Keep Betting on Tech

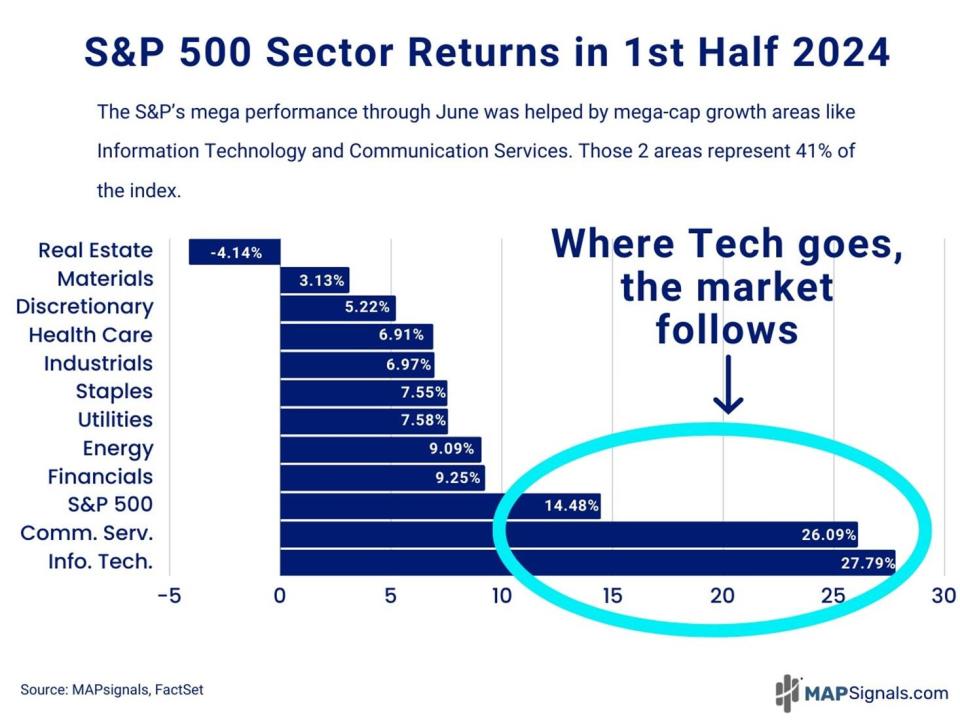

The S&P 500 delivered a monster first six months of the year, gaining 14.5% on the back of huge technology stocks. It’s quite possible the second half of the year could be similar.

First, let’s cover some history.

Back in January, MAPsignals data showed good fortunes for semiconductor and software companies. About a month ago, after heavy selling in technology shares, our data said a big revision trade was near.

Both calls were right.

The S&P 500 Packaged Software industry and the S&P 500 Semiconductors industry have gained 9.9% and 53.6%, respectively. And the Technology Select Sector SPDR ETF (XLK) is up over 9% since the capitulation:

Along with the tech sector, the tech-heavy communications sector, as represented by the Communication Services Select Sector SPDR Fund (XLC), jumped in the first half of 2024:

Tech and communications are the only two sectors to outperform the S&P 500 so far this year:

Data indicates it’s wise to keep betting on tech this year.

Keep Betting on Tech

In our modern economy, as tech goes, so goes the market. The tech and communications sectors make up 41% of the S&P 500’s overall weight. So, sticking with this theme seems like a good long-term plan.

But the market isn’t just tech. Looking back to 2002, when the S&P 500 gains 10% or more in the year’s first half, several sectors tend to outperform the market to end the year…including tech:

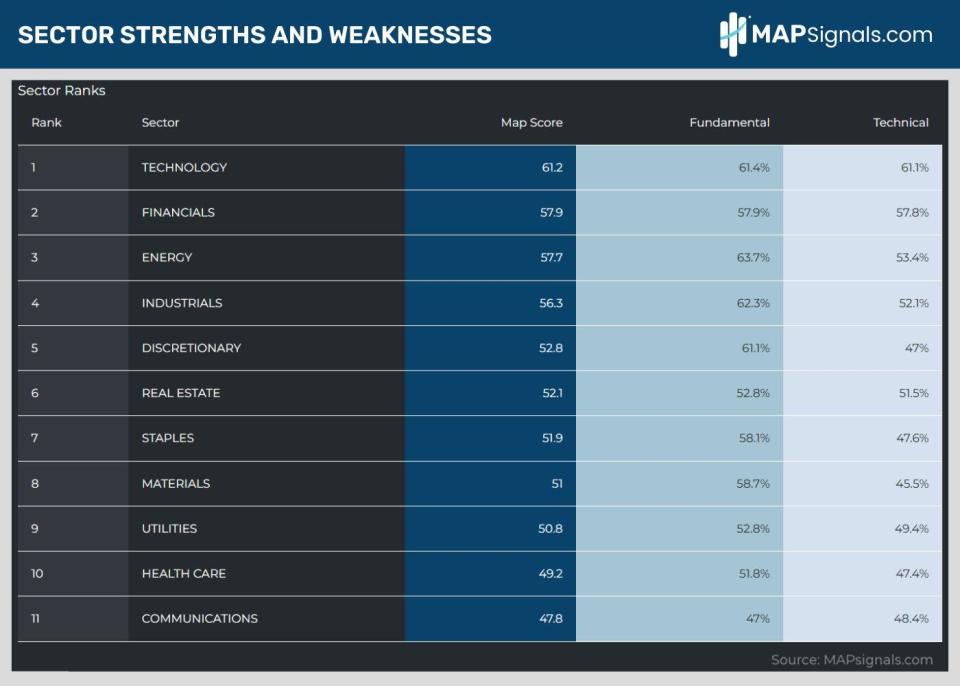

MAPsignals sector data (below) shows how multiple sectors are gaining. Based on history, it seems many of them could keep chugging higher due to superior fundamentals.

Chugging Higher Due to Superior Fundamentals

It’s time to reinforce the call on thriving semiconductor and software stocks. They soared in the first part of the year, and fundamentals look favorable for a repeat performance.

That’s especially true for two stocks in MAP data.

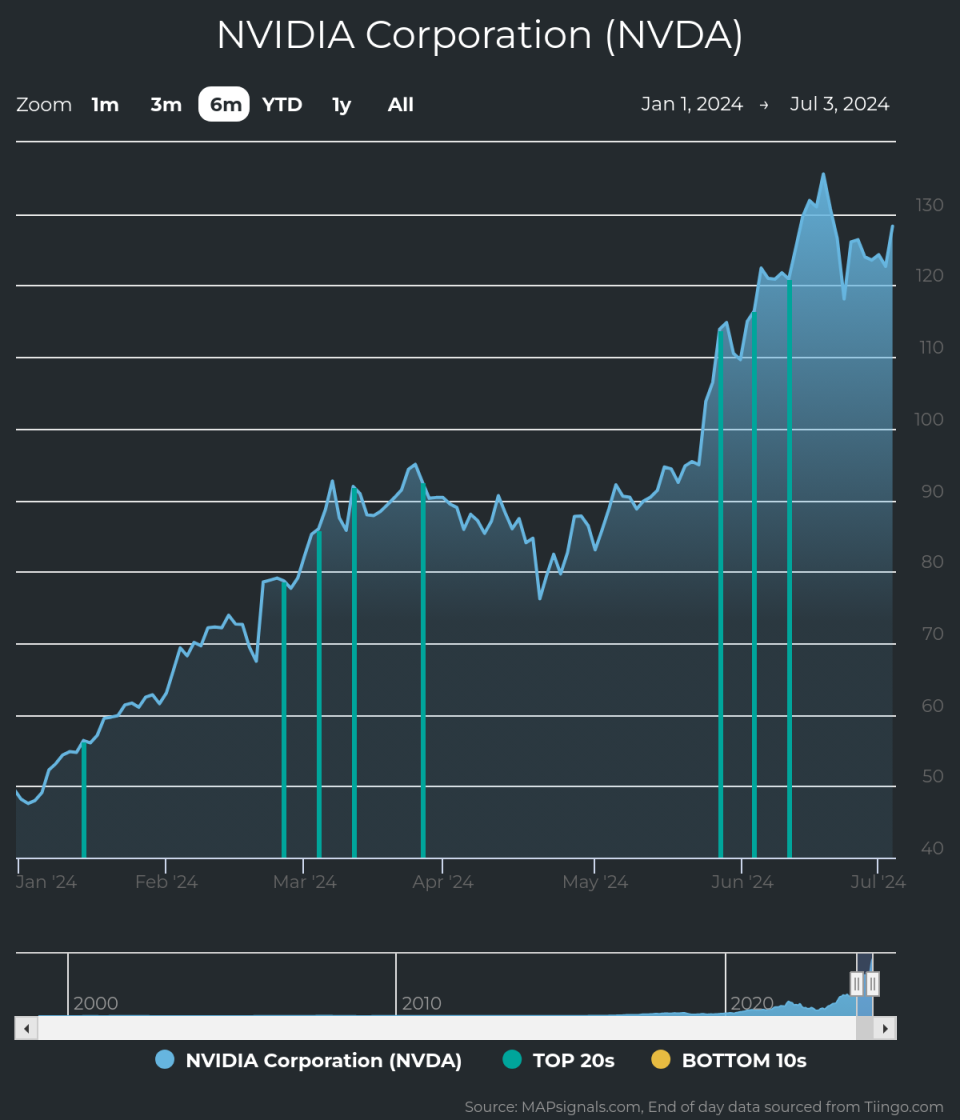

One is semiconductor superstar NVDA Corporation (NVDA). Its fundamentals are fantastic:

3-year sales growth rate (+62.5%)

3-year EPS growth rate (+218%)

Profit margin (+48.8%)

Source: FactSet

No wonder it’s made our Top 20 list multiple times this year:

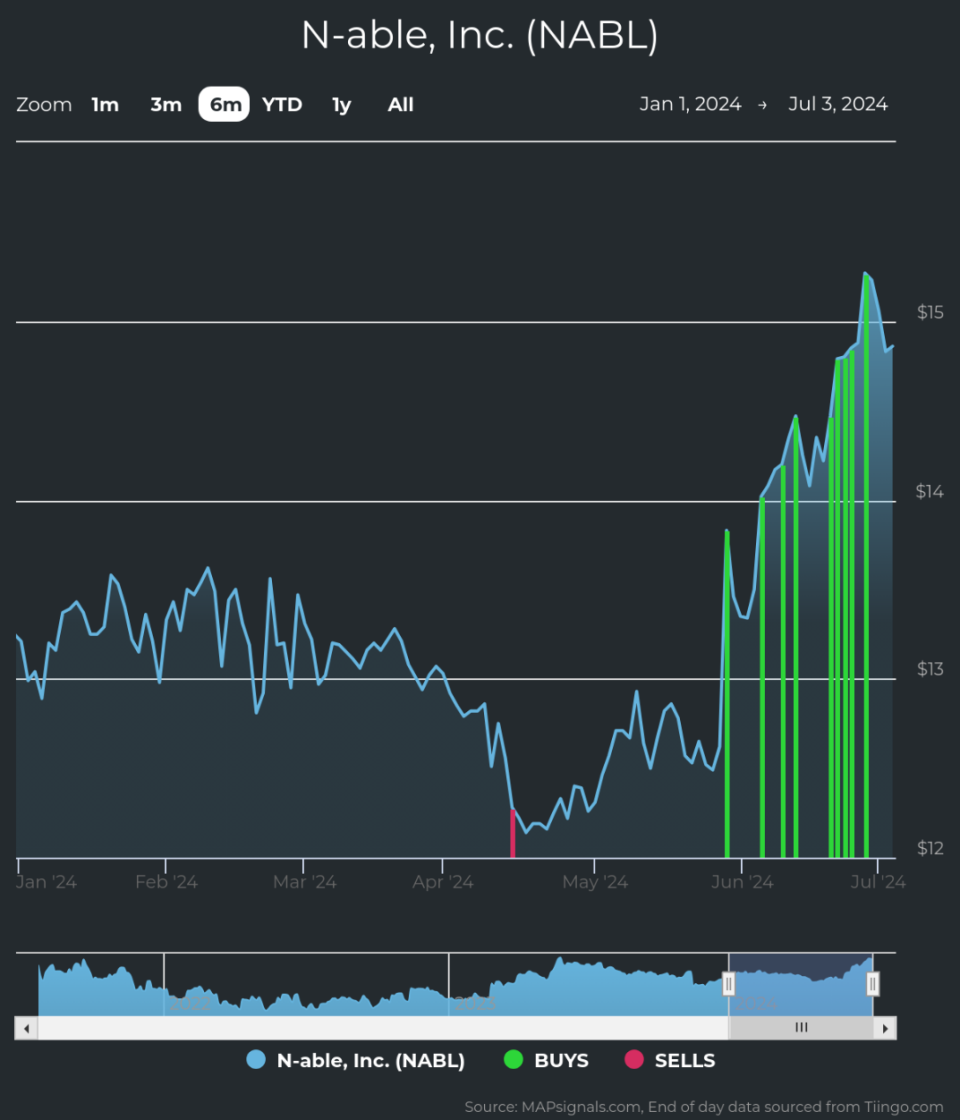

The other stock is software firm N-able, Inc. (NABL), which is a newer Big Money target with strong financial performance:

1-year sales growth rate (+13.5%)

1-year EPS growth rate (+14%)

3-year EPS growth rate (+7,702.5%)

Source: FactSet

Big Money has been all over it lately:

NABL made our Top 20 list twice since the stock began trading in 2021. The first signal was in April 2023, and it’s up 13.2% since.

To Find the Outliers, Use A MAP

The bottom line is this bull run has legs. Tech can keep leading the way and other sectors will show strength too. As always, superior fundamentals generate superior returns.

To find the outliers, use a MAP. Reveal tomorrow’s winners today with MAPsignals data.

If you’re a serious investor, Registered Investment Advisor (RIA), or a money manager looking for hedge-fund quality research, get started with a MAP PRO subscription today.

Disclosure: the author holds no positions in NVDA or NABL at the time of publication.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance