KRX Growth Leaders With A Minimum Of 16% Insider Ownership

Following a recent dip that ended its three-day winning streak, the South Korean stock market remains a focal point for investors, with the KOSPI now hovering just above the 2,855-point plateau. Amidst this backdrop of mild fluctuations and cautious optimism in global markets, companies with high insider ownership in South Korea are attracting attention as potentially resilient investments during uncertain times.

Top 10 Growth Companies With High Insider Ownership In South Korea

Name | Insider Ownership | Earnings Growth |

ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

Seojin SystemLtd (KOSDAQ:A178320) | 27.9% | 54% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

Vuno (KOSDAQ:A338220) | 19.5% | 105% |

Park Systems (KOSDAQ:A140860) | 33.1% | 35.6% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

HANA Micron (KOSDAQ:A067310) | 20% | 96.3% |

INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

Techwing (KOSDAQ:A089030) | 18.7% | 77.8% |

Let's take a closer look at a couple of our picks from the screened companies.

Techwing

Simply Wall St Growth Rating: ★★★★★★

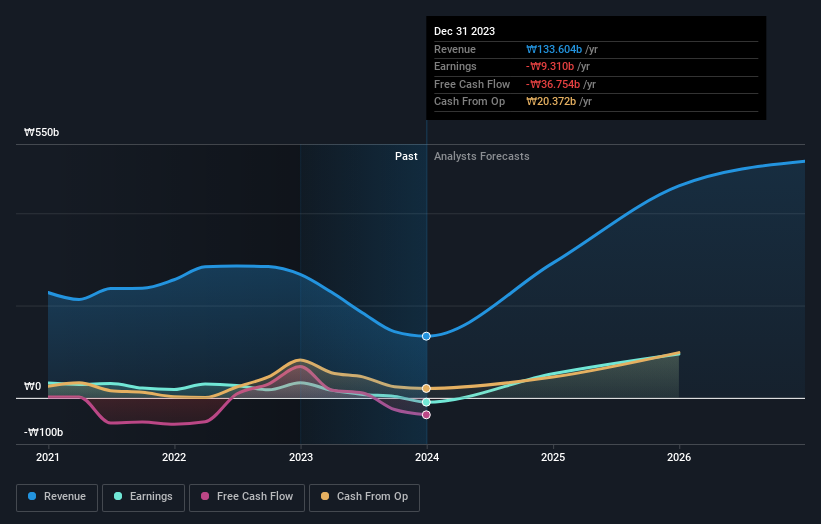

Overview: Techwing, Inc. operates globally, focusing on the development, manufacturing, sale, and servicing of semiconductor inspection equipment, with a market capitalization of approximately ₩2.40 trillion.

Operations: The company generates revenue primarily through the development, manufacturing, sale, and servicing of semiconductor inspection equipment on a global scale.

Insider Ownership: 18.7%

Techwing, a South Korean company, is poised for significant growth with its revenue expected to increase by 47.2% annually, outpacing the local market's 10.7%. While it struggles with covering interest payments from earnings and has experienced high share price volatility recently, its forecasted return on equity of 43.4% and profit growth are promising. Techwing is projected to turn profitable within three years, suggesting robust potential despite some financial challenges. Insider trading activity has been neutral in recent months.

People & Technology

Simply Wall St Growth Rating: ★★★★★☆

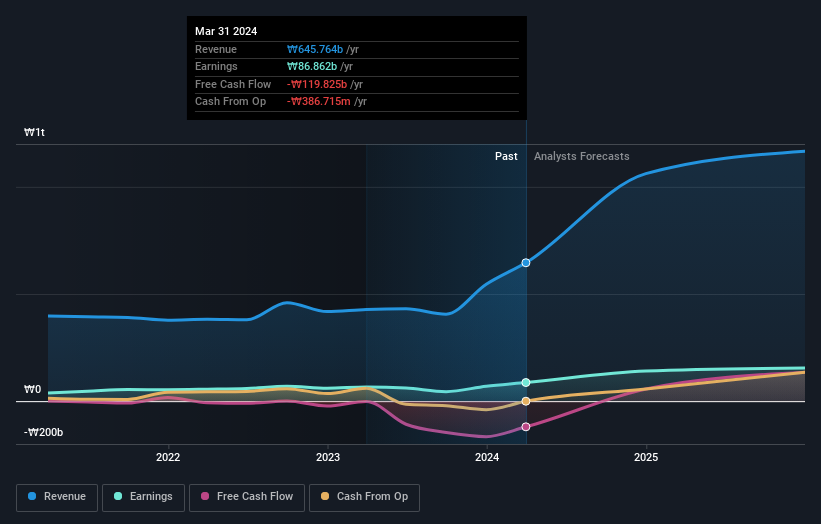

Overview: People & Technology Inc. specializes in providing machinery solutions including coating, calendaring, slitting, and automation, with a market capitalization of approximately ₩1.44 trillion.

Operations: The company generates revenue primarily from its machinery and industrial equipment segment, totaling approximately ₩645.76 million.

Insider Ownership: 16.5%

People & Technology, despite its highly volatile share price over the last three months and shareholder dilution in the past year, shows promising growth prospects in South Korea. The company's revenue is expected to grow by 35.5% per year, significantly outperforming the Korean market forecast of 10.7%. Additionally, earnings are projected to increase by 34.83% annually. However, there is a lack of recent insider trading data and insufficient information on its return on equity forecast.

DREAMTECH

Simply Wall St Growth Rating: ★★★★☆☆

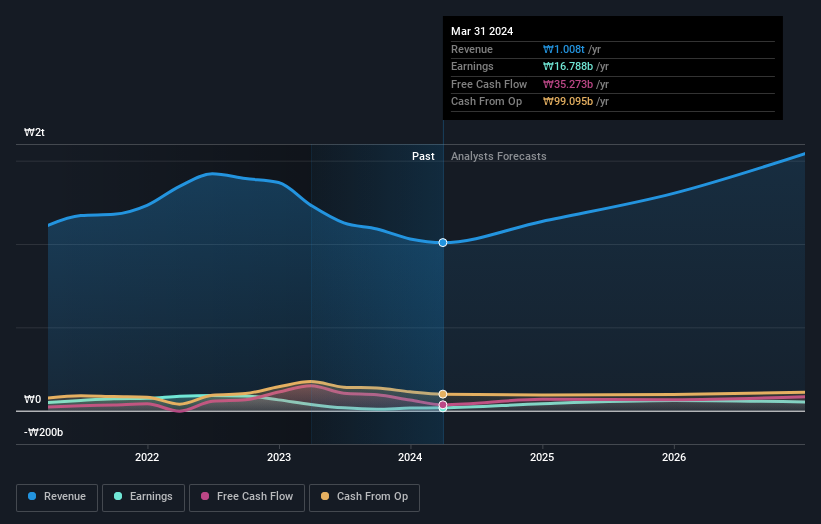

Overview: DREAMTECH Co., Ltd. specializes in the design, development, and manufacture of modules, operating both in South Korea and internationally, with a market capitalization of approximately ₩658.81 billion.

Operations: The company's revenue is primarily derived from three segments: IT & Mobile Communications (₩420.89 billion), Compact Camera Module (CCM) at ₩354.11 billion, and Biometrics, Healthcare & Convergence contributing ₩232.83 billion.

Insider Ownership: 39.9%

DREAMTECH, a South Korean company with high insider ownership, demonstrates notable growth potential despite some challenges. The company's earnings are expected to grow by 30.3% annually over the next three years, outpacing the broader Korean market forecast of 29.6%. However, its revenue growth forecast of 15.4% annually is below the significant growth threshold and its profit margins have declined from last year. Additionally, DREAMTECH recently completed a share buyback worth KRW 5 billion to enhance shareholder value and stabilize stock prices.

Get an in-depth perspective on DREAMTECH's performance by reading our analyst estimates report here.

Our valuation report unveils the possibility DREAMTECH's shares may be trading at a discount.

Where To Now?

Access the full spectrum of 84 Fast Growing KRX Companies With High Insider Ownership by clicking on this link.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include KOSDAQ:A089030KOSDAQ:A137400 and KOSE:A192650.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance