June 2024 KRX Stock Picks Estimated To Trade Below Their True Value

The South Korean stock market has recently experienced a notable upward trend, reaching a 30-month high as the KOSPI index climbed steadily across three sessions. Amidst mixed global forecasts and potential profit-taking in technology sectors, investors are keenly observing market movements. In this context, identifying stocks that trade below their intrinsic value can offer attractive opportunities for those looking to invest in potentially undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

Name | Current Price | Fair Value (Est) | Discount (Est) |

Solum (KOSE:A248070) | ₩21750.00 | ₩40080.13 | 45.7% |

Iljin ElectricLtd (KOSE:A103590) | ₩26550.00 | ₩50969.74 | 47.9% |

Grand Korea Leisure (KOSE:A114090) | ₩13030.00 | ₩24618.09 | 47.1% |

Protec (KOSDAQ:A053610) | ₩30050.00 | ₩55214.32 | 45.6% |

Interojo (KOSDAQ:A119610) | ₩24900.00 | ₩49600.76 | 49.8% |

Revu (KOSDAQ:A443250) | ₩11510.00 | ₩21005.02 | 45.2% |

Intellian Technologies (KOSDAQ:A189300) | ₩56000.00 | ₩107495.29 | 47.9% |

IMLtd (KOSDAQ:A101390) | ₩7070.00 | ₩13607.27 | 48% |

Hancom Lifecare (KOSE:A372910) | ₩5430.00 | ₩10711.17 | 49.3% |

NEXON Games (KOSDAQ:A225570) | ₩14150.00 | ₩25731.72 | 45% |

Let's review some notable picks from our screened stocks

Anapass

Overview: Anapass, Inc. is a South Korean company specializing in SoC semiconductor solutions for the display market, with a market capitalization of approximately ₩350.37 billion.

Operations: The company specializes in SoC semiconductor solutions, primarily serving the display market in South Korea.

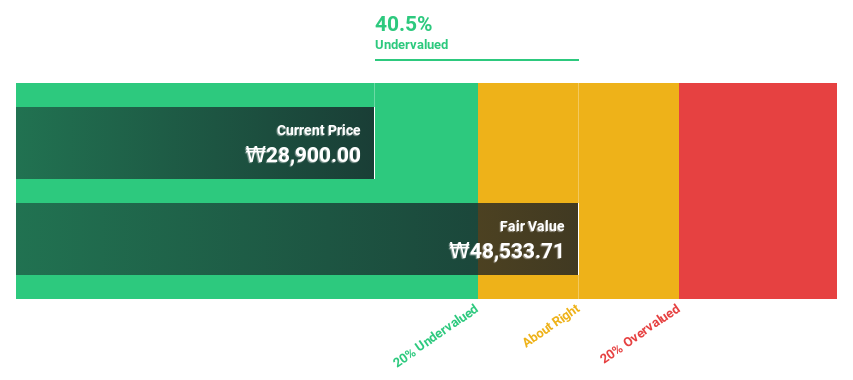

Estimated Discount To Fair Value: 40.5%

Anapass, a South Korean company, is currently trading at ₩28900, which is 40.5% below the estimated fair value of ₩48533.71, indicating significant undervaluation based on discounted cash flows. The firm has transitioned to profitability this year and is experiencing robust growth forecasts with earnings expected to increase by 115.5% annually over the next three years and revenue projected to grow at 60.7% per year—both metrics surpassing market averages significantly. However, shareholders have experienced dilution in the past year.

VIOL

Overview: Viol Co., Ltd., a company listed on KOSDAQ under the ticker A335890, specializes in manufacturing electrical diagnostics and medical devices, with a market capitalization of approximately ₩588.98 billion.

Operations: The company's revenue from its medical device segment amounted to approximately ₩35.49 billion.

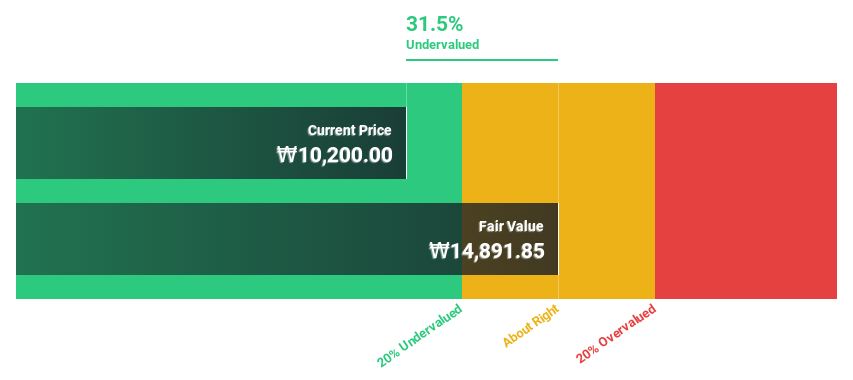

Estimated Discount To Fair Value: 31.5%

VIOL, priced at ₩10200, is valued well under its fair value of ₩14891.85, reflecting a 31.5% undervaluation. This South Korean entity is poised for substantial growth with earnings expected to increase by 30.6% annually, outpacing the market's 28.7%. Revenue growth projections are also strong at 29.3% yearly, higher than the market forecast of 10.5%. Despite these positives, potential investors should note the stock's high volatility in recent months and consensus that its price could rise by 32.7%.

Doosan Fuel Cell

Overview: Doosan Fuel Cell Co., Ltd. is a South Korean company specializing in the development and distribution of power generation fuel cells, with a market capitalization of approximately ₩1.48 trillion.

Operations: The company generates its revenue primarily from the electric equipment segment, totaling approximately ₩260.89 billion.

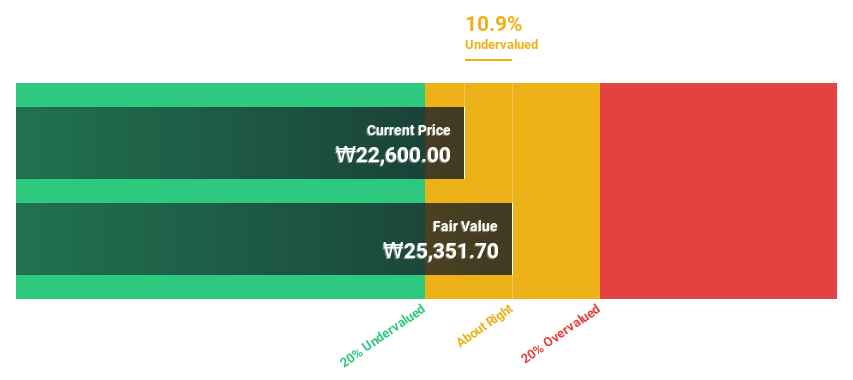

Estimated Discount To Fair Value: 10.9%

Doosan Fuel Cell, currently trading at ₩22600, is below our fair value estimate of ₩25351.7, indicating a modest undervaluation. The company's earnings are expected to grow by 73.25% annually, with revenue growth projected at 25.4% per year—significantly outpacing the South Korean market average of 10.5%. However, its financial position shows some concerns as interest payments are not well covered by earnings and the forecasted Return on Equity in three years is relatively low at 7.2%.

Make It Happen

Get an in-depth perspective on all 34 Undervalued KRX Stocks Based On Cash Flows by using our screener here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSDAQ:A123860KOSDAQ:A335890 and KOSE:A336260

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance