KRX Growth Companies With High Insider Ownership To Watch In June 2024

The South Korea stock market has recently experienced a notable uptrend, climbing higher in three consecutive sessions to reach a 30-month closing high. As the KOSPI index continues to show robust performance, investors might find particular interest in growth companies with high insider ownership, which can signal confidence in the company's future from those who know it best. In the current climate where some sectors show signs of profit-taking, such companies could present compelling opportunities for informed investors looking for stability and potential growth.

Top 10 Growth Companies With High Insider Ownership In South Korea

Name | Insider Ownership | Earnings Growth |

ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

HANA Micron (KOSDAQ:A067310) | 19.9% | 93.4% |

Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

Devsisters (KOSDAQ:A194480) | 26.7% | 67.5% |

INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

Underneath we present a selection of stocks filtered out by our screen.

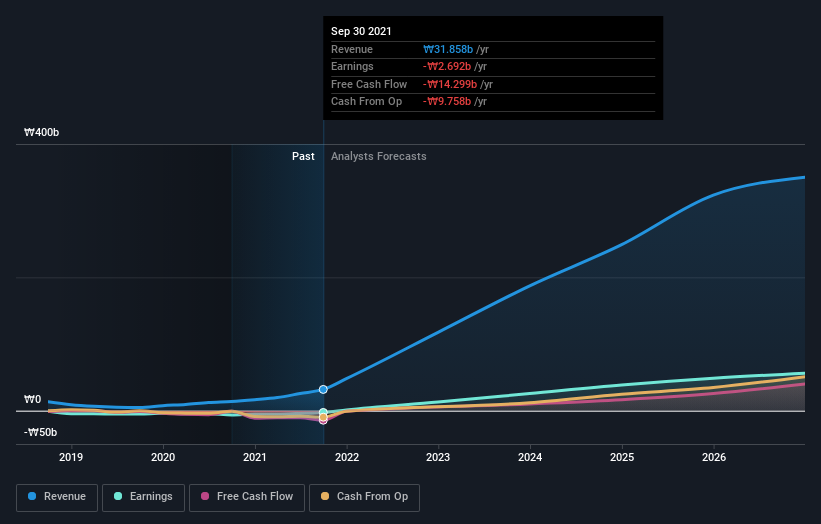

GAMSUNG Corporation

Simply Wall St Growth Rating: ★★★★★★

Overview: GAMSUNG Corporation Co., Ltd. operates in the apparel and mobile peripherals sectors, with a market capitalization of approximately ₩358.90 billion.

Operations: The company generates revenue from two primary sectors: apparel and mobile peripherals.

Insider Ownership: 24.7%

GAMSUNG Corporation, a South Korean company, is poised for robust growth with its earnings expected to increase by 43.82% annually and revenue by 34.4% annually, outpacing the local market's average. Despite this promising outlook and a very high forecasted Return on Equity of 40.8%, the company's share price has been highly volatile recently. Additionally, there has been no recent insider buying activity, though the firm recently completed a share buyback program to enhance shareholder value.

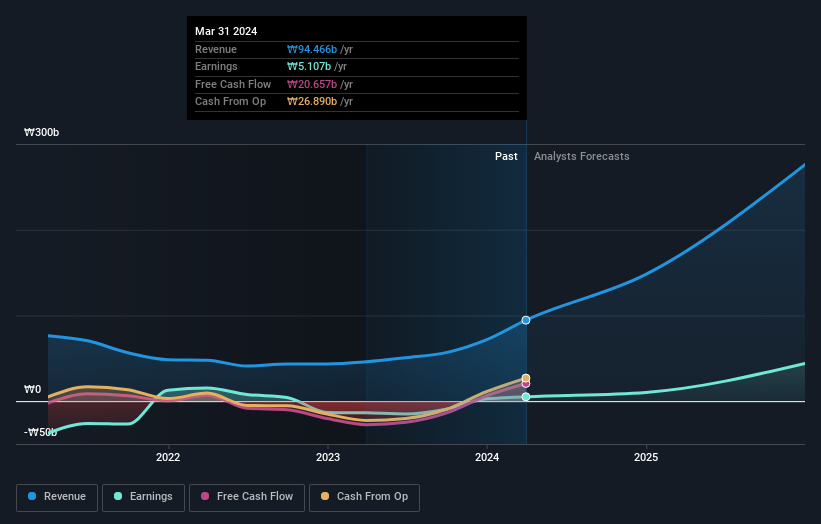

Eugene TechnologyLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: Eugene Technology Co., Ltd. specializes in the manufacturing and sale of semiconductor equipment and parts, operating both in South Korea and internationally, with a market capitalization of approximately ₩1.17 trillion.

Operations: The company generates revenue primarily from two segments: semiconductor equipment, which brings in ₩257.39 billion, and industrial gases for semiconductors, contributing ₩10.01 billion.

Insider Ownership: 37.5%

Eugene Technology Ltd., despite a recent dip in net income and earnings per share as reported on May 13, 2024, is forecasted to see significant growth. Revenue is expected to increase by 21% annually, outstripping the South Korean market's average of 10.5%. Earnings are also set to surge at an annual rate of 47.7%, well above the market's 28.7%. However, its Return on Equity is projected to be modest at 16.5% in three years, and the company has experienced high share price volatility recently.

Anapass

Simply Wall St Growth Rating: ★★★★★☆

Overview: Anapass, Inc. is a South Korean company specializing in SoC semiconductors for the display market, with a market capitalization of approximately ₩350.37 billion.

Operations: The company specializes in SoC semiconductors, primarily serving the display market in South Korea.

Insider Ownership: 14.9%

Anapass, Inc. recently turned profitable and is poised for substantial growth, with earnings expected to increase by 115.5% annually and revenue forecasted at a rate of 60.7% per year—both well above the South Korean market averages. However, shareholders have experienced dilution over the past year. The stock is currently trading at a 40.5% discount to its estimated fair value, highlighting potential undervaluation despite these growth prospects.

Key Takeaways

Unlock our comprehensive list of 84 Fast Growing KRX Companies With High Insider Ownership by clicking here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include KOSDAQ:A036620 KOSDAQ:A123860 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance