenue primarily from medicine manufacturing, which accounted for CN¥2.78 billion.

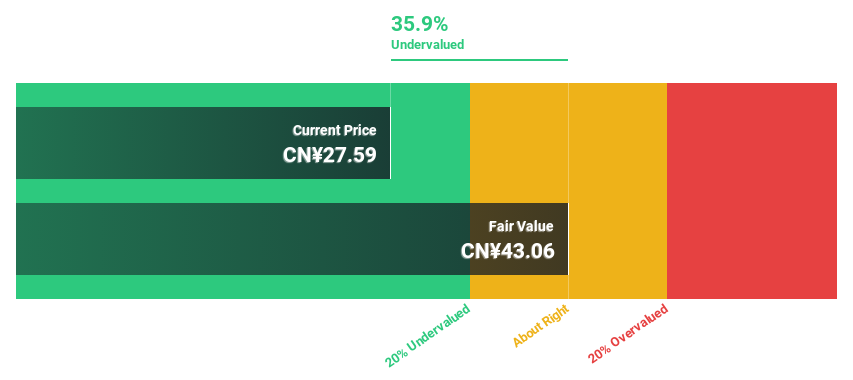

Estimated Discount To Fair Value: 35.9%

Hunan Jiudian Pharmaceutical Co., Ltd. recently reported a significant increase in quarterly earnings, with net income rising to CNY 125.67 million from CNY 76.89 million year-over-year and revenue climbing to CNY 590.9 million from CNY 501.87 million. Despite this growth and a dividend increase to CNY 3.21 per ten shares, the stock is trading at a substantial discount of 35.9% below its estimated fair value based on discounted cash flow analysis, indicating potential undervaluation. However, its dividend track record remains unstable, adding an element of risk for investors focused on cash flow sustainability.

Gambol Pet Group

Overview: Gambol Pet Group Co., Ltd., based in China, focuses on the research, development, production, and sale of pet food products with a market capitalization of CN¥22.28 billion.

Operations: The company generates CN¥4.52 billion from its pet food and supplies segment.

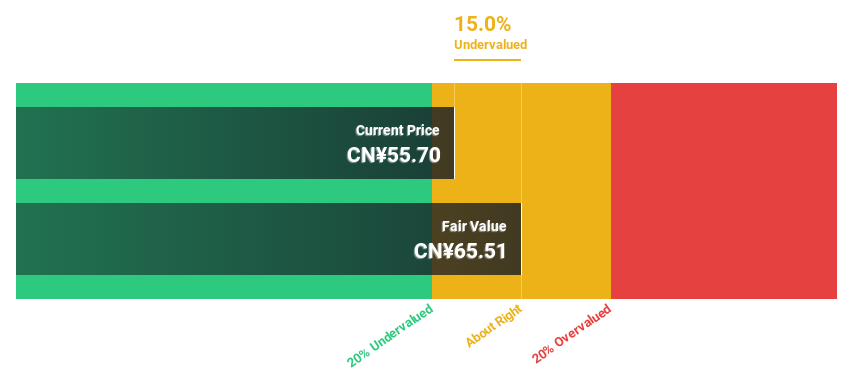

Estimated Discount To Fair Value: 15%

Gambol Pet Group, with a current price of CN¥55.7, is trading 15% below its calculated fair value of CN¥65.51, suggesting potential undervaluation based on cash flows. The company's earnings have seen a robust growth of 59.8% over the past year and are expected to expand by 22.67% annually over the next three years, outpacing the Chinese market's average. Recently, Gambol was added to an index following strong quarterly results with net income rising from CN¥84.98 million to CN¥148.29 million year-over-year, reflecting operational efficiency and market confidence.

Seize The Opportunity

Get an in-depth perspective on all 93 Undervalued Chinese Stocks Based On Cash Flows by using our screener here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:605333 SZSE:300705 and SZSE:301498.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance