Kelsian Group Leads Three ASX Stocks Considered Undervalued For Investment Opportunities

The Australian market has shown robust performance, rising 11% over the past year with earnings expected to grow by 14% annually. In this context, identifying stocks like Kelsian Group that are considered undervalued could present valuable investment opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

Name | Current Price | Fair Value (Est) | Discount (Est) |

LaserBond (ASX:LBL) | A$0.71 | A$1.21 | 41.4% |

COSOL (ASX:COS) | A$1.27 | A$2.43 | 47.8% |

Charter Hall Group (ASX:CHC) | A$12.21 | A$22.42 | 45.5% |

ReadyTech Holdings (ASX:RDY) | A$3.20 | A$5.96 | 46.3% |

Mader Group (ASX:MAD) | A$6.37 | A$12.62 | 49.5% |

hipages Group Holdings (ASX:HPG) | A$1.075 | A$1.94 | 44.7% |

Regal Partners (ASX:RPL) | A$3.27 | A$6.18 | 47% |

IPH (ASX:IPH) | A$6.30 | A$11.38 | 44.7% |

Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

Treasury Wine Estates (ASX:TWE) | A$12.51 | A$21.87 | 42.8% |

Let's take a closer look at a couple of our picks from the screened companies

Kelsian Group

Overview: Kelsian Group Limited operates in providing land and marine transport and tourism services across Australia, the United States, Singapore, and the United Kingdom, with a market capitalization of approximately A$1.36 billion.

Operations: The company generates revenue through three primary segments: Australian Bus operations, which brought in A$934.76 million, International Bus services with A$448.87 million, and Marine and Tourism activities accounting for A$337.90 million.

Estimated Discount To Fair Value: 14.3%

Kelsian Group Limited, priced at A$5.01, is trading 14.3% below its estimated fair value of A$5.84, reflecting a modest undervaluation based on discounted cash flow analysis. Despite this, the company faces challenges such as a low net profit margin decline from 3.8% to 1.7% over the past year and earnings that do not sufficiently cover interest payments. However, Kelsian's earnings are expected to grow by 25.84% annually, outpacing the Australian market forecast of 13.7%, although its revenue growth projection of 5.8% per year is just above market expectations (5.4%). The dividend yield stands at 3.49%, but it isn't well supported by either earnings or cash flows.

Megaport

Overview: Megaport Limited offers elastic interconnection services across multiple regions including Australia, New Zealand, Asia, and North America, with a market capitalization of approximately A$1.87 billion.

Operations: The company generates its revenue from three primary geographical segments: Europe (A$28.88 million), Asia-Pacific (A$48.84 million), and North America (A$99.78 million).

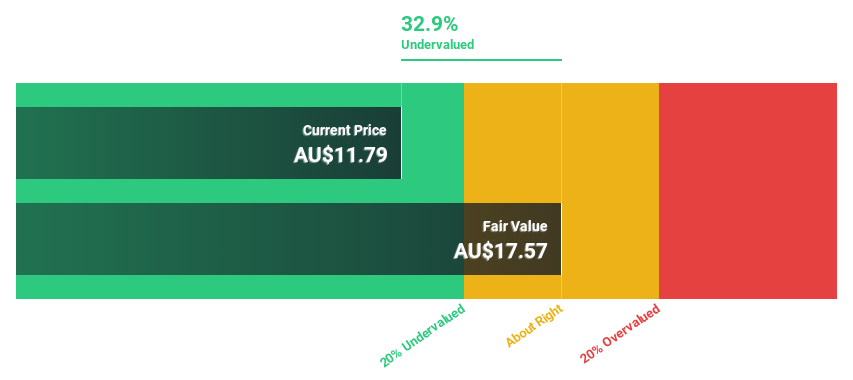

Estimated Discount To Fair Value: 32.9%

Megaport Limited, currently valued at A$11.79, is perceived as undervalued with a fair value estimate of A$17.57, indicating a significant discount. The company's earnings are projected to increase by 42.1% annually over the next three years, surpassing the Australian market's expected growth. Additionally, Megaport's revenue growth rate at 17.4% annually is also set to outpace the national average significantly. Recent strategic partnerships highlight its commitment to expanding its global network infrastructure and enhancing digital transformation capabilities in various industries.

Nanosonics

Overview: Nanosonics Limited, along with its subsidiaries, operates globally as an infection prevention company, boasting a market capitalization of approximately A$890.81 million.

Operations: The company generates its revenue primarily from the healthcare equipment segment, totaling A$164.07 million.

Estimated Discount To Fair Value: 30.5%

Nanosonics, priced at A$2.95, is considered undervalued with a fair value estimate of A$4.24, reflecting a substantial discount. Earnings have surged by 53.2% over the past year and are anticipated to grow by 24.23% annually for the next three years, outperforming the Australian market's growth rate. However, its Return on Equity is expected to remain low at 12.6%. Recent significant insider selling could indicate caution despite these positive financial projections and market performance comparisons.

The growth report we've compiled suggests that Nanosonics' future prospects could be on the up.

Dive into the specifics of Nanosonics here with our thorough financial health report.

Next Steps

Navigate through the entire inventory of 45 Undervalued ASX Stocks Based On Cash Flows here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:KLS ASX:MP1 and ASX:NAN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance