Kraft Heinz (KHC) Gains on Pricing Efforts Amid Rising Costs

The Kraft Heinz Company KHC is leaving no stone unturned to transform its business to unleash its full potential. In this regard, the company’s AGILE@SCALE strategy looks impressive. The iconic consumer packaged food and beverage company’s strategic pricing actions bode well amid rising inflationary environment.

Management expects to deliver robust financial performance in 2022. During its second-quarter earnings release, Kraft Heinz raised its organic net sales view for 2022. It expects organic net sales to be up high-single-digit percent year over year. Earlier, it had expected the metric to be up mid-single-digit percent. The revised outlook can be attributed to higher pricing and favorable year-to-date elasticities, especially in the United Sates.

Let’s delve deeper.

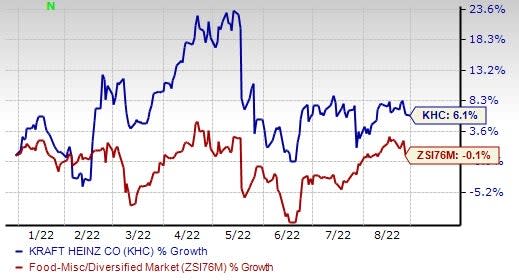

Image Source: Zacks Investment Research

Pricing Actions: Key Driver

Solid pricing initiatives have been aiding Kraft Heinz for a while now. In second-quarter 2022, the company’s pricing rose 12.4 percentage points year over year, reflecting growth in all segments. The upside can be attributed to measures undertaken to counter increasing input costs. During the quarter, pricing in North America moved up 13.1 percentage points. The International segment’s pricing moved up 10.3 percentage points. Management expects to see additional benefits from pricing actions in the third quarter.

Growth Efforts on Track

Kraft Heinz is committed to accelerating its profit and enhancing the long-term shareholders’ value. As part of its transformation phase, management unveiled AGILE@SCALE in February 2022. The strategy will help Kraft Heinz enhance its agile expertise and capabilities via partnerships with technology giants and cutting-edge innovators. The company will leverage its financial flexibility to take over other capabilities. Kraft-O-Matic, the company’s in-house proprietary software and data science model, aids in better analyzing consumer behavior for brands, utilizing integrated point-of-sale, panel and marketing data. On Feb 22, 2022, Kraft Heinz announced a joint venture with TheNotCompany, Inc. (“NotCo”) — a well-known food tech start-up. Through this venture, the parties will work to accelerate the adoption of plant-based foods. On Feb 23, 2022, Kraft Heinz and Simplot Food Group — a division of the J.R. Simplot Company — signed a long-term agreement to name Simplot as the exclusive manufacturer and supplier of Ore-Ida. The move is in sync with Kraft Heinz’s intentions to manage its portfolio with agility and accelerate growth.

The company’s top-line momentum is driven by three pillars of growth, including Consumer Platforms, Foodservice opportunities and further expansion in Emerging Markets. In its last earnings call, management highlighted that it witnessed solid growth across the portfolio, including the GROW platforms. With respect to growing the Emerging Markets, management is on track to expand its presence through a sustainable and repeatable Go-To-Market model. In April 2022, Kraft Heinz acquired a majority stake in a Brazil-based condiments and sauces company — Companhia Hemmer Indústria e Comercio ("Hemmer"). In January 2022, Kraft Heinz acquired 85% stake in Germany-based Just Spices GmbH (“Just Spices”). Management acquired sauces-focused business — Assan Foods — from privately-held Turkish conglomerate, Kibar Holding in October 2021.

Hurdles on Way

In the second quarter of 2022, Kraft Heinz’s gross margin came in at 30.3%, down 430 basis points from 34.6% reported in the year-ago quarter. The downside was caused by the dilutive impact of pricing to counter dollar inflation. Adjusted EBITDA fell 10.9% to $1,520 million, reflecting the adverse impact of divestitures and unfavorable currency translation. Management highlighted that adjusted EBITDA reflected increased pricing and efficiency gains, offset by escalated commodity costs as well as supply chain costs and unfavorable volume/mix.

For 2022, Kraft Heinz expects inflation to be in the high teens. In its last earnings call, management stated that while some costs like transportation have started to drop from peak levels, overall costs continue to remain high. That said, the Zacks Rank #3 (Hold) company is on track to undertake hedging and cost management strategy to counter rising costs.

Kraft Heinz’s shares have increased 6.1% so far this year against the industry’s decline of 0.1%.

Looking for Appetizing Food Bets? Check These Out

Some top-ranked stocks are The Chef's Warehouse CHEF, General Mills, Inc. GIS and United Natural Foods UNFI.

Chef’s Warehouse, a distributor of specialty food products in the United States, currently flaunts a Zacks Rank #1 (Strong Buy). CHEF has a trailing four-quarter earnings surprise of 355.9%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Chef Warehouse’s current financial year sales suggests growth of 40.7%from the year-ago reported numbers.

General Mills, which manufactures and markets branded consumer foods worldwide, currently carries a Zacks Rank of 2 (Buy). GIS has a trailing four-quarter earnings surprise of 6.5%, on average.

The Zacks Consensus Estimate for General Mills’ current financial year sales and earnings per share suggests growth of almost 2% and 1.5%, respectively, from the corresponding year-ago reported figures.

United Natural Foods distributes natural, organic, specialty, produce and conventional grocery and non-food products. UNFI currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for UNFI’s current financial year sales suggests 7.6% growth from the year-ago period’s reported figures. United Natural Foods has a trailing four-quarter earnings surprise of 29.9%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Mills, Inc. (GIS) : Free Stock Analysis Report

United Natural Foods, Inc. (UNFI) : Free Stock Analysis Report

The Chefs' Warehouse, Inc. (CHEF) : Free Stock Analysis Report

The Kraft Heinz Company (KHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance