Key takeaways from IMF/World Bank meetings in Morocco

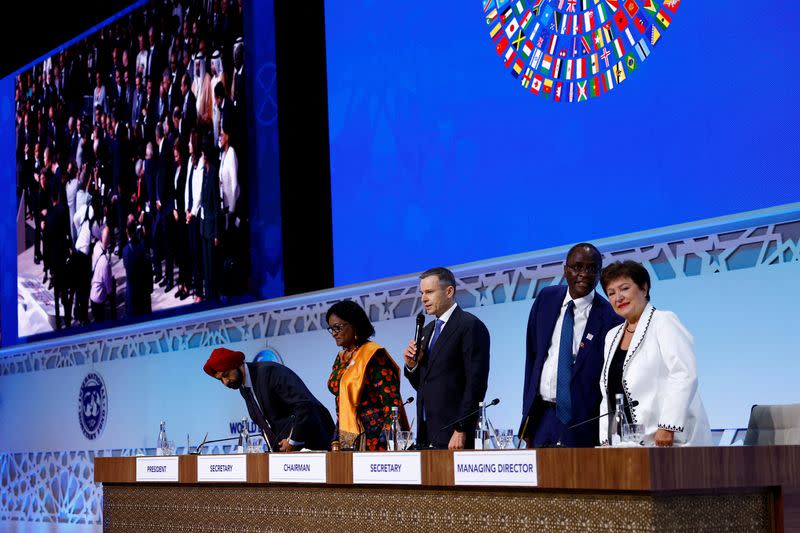

MARRAKECH, Morocco (Reuters) -The International Monetary Fund and World Bank wrapped up annual meetings in Morocco on Sunday with some progress towards increasing their lending resources but confronting a new economic shock from the Israel-Gaza conflict.

Discussions in the tourist hub of Marrakech, not far from the epicenter of a devastating September earthquake, focused on a flagging global economy weighed down by debt, inflation and conflict, a growing wealth gap between rich and poor countries and floundering efforts to tackle climate change.

Here are the main takeaways:

SOME FUNDING PROGRESS

IMF member countries pledged to increase quota contributions by year-end to help ensure the Fund has adequate lending firepower to respond to another large-scale crisis. They fell short of agreeing to a U.S. plan that would delay shareholding changes that would cede more influence to China, with more talks in the next two months.

The World Bank's governing body approved its new vision statement to "create world free of poverty on a liveable planet," incorporating its new mission to tackle climate change, and endorsed new steps to allow the use of debt-like hybrid capital and a new portfolio guarantee platform that could together yield up to $100 billion in new lending over a decade.

NO CONSENSUS ON MIDDLE EAST CONFLICT

Hamas' attack on Israel upset a carefully crafted script for the meetings, but IMF and World Bank leaders were slow to respond to risks presented by the conflict, ranging from higher energy prices, potential trade impacts and a new refugee crisis.

G20 finance leaders and the steering committees of both institutions also failed to issue joint communiques due to disagreement over Russia's invasion of Ukraine war, but unlike the strong condemnation of the Hamas attacks by G7 democracies, the larger, more diverse groups failed to mention the Middle East conflict

'LIMPING' ECONOMY

The new IMF outlook - signed off before the escalation of the conflict between Israel and Hamas - sees global economic growth slowing from 3.5% last year to 3% this year and 2.9% next year, a 0.1% point downgrade from a previous 2024 estimate.

Global inflation is seen dropping from 6.9% this year to a still-high 5.8% next. Central bankers signalled readiness to end interest rate hikes if events allow, hopeful that inflation can be finally tamed without too hard a landing. IMF chief economist Pierre-Olivier Gourinchas described the global economy as "limping along, not sprinting".

DEBT SQUEEZE

The heavy debt burdens of advanced economies - from the United States to China and Italy - was a recurrent theme in the meetings, which came after financial markets in recent weeks pushed U.S. bond yields higher. Italian central bank governor Ignazio Visco said there was an impression markets were "reevaluating the term premium" as investors become more nervous about holding longer term debt.

JPMorgan chair of global research Joyce Chang put it another way. "The bond vigilantes are back, and the Great Moderation is over," she told a panel of the two-decade era of relative economic calm before the 2008/09 financial crisis.

One policy area where this could have a knock-on effect is the fight against climate change. Vitor Gaspar, head of the IMF's fiscal division, warned current subsidies-based policies were failing to deliver net zero emissions and that scaling them up would explode public debt without carbon pricing to generate revenue.

DEBT DEALS AND REFORMS

Looking beyond the major developed economies, higher policy rates, a strong dollar and geopolitical uncertainties are adding to challenges for the rest of the world.

Turkey was in the spotlight as Finance Minister Mehmet Simsek pitched its reform plan. "The biggest structural issue is to bring inflation down. And they're working on it," said Murat Ulgen, Global Head of Emerging Markets Research at HSBC.

Kenya is looking to avoid slipping into debt distress and its central bank governor told Reuters it plans a buyback of a quarter of its $2 billion international bond maturing in June - pushing its 2024 bond up 1.2 cents on the dollar.

One debt restructuring deal emerged: Zambia finally agreed a debt rework memorandum of understanding with creditors including China and France.

Progress on Sri Lanka was less clear. Sri Lanka said on Thursday it reached an agreement with the Export-Import Bank of China covering about $4.2 billion of debt, while talks with other official creditors are stalling.

RISKS SKEWED TO DOWNSIDE

High interest rates will put some borrowers in more precarious positions, the IMF warned in its Global Financial Stability Report. Around 5% of banks globally are vulnerable to stress if those rates remain higher for longer, it estimated, and a further 30% of banks - including some of the world's largest - would be vulnerable if the global economy enters a prolonged period of low growth and high inflation.

JOSTLING FOR INFLUENCE

The Ukraine war, growing trade protectionism and tensions between the United States and China are all making consensus-building tougher. There was much talk ahead of Marrakech on revamping the IMF and World Bank to better reflect the emergence of economies like China and Brazil, but actions taken at the meetings may delay them.

"The big theme this week is G7 countries papering over the cracks of shattered promises," said Kate Donald, Head of Oxfam International's Washington DC Office. "Despite the wringing of hands about the billions of dollars needed to tackle poverty and climate breakdown, there has been no sign of new money."

(Reporting in Marrakech by Ahmed El Jechtimi, Andrea Shalal, David Lawder, Leika Kihara, Elisa Martinuzzi, Rachel Savage, Jorgelina do Rosario, Balazs Koranyi; Compiled by Mark John; Editing by Christina Fincher)

Yahoo Finance

Yahoo Finance