June 2024 Insight Into US Growth Companies With High Insider Ownership

As of June 2024, the U.S. stock market displays resilience with tech stocks driving gains amidst a mixed performance in other sectors like semiconductors and financials. In this environment, growth companies with high insider ownership can be particularly compelling as these insiders often have a deep commitment to the company's long-term success.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Duolingo (NasdaqGS:DUOL) | 15% | 48% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

Here's a peek at a few of the choices from the screener.

Coastal Financial

Simply Wall St Growth Rating: ★★★★★☆

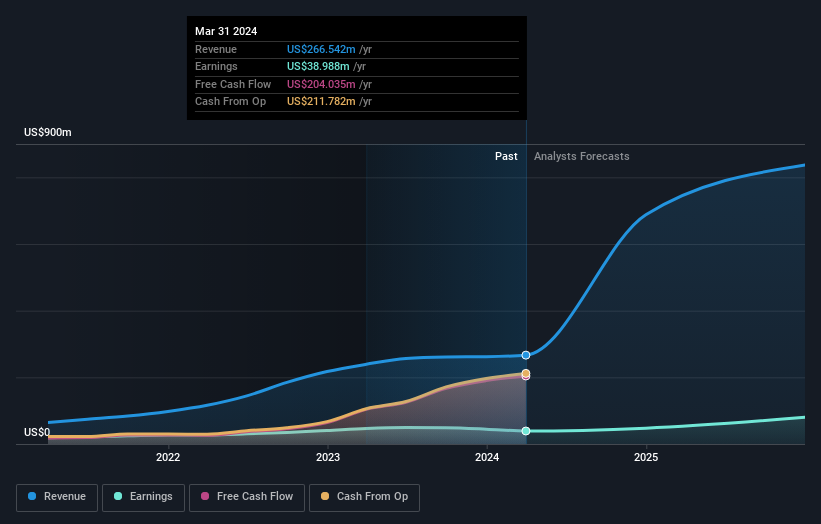

Overview: Coastal Financial Corporation, operating as the bank holding company for Coastal Community Bank, offers banking products and services to small and medium-sized businesses, professionals, and individuals in Washington's Puget Sound region, with a market cap of approximately $589.65 million.

Operations: The bank's primary revenue streams include $170.08 million from CCBX and $166.08 million from its Community Bank operations, along with $9.31 million contributed by Treasury & Administration.

Insider Ownership: 18.8%

Revenue Growth Forecast: 53% p.a.

Coastal Financial is trading at 62.1% below its estimated fair value, indicating potential undervaluation. Despite recent substantial insider selling, earnings are expected to significantly increase, with a forecasted growth of 43.16% per year, outpacing the US market's 14.8%. Revenue growth is also projected to be strong at 53% annually, well above the market average of 8.7%. However, recent financial disclosures show a downturn in net income and an increase in net charge-offs compared to the previous year.

Li Auto

Simply Wall St Growth Rating: ★★★★★☆

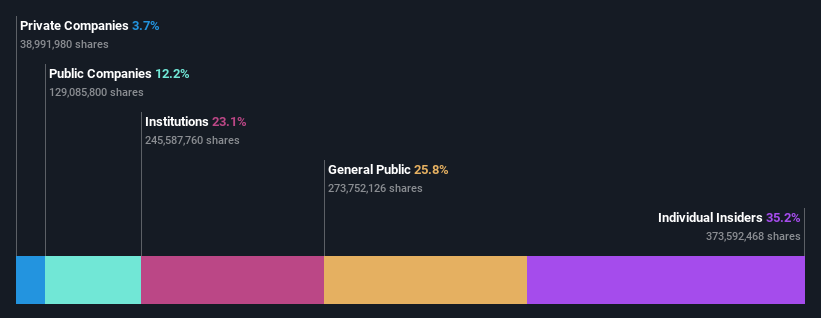

Overview: Li Auto Inc., valued at a market cap of approximately $20.07 billion, operates in the electric vehicle market in the People’s Republic of China.

Operations: Li Auto primarily generates revenue through its auto manufacturing segment, totaling CN¥130.70 billion.

Insider Ownership: 29.3%

Revenue Growth Forecast: 20.5% p.a.

Li Auto, despite facing recent legal challenges and revenue fluctuations, continues to show promise with a 20.5% annual revenue growth forecast, outpacing the US market's 8.6%. The company reported a significant increase in gross profit for Q1 2024 but faced setbacks with its Li MEGA model leading to a revised vehicle delivery outlook and subsequent share price declines. Insider ownership remains substantial, aligning leadership interests with shareholder returns, though past year dilution poses concerns for existing shareholders.

Click here and access our complete growth analysis report to understand the dynamics of Li Auto.

The valuation report we've compiled suggests that Li Auto's current price could be quite moderate.

Youdao

Simply Wall St Growth Rating: ★★★★☆☆

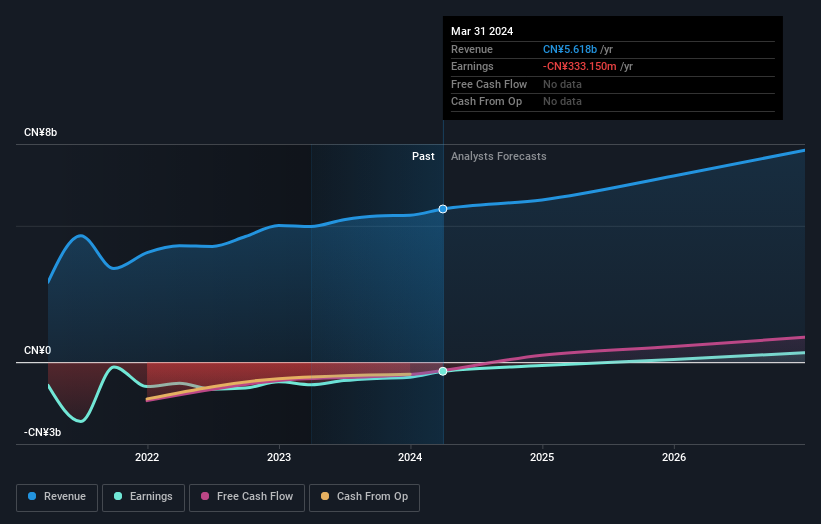

Overview: Youdao, Inc. is an internet technology company operating in China, offering online services across content, community, communication, and commerce sectors with a market capitalization of approximately $451.78 million.

Operations: The company's revenue is divided into three main segments: Smart Devices generating CN¥877.64 million, Learning Services at CN¥3.13 billion, and Online Marketing Services contributing CN¥1.61 billion.

Insider Ownership: 20.3%

Revenue Growth Forecast: 11.9% p.a.

Youdao, Inc. recently reported a substantial recovery in Q1 2024 with earnings turning positive at CNY 12.43 million from a loss last year, alongside revenue growth to CNY 1,391.86 million. This performance aligns with forecasts predicting robust annual earnings growth (108.24%) over the next three years, surpassing average market expectations. Additionally, the company's strategic share buybacks totaling US$30.4 million reflect strong insider confidence despite its short cash runway and trading at significant undervaluation relative to its estimated fair value.

Click to explore a detailed breakdown of our findings in Youdao's earnings growth report.

Our valuation report here indicates Youdao may be undervalued.

Summing It All Up

Reveal the 180 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:CCB NasdaqGS:LI and NYSE:DAO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance