Kronos Worldwide (KRO) Shares Rally 19% in 3 Months: Here's Why

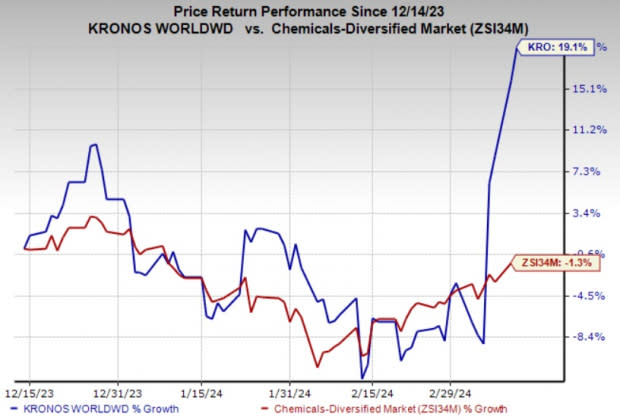

Kronos Worldwide, Inc.’s KRO shares have shot up 19.1% over the past three months. The company has also outperformed its industry’s decline of 1.3% over the same time frame. Moreover, it has topped the S&P 500’s 10.2% rise over the same period.

Let’s take a look into the factors behind this Zacks Rank #2 (Buy) stock’s price appreciation.

Image Source: Zacks Investment Research

What’s Driving KRO?

Better-than-expected earnings performance in the fourth quarter of 2023 and an upbeat outlook have contributed to the rally in the company's shares. Kronos Worldwide recorded a loss of 5 cents per share in the fourth quarter, narrower than a loss of 18 cents in the year-ago quarter. The figure was also narrower than the Zacks Consensus Estimate of a loss of 7 cents.

The company’s net sales climbed around 17% year over year to $400.1 million on higher sales volumes driven by stronger demand for titanium dioxide (TiO2) in primary markets of Europe and North America, which more than offset lower average TiO2 selling prices.

Kronos Worldwide is expected to gain from higher demand for TiO2. Per the company, TiO2 consumption has increased at a compound annual growth rate of around 2% since 2000. Western Europe and North America account for roughly 14% and 15% of global TiO2 consumption, respectively. These regions are expected to continue to be the biggest consumers of TiO2. Moreover, markets for TiO2 are growing in South America, Eastern Europe, the Asia Pacific region and China.

The company envisions consumer demand to improve in 2024. It believes customer destocking of TiO2 is largely complete and customer inventories are historically low. KRO also sees the pricing pressure to be somewhat eased this year. It expects sales volumes to rise on a year-over-year basis in 2024.

Kronos has increased its production rates in sync with current and expected near-term demand improvement. It expects its production volumes in 2024 will be higher than the level witnessed in 2023.

The company also expects reduced energy costs along with its cost-reduction initiatives to result in improved margins on a year-over-year basis in 2024.

Kronos Worldwide Inc Price and Consensus

Kronos Worldwide Inc price-consensus-chart | Kronos Worldwide Inc Quote

Other Stocks to Consider

Other top-ranked stocks worth a look in the basic materials space include Carpenter Technology Corporation CRS, Alpha Metallurgical Resources Inc. AMR and Hawkins, Inc. HWKN.

The Zacks Consensus Estimate for Carpenter Technology’s current fiscal year earnings is pegged at $4.00, indicating a year-over-year surge of 250.9%. CRS beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 12.2%. The company’s shares have gained around 42% in the past year. CRS currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Alpha Metallurgical Resources’ current-year earnings has been revised upward by 49.2% in the past 60 days. AMR delivered a trailing four-quarter earnings surprise of roughly 24.8%, on average. Its shares are up around 97% in a year. AMR currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Hawkins’ current fiscal year earnings is pegged at $3.61 per share, indicating a year-over-year rise of 26.2%. The Zacks Consensus Estimate for HWKN’s current-year earnings has been revised 4.3% upward in the past 30 days. HWKN, a Zacks Rank #2 stock, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 30.6%. The company’s shares have rallied roughly 70% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alpha Metallurgical Resources, Inc. (AMR) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Kronos Worldwide Inc (KRO) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance