June 2024 Insight Into TSX Growth Companies With High Insider Ownership

The Canadian market has shown robust growth recently, with a 9.9% increase over the past year and a 1.1% rise in just the last week, alongside expectations of earnings growing by 15% annually. In such an optimistic climate, stocks with high insider ownership can be particularly appealing as they often indicate confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

Vox Royalty (TSX:VOXR) | 12.3% | 58.7% |

Payfare (TSX:PAY) | 15% | 46.7% |

goeasy (TSX:GSY) | 21.5% | 15.8% |

Propel Holdings (TSX:PRL) | 40% | 36.4% |

Aritzia (TSX:ATZ) | 19.1% | 51.2% |

Aya Gold & Silver (TSX:AYA) | 10.2% | 51.6% |

Ivanhoe Mines (TSX:IVN) | 13.1% | 65.9% |

Silver X Mining (TSXV:AGX) | 14.2% | 144.2% |

Artemis Gold (TSXV:ARTG) | 31.8% | 48.8% |

Almonty Industries (TSX:AII) | 12.3% | 105% |

Let's explore several standout options from the results in the screener.

Ivanhoe Mines

Simply Wall St Growth Rating: ★★★★★☆

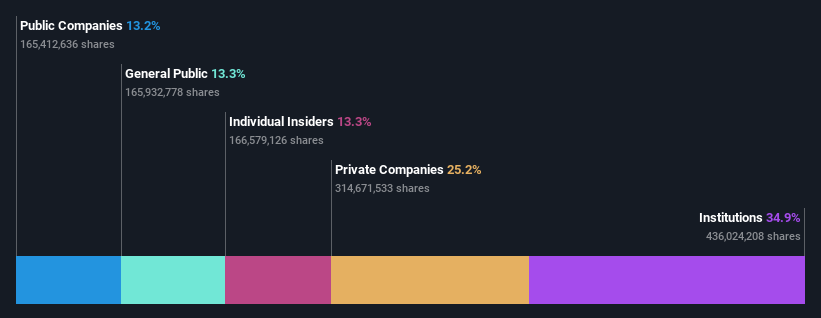

Overview: Ivanhoe Mines Ltd. is a company focused on the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market capitalization of approximately CA$22.33 billion.

Operations: The company primarily generates its revenue from the mining, development, and exploration of minerals and precious metals in Africa.

Insider Ownership: 13.1%

Earnings Growth Forecast: 65.9% p.a.

Ivanhoe Mines, a growth-focused company with substantial insider ownership, recently achieved significant operational milestones. The early and on-budget completion of their Phase 3 concentrator at the Kamoa-Kakula Copper Complex has increased processing capacity significantly, positioning it as one of the world's largest copper mines. This expansion aligns with a robust forecast for revenue growth at 83% per year, outpacing the Canadian market significantly. Despite recent financial losses in Q1 2024, insider transactions suggest confidence in long-term prospects.

North American Construction Group

Simply Wall St Growth Rating: ★★★★★☆

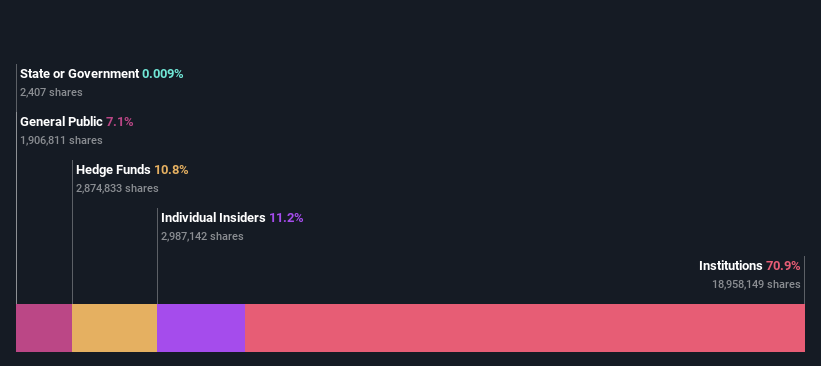

Overview: North American Construction Group Ltd. operates in Australia, Canada, and the United States, offering mining and heavy civil construction services primarily to the resource development and industrial construction sectors, with a market cap of approximately CA$695.50 million.

Operations: The company generates its revenues by providing mining and heavy civil construction services across Australia, Canada, and the United States.

Insider Ownership: 11.3%

Earnings Growth Forecast: 33.1% p.a.

North American Construction Group, with high insider ownership, shows promising growth prospects despite some challenges. The company's revenue is expected to grow at 17.4% annually, outpacing the general Canadian market's 7.2%. Earnings are set to increase significantly by 33.1% per year. Recent substantial insider buying reflects confidence in the company’s future, though profit margins have dipped this year from 9% to 5.2%, and interest payments are not well covered by earnings.

Propel Holdings

Simply Wall St Growth Rating: ★★★★★☆

Overview: Propel Holdings Inc. is a financial technology company with a market capitalization of approximately CA$760.99 million.

Operations: The company generates revenue primarily by providing lending-related services, totaling CA$347.37 million.

Insider Ownership: 40%

Earnings Growth Forecast: 36.4% p.a.

Propel Holdings, a Canadian growth company with high insider ownership, demonstrates robust financial performance and promising future projections. The company's earnings have surged by 79.4% over the past year and are expected to grow by 36.44% annually over the next three years, outstripping the broader Canadian market forecast of 14.7%. Revenue growth is also strong at 22.7% per year, significantly ahead of the market's 7.2%. However, challenges include substantial insider selling in recent months and dividends that are poorly covered by cash flows.

Take a closer look at Propel Holdings' potential here in our earnings growth report.

Our valuation report unveils the possibility Propel Holdings' shares may be trading at a premium.

Taking Advantage

Gain an insight into the universe of 29 Fast Growing TSX Companies With High Insider Ownership by clicking here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:IVN TSX:NOA and TSX:PRL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance