Kennametal Inc. (KMT) Fiscal Q3 2024 Earnings: Aligns with Analyst EPS Projections Amidst ...

Reported Earnings Per Share (EPS): $0.24, falling short of the estimated $0.30.

Adjusted Earnings Per Share (EPS): Met analyst estimates at $0.30.

Revenue: $516 million, slightly below the estimated $518.44 million.

Net Income: $20.71 million, below the estimated $24.27 million.

Year-to-Date Free Operating Cash Flow (FOCF): Increased to $84 million from $60 million in the prior year period.

Dividends: Paid $16 million in cash dividends and repurchased $15 million in shares.

Full-Year Outlook: Adjusted EPS now expected to be between $1.40 and $1.55, with sales projected between $2.030 billion and $2.050 billion.

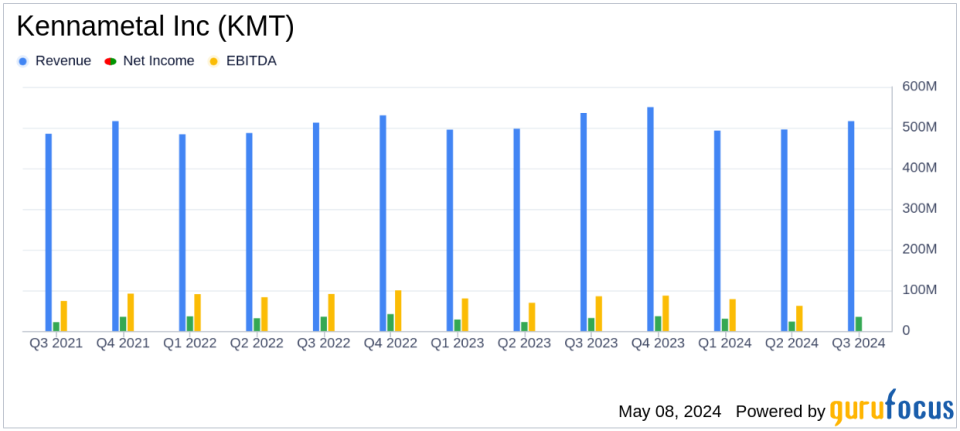

Kennametal Inc. (NYSE:KMT), a leader in the manufacturing of metalworking tools and wear-resistant engineered components, released its 8-K filing on May 8, 2024, detailing the financial results for its fiscal third quarter ended March 31, 2024. The company reported a slight decline in sales and earnings per share compared to the previous year, amidst a challenging market environment.

Company Overview

Kennametal Inc. operates primarily through two segments: Metal Cutting and Infrastructure. The Metal Cutting segment, which is the major revenue contributor, focuses on manufacturing high-performance tooling and solutions for various industries including aerospace and transportation. The majority of the company's revenue is generated in the United States.

Fiscal Q3 2024 Performance Highlights

For the quarter, Kennametal posted sales of $516 million, a decrease from $536 million in the prior year, attributed to organic sales decline and unfavorable currency exchange impacts. The earnings per diluted share (EPS) stood at $0.24, with an adjusted EPS of $0.30, aligning with analyst expectations of $0.30 per share. This performance reflects the ongoing market softness, particularly in the energy sector and a slow recovery in China.

Operating income was reported at $35 million or 6.8% of sales, down from $52 million or 9.8% of sales in the prior year quarter. The decrease was mainly due to lower sales volumes, restructuring charges, and general inflationary pressures, partially offset by higher pricing in the Metal Cutting segment and $6 million in restructuring savings.

Financial Stability and Shareholder Returns

Kennametal demonstrated strong year-to-date cash from operations, amounting to $163 million compared to $126 million in the prior year, driven by improved inventory levels. The company also returned approximately $31 million to shareholders through dividends and share repurchases during the quarter.

Leadership and Future Outlook

Christopher Rossi, President and CEO of Kennametal, emphasized the company's focus on productivity and share gain amidst current market conditions. With Rossi's upcoming departure, incoming CEO Sanjay Chowbey is expected to continue driving growth and margin expansion. For the full fiscal year 2024, Kennametal has adjusted its sales expectations to between $2.030 billion and $2.050 billion and adjusted EPS to range from $1.40 to $1.55.

Segment Performance

The Metal Cutting segment saw a slight decrease in sales, while the Infrastructure segment experienced a 7% decrease, primarily due to lower sales volumes and adverse pricing versus raw material costs. Both segments faced challenges that were mitigated by restructuring savings and pricing adjustments.

Investor and Analyst Perspectives

Despite the challenges, Kennametal's alignment with analyst EPS projections and strong cash flow generation highlight its resilience and strategic financial management. The company's focus on operational efficiency and cost-saving measures is likely to support its performance in the upcoming quarters.

Conclusion

Kennametal remains committed to delivering shareholder value and strengthening its market position through strategic initiatives and effective capital allocation. As the company navigates through market uncertainties, its robust financial health and strategic adjustments are pivotal in maintaining its competitive edge in the industry.

Explore the complete 8-K earnings release (here) from Kennametal Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance