June 2024 Insights Into US Stocks Estimated As Undervalued

As of June 2024, the U.S. stock market presents a mixed landscape, with recent semiconductor weaknesses impacting the Nasdaq while the Dow Jones Industrial Average shows resilience with notable gains. In such a varied market environment, identifying undervalued stocks requires careful analysis of fundamentals and market conditions to discern potential opportunities for value investing.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

Name | Current Price | Fair Value (Est) | Discount (Est) |

Noble (NYSE:NE) | $44.55 | $88.41 | 49.6% |

Selective Insurance Group (NasdaqGS:SIGI) | $92.82 | $183.69 | 49.5% |

Hanover Bancorp (NasdaqGS:HNVR) | $16.435 | $32.30 | 49.1% |

Atlantic Union Bankshares (NYSE:AUB) | $31.48 | $60.83 | 48.2% |

Marriott Vacations Worldwide (NYSE:VAC) | $84.73 | $162.76 | 47.9% |

Associated Banc-Corp (NYSE:ASB) | $20.41 | $39.50 | 48.3% |

USCB Financial Holdings (NasdaqGM:USCB) | $12.045 | $23.71 | 49.2% |

HeartCore Enterprises (NasdaqCM:HTCR) | $0.7092 | $1.40 | 49.5% |

Carter Bankshares (NasdaqGS:CARE) | $12.30 | $24.26 | 49.3% |

Hesai Group (NasdaqGS:HSAI) | $4.34 | $8.43 | 48.5% |

Here we highlight a subset of our preferred stocks from the screener

Amazon.com

Overview: Amazon.com, Inc. operates as a global online and physical retailer, offering consumer products, advertising services, and subscriptions, with a market capitalization of approximately $1.90 trillion.

Operations: The company generates revenue through its international operations ($134.01 billion), North American sales ($362.29 billion), and Amazon Web Services (AWS) ($94.44 billion).

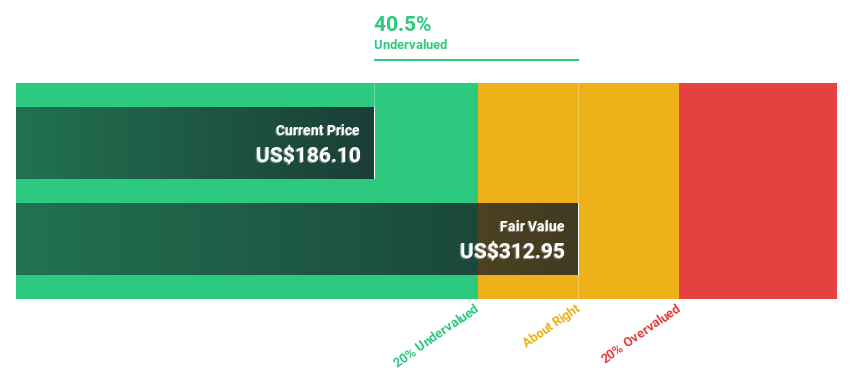

Estimated Discount To Fair Value: 40.5%

Amazon.com, valued at US$186.1, is trading below its fair value estimate of US$312.95, indicating potential undervaluation based on cash flows. Earnings have surged by 777.6% over the past year with expectations of a 21.39% annual growth moving forward, outpacing the US market projection of 14.9%. Despite slower revenue growth forecasts at 9.8% annually compared to earnings growth rates, Amazon remains an attractive proposition for those looking at cash flow-based valuations in undervalued stocks.

Atlassian

Overview: Atlassian Corporation operates globally, designing, developing, licensing, and maintaining a range of software products with a market capitalization of approximately $39.87 billion.

Operations: The company generates its revenue primarily from software and programming, which totaled approximately $4.17 billion.

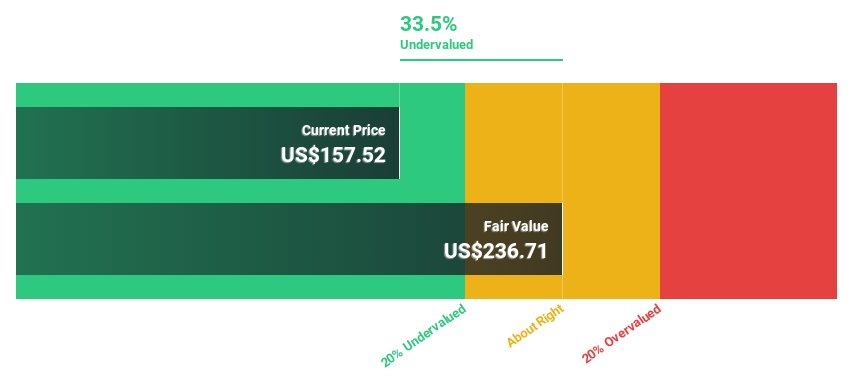

Estimated Discount To Fair Value: 33.5%

Atlassian, currently priced at US$157.52, appears undervalued against a fair value estimate of US$236.71, reflecting a 33.5% discount based on discounted cash flow analysis. Despite recent debt financing and fixed-income offerings totaling nearly US$1 billion to bolster financial flexibility, Atlassian's earnings trajectory is promising with an expected growth rate of 42.94% per year. This performance is underpinned by significant revenue growth outstripping the U.S market average and an anticipated robust return on equity in the near future.

Overview: Pinterest, Inc. is a global visual search and discovery platform with a market capitalization of approximately $30.21 billion.

Operations: The company generates its revenue primarily from internet information providers, totaling approximately $3.19 billion.

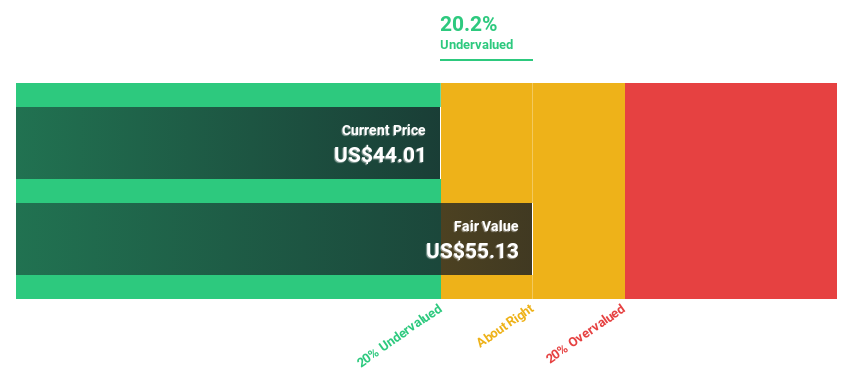

Estimated Discount To Fair Value: 20.2%

Pinterest, trading at US$44.01, is assessed as undervalued by more than 20% with a fair value estimate of US$55.13 based on discounted cash flow analysis. The company recently turned profitable and forecasts robust earnings growth of 34.6% annually, outpacing the U.S market projection of 14.9%. Additionally, a strategic partnership with VTEX aims to expand its social commerce presence, potentially enhancing future revenue streams which are expected to grow by 14% yearly.

Seize The Opportunity

Unlock our comprehensive list of 171 Undervalued US Stocks Based On Cash Flows by clicking here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:AMZN NasdaqGS:TEAM and NYSE:PINS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance