June 2024 Spotlight On Euronext Amsterdam Growth Companies With High Insider Ownership

Amidst a backdrop of fluctuating global markets, the Netherlands' stock market remains a point of interest for investors looking for growth opportunities. Recent economic indicators suggest a cautious but steady environment, making companies with high insider ownership particularly compelling as they often signal strong confidence in the company's future from those who know it best.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

Name | Insider Ownership | Earnings Growth |

BenevolentAI (ENXTAM:BAI) | 27.8% | 62.8% |

Envipco Holding (ENXTAM:ENVI) | 15.1% | 67.8% |

Ebusco Holding (ENXTAM:EBUS) | 31.4% | 115.2% |

MotorK (ENXTAM:MTRK) | 35.9% | 105.8% |

Basic-Fit (ENXTAM:BFIT) | 12% | 66.1% |

PostNL (ENXTAM:PNL) | 30.8% | 24.3% |

Underneath we present a selection of stocks filtered out by our screen.

Envipco Holding

Simply Wall St Growth Rating: ★★★★★☆

Overview: Envipco Holding N.V. operates in the environmental technology sector, specializing in the design, development, manufacture, and sale or lease of reverse vending machines (RVMs) for recycling used beverage containers primarily in the Netherlands, North America, and Europe, with a market capitalization of approximately €328.84 million.

Operations: The company generates its revenue primarily through the design, development, manufacture, and sale or lease of reverse vending machines for recycling used beverage containers in the Netherlands, North America, and Europe.

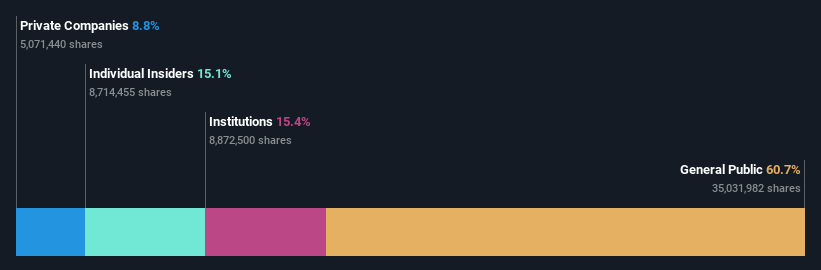

Insider Ownership: 15.1%

Earnings Growth Forecast: 67.8% p.a.

Envipco Holding N.V. has shown a remarkable turnaround, transitioning from a net loss in the previous year to reporting substantial earnings and revenue growth. With recent sales reaching €87.58 million and net income at €1.42 million, the company's financial health appears robust. Despite high share price volatility and some shareholder dilution over the past year, Envipco's revenue and earnings are expected to grow significantly above market trends in the coming years, indicating strong future potential amidst its challenges.

MotorK

Simply Wall St Growth Rating: ★★★★★☆

Overview: MotorK plc operates as a provider of software-as-a-service solutions tailored for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union, with a market capitalization of approximately €274.76 million.

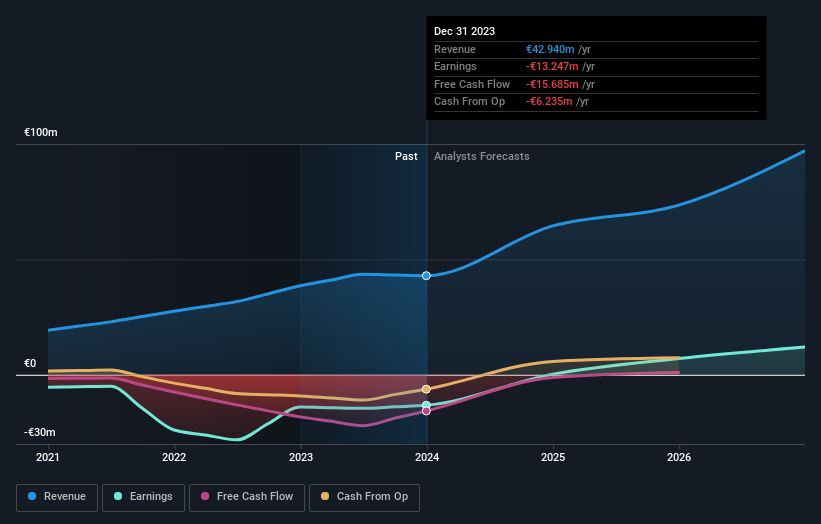

Operations: The company generates revenue primarily through its software and programming segment, which amounted to €42.94 million.

Insider Ownership: 35.9%

Earnings Growth Forecast: 105.8% p.a.

MotorK plc, a Dutch growth company with high insider ownership, has experienced some volatility. The firm reported a slight decrease in quarterly revenue to €11.25 million and an increased annual net loss to €13.25 million. Despite these challenges, MotorK is expected to see substantial revenue growth at 24% annually, outpacing the Dutch market's 9.2%. Additionally, it aims for a significant increase in Committed Annual Recurring Revenues (CARR) to €50 million by next year and anticipates profitability within three years.

Unlock comprehensive insights into our analysis of MotorK stock in this growth report.

The valuation report we've compiled suggests that MotorK's current price could be inflated.

PostNL

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PostNL N.V. operates as a postal and logistics service provider catering to businesses and consumers across the Netherlands, other parts of Europe, and globally, with a market capitalization of approximately €0.66 billion.

Operations: PostNL's revenue is primarily derived from its Packages and Mail in The Netherlands segments, generating €2.25 billion and €1.35 billion respectively.

Insider Ownership: 30.8%

Earnings Growth Forecast: 24.3% p.a.

PostNL, though trading at 47.3% below its estimated fair value, faces challenges with a high level of debt and recent shifts to profitability. The company's earnings are expected to significantly increase by 24.3% annually over the next three years, outperforming the Dutch market forecast of 16.2%. However, revenue growth projections remain modest at 3.4% per year, trailing behind the broader Dutch market expectation of 9.2%. Recent financials indicate a net loss in Q1 2024 with sales dropping from €780 million to €763 million year-over-year.

Make It Happen

Get an in-depth perspective on all 6 Fast Growing Euronext Amsterdam Companies With High Insider Ownership by using our screener here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ENXTAM:ENVIENXTAM:MTRK ENXTAM:PNL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance