KRX Dividend Stocks Yielding From 4% To 6%

The South Korean market has shown robust performance, climbing 2.0% in the last week and achieving an 11% increase over the past year, with earnings anticipated to grow by 30% annually. In this thriving environment, dividend stocks yielding between 4% and 6% can offer investors a blend of stability and potential income growth.

Top 10 Dividend Stocks In South Korea

Name | Dividend Yield | Dividend Rating |

Kia (KOSE:A000270) | 4.57% | ★★★★★★ |

LOTTE Fine Chemical (KOSE:A004000) | 4.32% | ★★★★★☆ |

NH Investment & Securities (KOSE:A005940) | 6.24% | ★★★★★☆ |

Industrial Bank of Korea (KOSE:A024110) | 7.09% | ★★★★★☆ |

KT (KOSE:A030200) | 5.53% | ★★★★★☆ |

Shinhan Financial Group (KOSE:A055550) | 4.08% | ★★★★★☆ |

KB Financial Group (KOSE:A105560) | 3.59% | ★★★★★☆ |

Kyung Nong (KOSE:A002100) | 4.93% | ★★★★★☆ |

HANYANG ENGLtd (KOSDAQ:A045100) | 3.15% | ★★★★★☆ |

Tong Yang Life Insurance (KOSE:A082640) | 5.26% | ★★★★☆☆ |

Click here to see the full list of 71 stocks from our Top KRX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

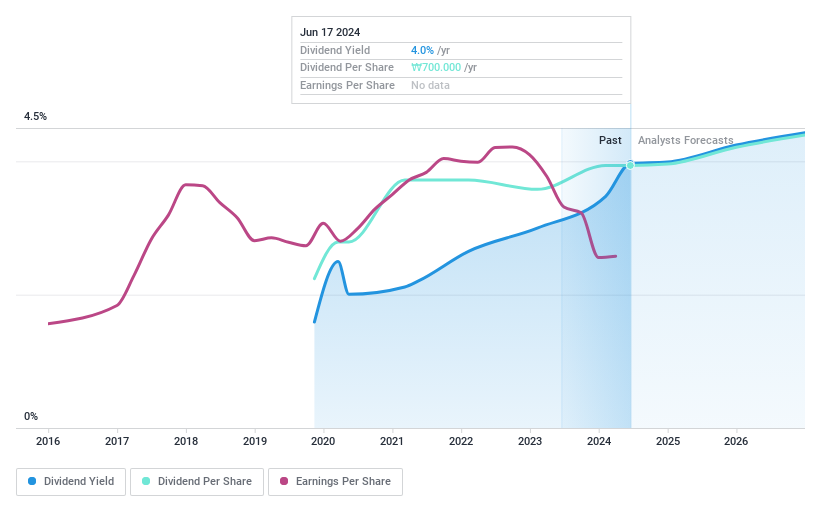

Nasmedia

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nasmedia Co., Ltd. is a digital media representative agency based in South Korea, with a market capitalization of approximately ₩194.13 billion.

Operations: Nasmedia Co., Ltd. specializes in digital media representation across South Korea.

Dividend Yield: 4.1%

Nasmedia, a South Korean company, reported a slight increase in Q1 2024 earnings with sales rising to KRW 0.00005 million and net income up to KRW 3.01 billion. Despite its short dividend history of under ten years, the firm has shown stability in its dividend payments which are well-supported by both earnings and cash flows, with payout ratios at 47% and 72% respectively. However, the dividends lack a long-term track record, presenting potential risks for sustainability despite forecasts of future earnings growth at around 20.02% annually.

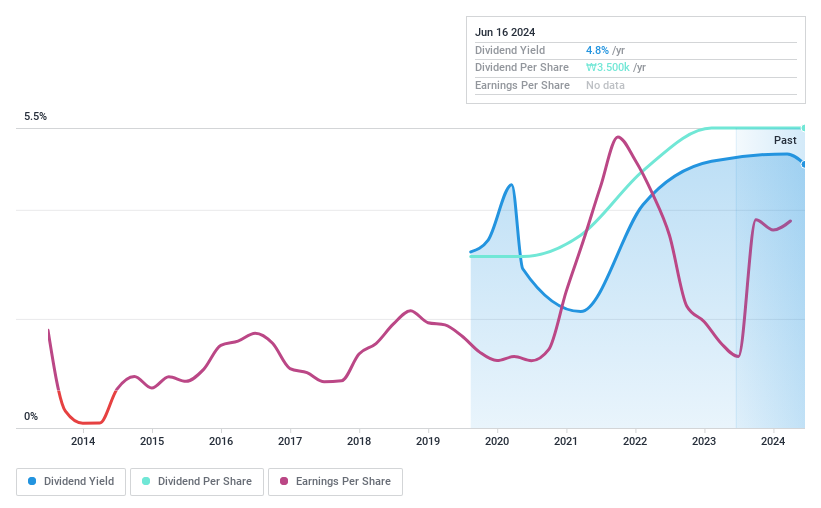

Samyang Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samyang Holdings Corporation operates in various sectors including chemicals, food, packaging, and pharmaceuticals across regions such as South Korea, China, Japan, other Asian countries, and Europe, with a market capitalization of approximately ₩538.07 billion.

Operations: Samyang Holdings Corporation generates revenue through its involvement in the chemicals, food, packaging, and pharmaceuticals sectors across multiple regions including South Korea, China, Japan, other Asian countries, and Europe.

Dividend Yield: 5%

Samyang Holdings, with a dividend yield of 4.99%, ranks in the top 25% of Korean dividend payers. The company's dividends are securely funded by earnings and cash flows, evidenced by low payout ratios of 15.5% and 24.4%, respectively. Despite its robust coverage, Samyang has only been distributing dividends for five years, lacking a longer history which might concern stability-focused investors. Recent financials show strong growth, with Q1 2024 sales up to KRW 871.15 billion and net income rising to KRW 27.89 billion from the previous year.

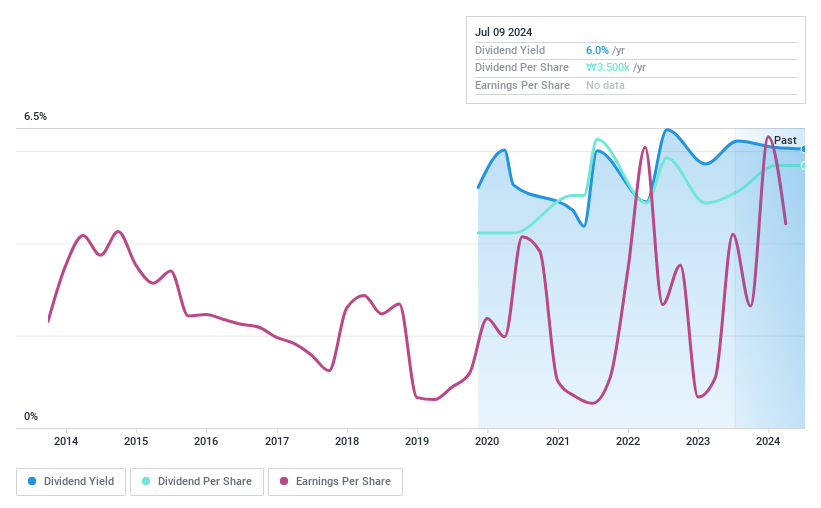

KPX Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KPX Holdings Co., Ltd. operates in the chemical manufacturing sector through its subsidiaries and has a market capitalization of approximately ₩227.62 billion.

Operations: KPX Holdings Co., Ltd. generates ₩1.23 billion from its Polypropylene Glycol segment and ₩129.81 million from its Automotive Parts Division.

Dividend Yield: 6%

KPX Holdings offers a dividend yield of 6.04%, placing it among the top 25% of Korean dividend stocks. Its dividends are well-supported by earnings and cash flows, with payout ratios of 23.4% and 20.3% respectively, indicating sustainability. However, its recent Q1 earnings have declined to KRW 13.65 billion from KRW 38.75 billion year-over-year, reflecting potential volatility in profitability which could impact future dividends despite current coverage levels.

Delve into the full analysis dividend report here for a deeper understanding of KPX Holdings.

Our valuation report unveils the possibility KPX Holdings' shares may be trading at a discount.

Where To Now?

Click here to access our complete index of 71 Top KRX Dividend Stocks.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSDAQ:A089600KOSE:A000070 and KOSE:A092230

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance