KRX Growth Leaders With Up To 36% Insider Ownership

The South Korean market is currently abuzz with discussions about technological compatibility and performance, highlighted by Samsung Electronics' latest release of their Galaxy Book4 Edge, which faces challenges in software integration. In this environment, identifying growth companies with high insider ownership can offer investors a unique blend of committed leadership and potential resilience amidst evolving market conditions.

Top 10 Growth Companies With High Insider Ownership In South Korea

Name | Insider Ownership | Earnings Growth |

ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

HANA Micron (KOSDAQ:A067310) | 19.9% | 93.4% |

Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

Devsisters (KOSDAQ:A194480) | 26.7% | 67.5% |

INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

Let's explore several standout options from the results in the screener.

JUSUNG ENGINEERINGLtd

Simply Wall St Growth Rating: ★★★★★☆

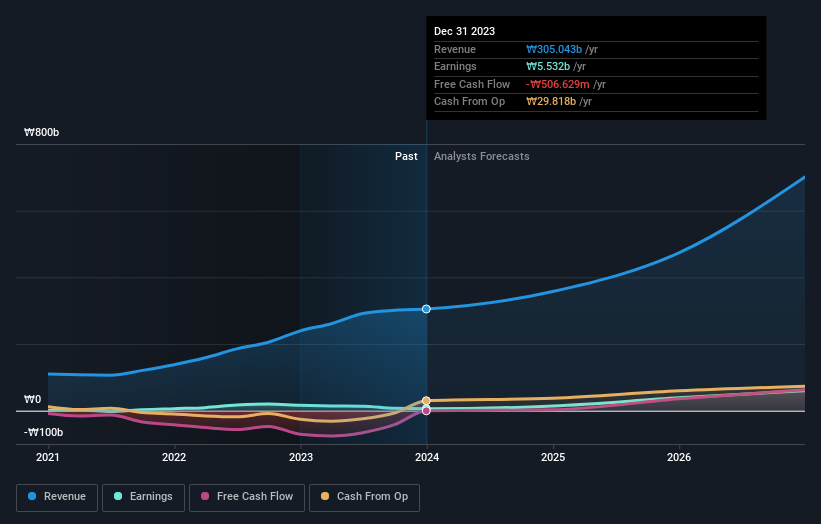

Overview: JUSUNG ENGINEERING Ltd. operates globally, specializing in the manufacture and sale of semiconductor, display, solar, and lighting equipment, with a market capitalization of approximately ₩1.66 trillion.

Operations: The company generates revenue through the sale of equipment for semiconductors, displays, solar panels, and lighting on both domestic and international levels.

Insider Ownership: 36.8%

JUSUNG ENGINEERING Co., Ltd. is poised for substantial growth, with revenue expected to increase by 24.7% annually, outpacing the South Korean market's average. Earnings are also projected to rise significantly at a rate of 37.9% per year, exceeding the broader market's growth. However, despite these positive forecasts, the company's return on equity is anticipated to be low at 17.4% in three years' time and profit margins have declined from last year to 14.6%. Analysts believe the stock price could potentially increase by 35.1%.

UTI

Simply Wall St Growth Rating: ★★★★★★

Overview: UTI Inc. specializes in the research, development, manufacture, and sale of smartphone camera windows and sensor glasses both domestically in South Korea and internationally, with a market capitalization of approximately ₩474.65 billion.

Operations: The company generates its revenue primarily from the development and sale of smartphone camera windows and sensor glasses across both domestic and international markets.

Insider Ownership: 34.1%

UTI Inc., a South Korean growth company with high insider ownership, has recently completed substantial private placements totaling KRW 80 billion, attracting significant investor interest. Despite its highly volatile share price, UTi is expected to become profitable within three years with projected annual revenue growth of 103.6%, significantly outpacing the market average of 10.5%. However, while its future return on equity is anticipated to be very high at 71.4%, current earnings forecasts suggest a robust increase of 122.67% per year, reflecting strong potential for value creation despite short-term price fluctuations.

Navigate through the intricacies of UTI with our comprehensive analyst estimates report here.

Our valuation report unveils the possibility UTI's shares may be trading at a premium.

Intellian Technologies

Simply Wall St Growth Rating: ★★★★★☆

Overview: Intellian Technologies, Inc. specializes in providing satellite antennas and terminals across both domestic and international markets, with a market capitalization of approximately ₩585.97 billion.

Operations: The firm operates primarily in the satellite antennas and terminals sector, serving both South Korean and global markets.

Insider Ownership: 18.9%

Intellian Technologies, a South Korean growth company, is poised for significant advancement with expected revenue growth of 30.1% per year, outstripping the market's 10.5%. While shareholder dilution occurred last year, the firm's valuation stands at 47.9% below estimated fair value, indicating potential upside. Despite a low forecasted return on equity of 15.5%, analysts predict a substantial price increase of 44.2%. Recent actions include a share buyback program where Intellian repurchased shares worth KRW 2.77 billion.

Turning Ideas Into Actions

Click through to start exploring the rest of the 81 Fast Growing KRX Companies With High Insider Ownership now.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include KOSDAQ:A036930 KOSDAQ:A179900 and KOSDAQ:A189300.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance