KBR Enters Into Partnership With HJF for the SPARC Contract

KBR, Inc. KBR has announced teaming up with the Henry M. Jackson Foundation for the Advancement of Military Medicine (HJF) for the Service Personnel Advancing Research in Chronic Traumatic Encephalopathy (SPARC) contract for supporting neuroscience research for service members.

Per the SPARC contract, KBR will offer services for outreach, education and data analytics, supporting critical neuroscience research. In collaboration with the Uniformed Services University and the University of California San Francisco, this research will be conducted to prevent and treat military members with chronic traumatic encephalopathy (CTE). Also, this cost-plus-fixed-fee contract will additionally assist in the development of therapeutics for treating CTE and is expected to have a term of 52 months.

KBR is optimistic about the SPARC contract as it believes this will lead to the development of its human health and technology portfolio to facilitate this important work.

Post the announcement of this accretive collaboration, shares of KBR gained 1.3% during the trading hours and 1.6% in the after-hours trading session on Dec 18.

Ongoing Contract Wins Spur Growth

KBR’s focus on a resilient business model and efficiency-boosting initiatives has sparked its project-winning momentum. Also, the rising global importance of national security, energy security, energy transition and climate change has been acting as a major tailwind.

During the third quarter of 2023, KBR received $3.5 billion in bookings and options in highly strategic areas, thus taking its backlog and option level to $21.8 billion. This uptrend was backed by increased new contracts and on-contract growth within all Government Solutions (GS) business units. Also, growing demand for Sustainable Technology Solutions (STS), mainly from engineering and professional services and technology licensing, adds to growth.

Since the third quarter of 2023 end, the company announced 11 contract wins. Recently, on Nov 29, its Purifier ammonia technology was selected by PT Pupuk Sriwidjaja Palembang for the planned 3B Ammonia Plant to be built in South Sumatera Province, Indonesia, thus marking KBR’s 12th ammonia plant licensed to PT Pupuk Indonesia. On Nov 16, KBR unveiled that it has increased support for new energy technologies, systems and processes for the UK's £1 billion Net Zero Innovation portfolio.

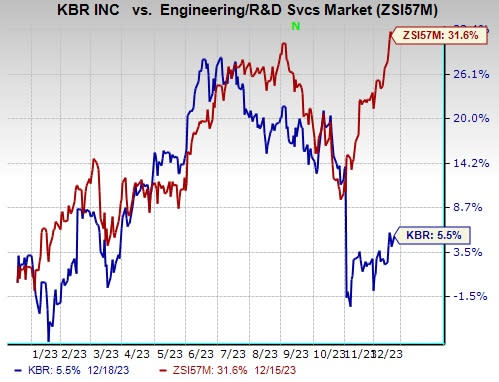

Image Source: Zacks Investment Research

Shares of this global engineering, construction and services firm have gained 5.5% in the past year compared with the Zacks Engineering - R and D Services industry’s 31.6% growth. Nonetheless, going forward, KBR expects broad-based growth across both GS and STS segments. Primary growth drivers include high-end and differentiated government business work, strong margin performance, and technology and consulting business.

Zacks Rank & Key Picks

KBR currently carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks from the Construction sector.

EMCOR Group, Inc. EME presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

It has a trailing four-quarter earnings surprise of 25%, on average. Shares of EME have increased 47.9% in the past year. The Zacks Consensus Estimate for EME’s 2023 sales and earnings per share (EPS) indicates an improvement of 12% and 52.8%, respectively, from the year-ago levels.

M-tron Industries, Inc. MPTI currently sports a Zacks Rank of 1. MPTI delivered a trailing four-quarter earnings surprise of 35.6%, on average. It has surged 252.2% in the past year.

The Zacks Consensus Estimate for MPTI’s 2023 sales and EPS indicates growth of 30.6% and 156.7%, respectively, from the previous year.

Willdan Group, Inc. WLDN currently sports a Zacks Rank of 1. WLDN delivered a trailing four-quarter earnings surprise of a whopping 850.6%, on average. The stock has gained 11.7% in the past year.

The Zacks Consensus Estimate for WLDN’s 2023 sales and EPS indicates growth of 14.1% and 47.7%, respectively, from a year ago.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

KBR, Inc. (KBR) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Willdan Group, Inc. (WLDN) : Free Stock Analysis Report

M-tron Industries, Inc. (MPTI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance