KRX Growth Companies With Up To 38% Insider Ownership

The South Korean market has shown resilience with a steady performance over the last week and a growth of 6.0% over the past year, with earnings expected to increase by 30% annually. In this context, stocks from growth companies with high insider ownership can be particularly interesting, as they often suggest a strong alignment between company management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In South Korea

Name | Insider Ownership | Earnings Growth |

ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

Seojin SystemLtd (KOSDAQ:A178320) | 26.2% | 48.1% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

Park Systems (KOSDAQ:A140860) | 33.1% | 35.6% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

Vuno (KOSDAQ:A338220) | 19.5% | 105% |

HANA Micron (KOSDAQ:A067310) | 20% | 96.3% |

INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

Techwing (KOSDAQ:A089030) | 18.7% | 77.8% |

We'll examine a selection from our screener results.

Techwing

Simply Wall St Growth Rating: ★★★★★★

Overview: Techwing, Inc. operates globally, focusing on the development, manufacture, sale, and servicing of semiconductor inspection equipment with a market capitalization of approximately ₩2.39 trillion.

Operations: The company primarily generates revenue from the development, manufacture, sale, and servicing of semiconductor inspection equipment globally.

Insider Ownership: 18.7%

Techwing, a South Korean company, is on track to become profitable within three years with its revenue growth rate at 47.2% annually, outpacing the local market's average of 10.7%. Despite this promising growth trajectory and very high forecasted Return on Equity (43.4%), the firm struggles with financial stability as earnings do not adequately cover interest payments. Additionally, the stock has shown high volatility in recent months, adding an element of risk for potential investors.

Click here to discover the nuances of Techwing with our detailed analytical future growth report.

Our valuation report here indicates Techwing may be overvalued.

Seojin SystemLtd

Simply Wall St Growth Rating: ★★★★★★

Overview: Seojin System Co., Ltd. specializes in manufacturing telecom equipment, repeaters, mechanical products, and LED equipment, with a market capitalization of approximately ₩1.81 billion.

Operations: Seojin System generates revenue primarily from EMS, which brought in ₩1.22 billion, and its semiconductor segment contributed ₩0.16 billion.

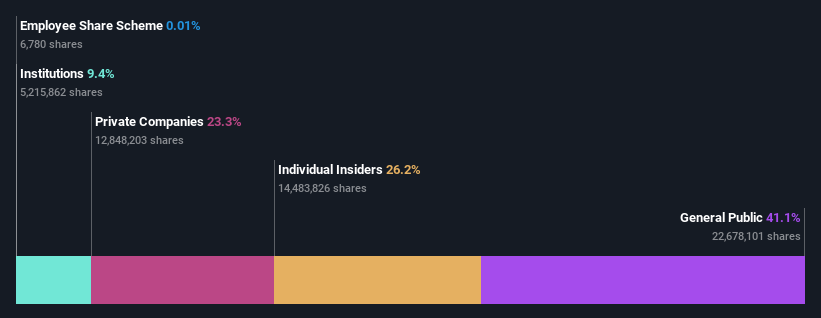

Insider Ownership: 26.2%

Seojin System Ltd, a South Korean growth company, exhibits high insider ownership and is poised for substantial earnings growth at 48.1% annually, surpassing the local market's average. Despite trading 54.4% below its estimated fair value, challenges persist with a highly volatile share price and low profit margins declining from last year's 4.2% to 1.2%. Moreover, financial stability is compromised as earnings fail to cover interest payments adequately, reflecting potential risks amidst the aggressive growth forecasts.

Doosan

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doosan Corporation operates in heavy industry, machinery manufacturing, and apartment construction across various global markets including South Korea, the United States, Asia, the Middle East, and Europe with a market capitalization of approximately ₩3.49 billion.

Operations: The company's revenue is derived from heavy industry, machinery manufacturing, and apartment construction across diverse global markets.

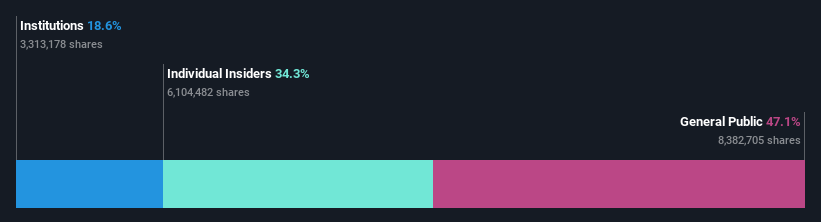

Insider Ownership: 38.9%

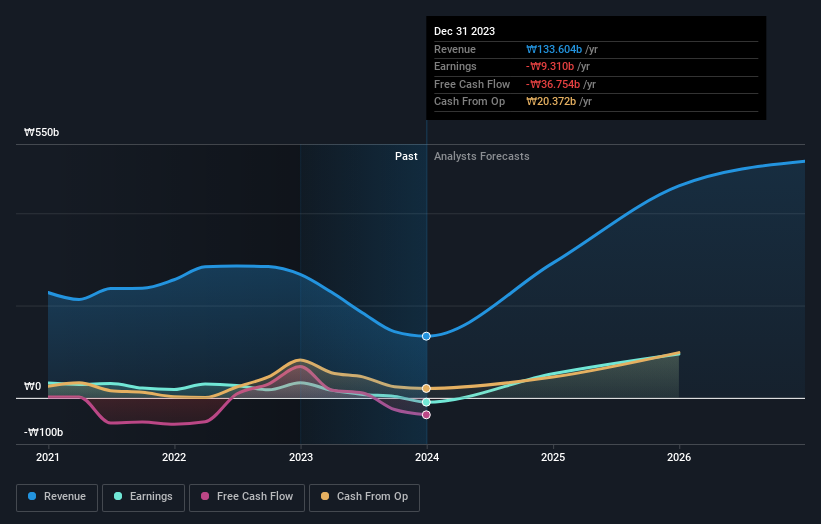

Doosan Corporation, a South Korean company with significant insider ownership, is on track to become profitable within three years, outpacing average market growth. Despite its promising 72.89% annual earnings growth forecast and trading at 57.1% below its fair value estimate, challenges include a highly volatile share price and slower-than-market revenue growth at 3.6% annually. Recently, Doosan reported a substantial improvement in Q1 earnings for 2024 with sales up to KRW 180.97 billion from KRW 169.05 billion last year and transformed last year's net loss into a net income of KRW 4.98 billion.

Get an in-depth perspective on Doosan's performance by reading our analyst estimates report here.

The valuation report we've compiled suggests that Doosan's current price could be quite moderate.

Make It Happen

Discover the full array of 86 Fast Growing KRX Companies With High Insider Ownership right here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include KOSDAQ:A089030 KOSDAQ:A178320 and KOSE:A000150.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance