KRX Growth Companies With High Insider Ownership And 19% Revenue Growth

The South Korean stock market recently halted a two-day winning streak, reflecting a mix of pressures and supports within key sectors such as financials, chemicals, and automobiles. Amidst these fluctuations, the KOSPI index now hovers just above the 2,780-point mark with potential for varied movements depending on upcoming economic data releases. In such a market environment, growth companies with high insider ownership can be particularly compelling as they often signal strong confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In South Korea

Name | Insider Ownership | Earnings Growth |

ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

HANA Micron (KOSDAQ:A067310) | 20% | 93.4% |

Park Systems (KOSDAQ:A140860) | 33.1% | 35.9% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

Vuno (KOSDAQ:A338220) | 19.5% | 103.8% |

Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

Here's a peek at a few of the choices from the screener.

Intops

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Intops Co., Ltd. is a company based in South Korea that specializes in manufacturing and selling information and communication devices, with a market capitalization of approximately ₩393.82 billion.

Operations: The firm specializes in the production and sales of information and communication devices.

Insider Ownership: 34.8%

Revenue Growth Forecast: 19.1% p.a.

Intops, a South Korean company, is trading at 21% below its estimated fair value and shows promising growth with earnings expected to increase significantly over the next three years. Despite a slowdown in revenue growth to 19.1% per year, it still outpaces the local market's average of 10.5%. However, profit margins have dipped from 6.5% to 4.2% over the past year. Recent financials reveal a robust net income increase in Q1 2024 compared to the previous year, suggesting resilience amidst challenges.

Seegene

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Seegene, Inc., a global manufacturer and seller of molecular diagnostics products, has a market capitalization of approximately ₩924.88 billion.

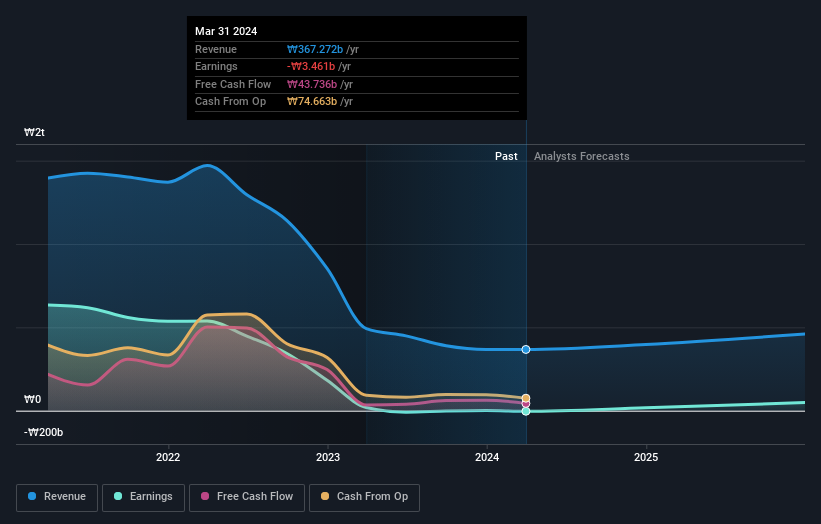

Operations: The company generates its revenue primarily from the sale of diagnostic kits and equipment, totaling approximately ₩367.27 billion.

Insider Ownership: 35.7%

Revenue Growth Forecast: 13.1% p.a.

Seegene, a South Korean biotech firm, is navigating a challenging phase with a shift from net income to a loss in Q1 2024 as sales slightly declined. Despite this, the company is poised for recovery with expected profitability and revenue growth surpassing the local market's average over the next three years. However, its recent dividend seems unsustainable given current earnings. Insider transactions have been minimal in recent months, indicating stable insider confidence amidst financial adjustments.

Click here and access our complete growth analysis report to understand the dynamics of Seegene.

Upon reviewing our latest valuation report, Seegene's share price might be too pessimistic.

i-SENS

Simply Wall St Growth Rating: ★★★★☆☆

Overview: i-SENS, Inc. is a South Korean company specializing in the development, manufacture, and sale of chemical and biosensors, with a market capitalization of approximately ₩518.69 billion.

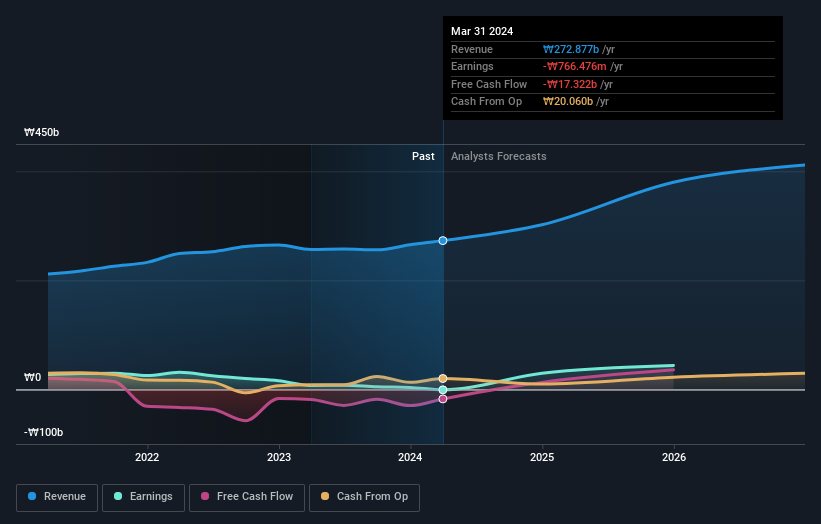

Operations: The company generates its revenue primarily from the sale of diagnostic kits and equipment, totaling approximately ₩272.88 billion.

Insider Ownership: 25.7%

Revenue Growth Forecast: 16.1% p.a.

i-SENS, a South Korean company, experienced a significant drop in net income to a loss of KRW 261.44 million in Q1 2024 from a substantial profit last year, despite nearly doubling its sales to KRW 413.85 million. The firm recently raised KRW 50 billion through private placements, indicating strong investor confidence and strategic growth funding. Forecasts suggest robust revenue growth at 16.1% annually and profitability within three years, although its return on equity is expected to remain low at 7.5%.

Make It Happen

Reveal the 86 hidden gems among our Fast Growing KRX Companies With High Insider Ownership screener with a single click here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include KOSDAQ:A049070KOSDAQ:A096530KOSDAQ:A099190 and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance