KSH Holdings-led consortium purchases Euro-Asia Apartments enbloc for $222.18 million

The purchase price translates to a land rate of $1,313 psf per plot ratio, inclusive of bonus balcony area.

SINGAPORE (EDGEPROP) - A consortium of local companies led by property developer KSH Holdings has acquired Euro-Asia Apartments at 1037 Serangoon Road for $222.18 million. The collective sale was brokered by Low Choon Sin, managing partner of SRI Capital Market.

Read also: Updates to planning parameters on Lakepoint Condominium collective sale site

The 84-unit development sits on a 56,476 sq ft site that has a plot ratio of 2.8 under the latest Master Plan. Thus, the purchase price translates to a land rate of $1,313 psf per plot ratio, inclusive of bonus balcony area.

According to a media release by the developer on July 26, the collective sale of the freehold property was through an indirect 49%-owned associated company called KSH Ultra Unity. The other owners of the company are H10 Holdings and SLB Development who hold an equity interest of 36% and 15% respectively.

Euro-Asia Apartments had been put up for collective sale on June 1 this year, and it had a guide price of $218 million. The owners of the development had also attempted an enbloc sale in 2018 with a guide price of $200 million at the time.

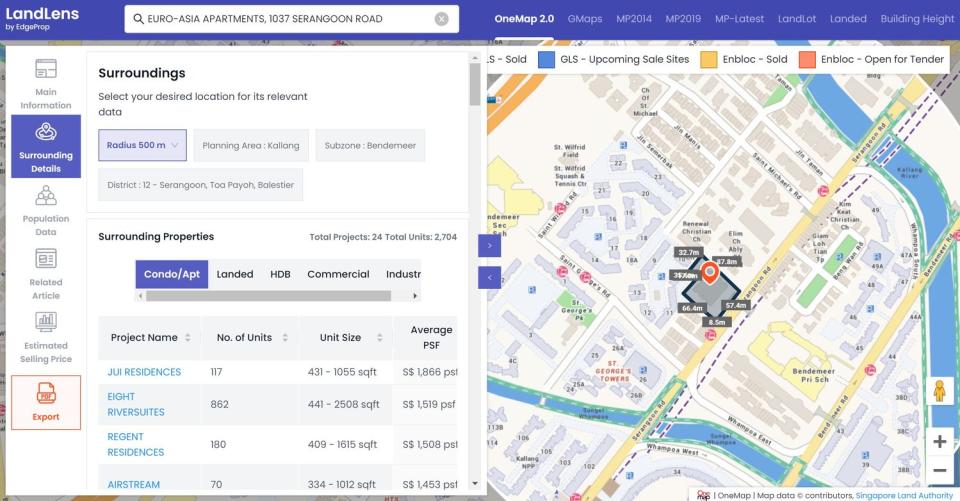

A comparison of average selling prices of nearby condos around Euro-Asia Apartments. (Map: EdgeProp Singapore)

“The outcome of tender is well received with various interest from developers,” says Low Choon Sin, managing partner of SRI Capital Markets. He adds: “The site’s attributes further enhance the attractiveness to allow the developer to build an iconic highrise residential development along the prominent Serangoon Road.”

The developers say that they intend to redevelop the site into a new residential development with about 172 residential units.

Based on a compilation of nearby transaction data by EdgeProp Singapore, most of the existing properties in the area have recorded approximate resale prices that range from about $1,000 psf to $1,800 psf.

The highest average psf price in the vicinity comes from Jui Residences, a 117-unit freehold project by Malaysian developer Selangor Dredging. The project was launched for sale in September 2018 and was fully sold by August 2021.

Stay updated with En Bloc Singapore - Latest News, Enbloc Potential, Listings & Sales in 2022

Check out the latest listings near Euro-Asia Apartments, Jui Residences

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

Meyer Park in Marine Parade up for collective sale at $420 mil

Updates to planning parameters on Lakepoint Condominium collective sale site

Four adjoining strata commercial units at Peninsula Plaza up for sale at $60 mil

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance