Klarna’s CEO embraced AI by telling OpenAI’s Sam Altman, “I want Klarna to be your favorite guinea pig”

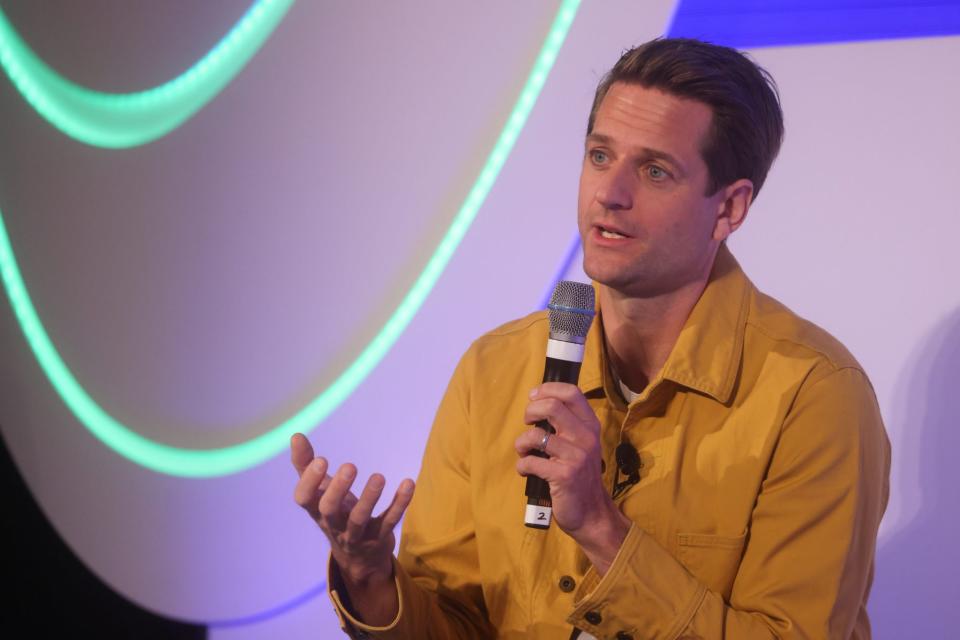

Klarna CEO Sebastian Siemiatkowski knows we’re all obsessed with IPOs.

When I ask about the IPO-shaped elephant-in-the-room, Siemiatkowski is clear on the plan, and flexible on the timeline: He wants to take the fintech giant public, and does believe that Klarna will be ready for that next step—when the company takes it.

“In my opinion, I’ve been extremely consistent, I’ve always said the exact same thing,” he tells Term Sheet on a Monday video call. “First, yes, that it’s not too far away, probably a few years, and, then, that I’ve always dreamed Klarna would be a global company. And what that means is success in the U.S.”

Check: Klarna, founded in Stockholm in 2005 by Siemiatkowski and Niklas Adalberth, has been barreling into the U.S. market in recent years. And it seems to have worked—the company now has 37 million users in the U.S., and Klarna’s warm, millennial pink branding has grown (at least, to me) increasingly familiar.

“Second, you have to make it profitable as well—spending a lot of money to buy a bunch of Super Bowl ads doesn’t necessarily mean you’re a functioning business.”

Check, again: Klarna, which was profitable for its first 16 years, went into the red for a time, spending heavily on its U.S. expansion. But those days are gone—Klarna went back into the black in November, after a process that involved layoffs.

“We were investing at very, very intense levels,” Siemiatkowski said. “We were basically booking a loss of negative Ebitda of $100 million or even $250 million a month.”

A giant company is like a cruise ship. You can turn it around, but it’s tough—and if you’re not careful, you can hit an iceberg. Very few know this as well as Siemiatkowski, who’s weathered three downturns. And in this current downturn, fintech has been hit especially hard—funding in the sector fell 42% year-over-year to $35 billion in 2023, according to S&P Global Market Intelligence.

Does he have any advice for fintech founders, at a moment where the sector itself feels especially vulnerable? Siemiatkowski has two pieces of advice. First, “don't expect times to get better very quickly, because I don't think they will.”

Second, “Many people have tried to apply AI and failed, or it didn’t work out and they’ll say ‘that was a fun thing, but it didn’t really make a difference'…But don’t get fooled by that, because it can work for real and is going to have a significant impact on business.”

Siemiatkowski seems to follow his own advice, as he’s led Klarna headfirst into AI innovation and experimentation––with some help. Drawing on a common investor, Siemiatkowski reached out to OpenAI CEO Sam Altman last year, telling him: “I want Klarna to be your favorite guinea pig.” The two companies have worked together ever since.

“We’ve had a very close relationship, and we’ve been able to try and test these technologies very early on,” he said. “It took us some time to get there, but now we’re seeing a very concrete impact.”

In 2023, the payments and shopping company rolled out a range of AI features, including AI-powered image search and highly personalized shopping feeds.

The tangible impact of AI has led Siemiatkowski to a new hypothesis: Startups could see a massive business model change, as companies emerge that are AI-driven and characterized by high revenue per employee, as growth and operations become more efficient. Companies like this, he says, could be a reality within a year and we might call them, say, “AI tigers.” I tell him this sounds like something Klarna aspires to.

“Well, of course. In the end, we're a business, here to create value for customers and shareholders and society as a whole—to me, as much as profit’s debated, in the end, profit is just proof that the value we create for our customers is worth more than it costs us to produce it.”

Next act…Former Salesforce co-CEO Bret Taylor is unveiling his new startup, one year after leaving his old job. Sierra, as the new company is called, is betting that conversational AI "agents" will become standard features for business of all types, and it has raised $110 million in funding from top-tier VCs including Sequoia and Benchmark. Taylor and former Google executive Clay Bavor, Sierra's cofounders, sat down with Fortune's Kylie Robison to provide the first up-close look at the company, its technology, and its roster of customers. —Alexei Oreskovic

Thriving…Thrive Capital’s Joshua Kushner has invested in more than a dozen VC firms from its $3.3 billion eighth growth-stage fund, my colleague Jessica Mathews has exclusively learned. Many of the firms that Thrive’s invested in are emerging managers.

See you tomorrow,

Allie Garfinkle

Twitter: @agarfinks

Email: alexandra.garfinkle@fortune.com

Submit a deal for the Term Sheet newsletter here.

Joe Abrams curated the deals section of today's newsletter.

This story was originally featured on Fortune.com

Yahoo Finance

Yahoo Finance