June 2024 Insight: Three Value Stocks On SIX Swiss Exchange With Estimated Discount Opportunities

Recent fluctuations in the Switzerland market, highlighted by a downturn influenced by concerns over U.S. economic data and Federal Reserve interest rate decisions, have left investors cautious. Amidst these conditions, identifying undervalued stocks on the SIX Swiss Exchange could present opportunities for value-seeking investors.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

Name | Current Price | Fair Value (Est) | Discount (Est) |

COLTENE Holding (SWX:CLTN) | CHF47.00 | CHF75.89 | 38.1% |

Burckhardt Compression Holding (SWX:BCHN) | CHF584.00 | CHF824.20 | 29.1% |

Julius Bär Gruppe (SWX:BAER) | CHF50.92 | CHF96.39 | 47.2% |

Sonova Holding (SWX:SOON) | CHF274.80 | CHF449.16 | 38.8% |

Temenos (SWX:TEMN) | CHF61.00 | CHF84.36 | 27.7% |

Comet Holding (SWX:COTN) | CHF357.50 | CHF546.94 | 34.6% |

SGS (SWX:SGSN) | CHF80.76 | CHF122.80 | 34.2% |

Medartis Holding (SWX:MED) | CHF69.70 | CHF120.61 | 42.2% |

Kudelski (SWX:KUD) | CHF1.44 | CHF1.87 | 22.9% |

Galderma Group (SWX:GALD) | CHF76.49 | CHF150.16 | 49.1% |

Let's dive into some prime choices out of from the screener

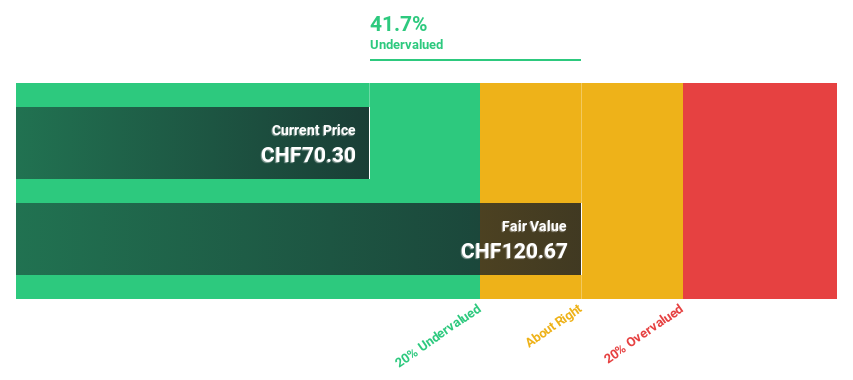

Medartis Holding

Overview: Medartis Holding AG is a global medical device company that specializes in developing, manufacturing, and selling implant solutions, with a market capitalization of approximately CHF 946.57 million.

Operations: The company generates CHF 212.01 million in revenue from its medical products segment.

Estimated Discount To Fair Value: 42.2%

Medartis Holding is significantly undervalued based on discounted cash flow, priced at CHF69.7 against a fair value of CHF120.61, indicating a 42.2% undervaluation. Despite recent shareholder dilution and low forecasted return on equity at 7%, the company's earnings are expected to grow by 60.44% annually over the next three years, outpacing the Swiss market's growth. Additionally, revenue growth projections stand at 13.3% annually, also above market averages.

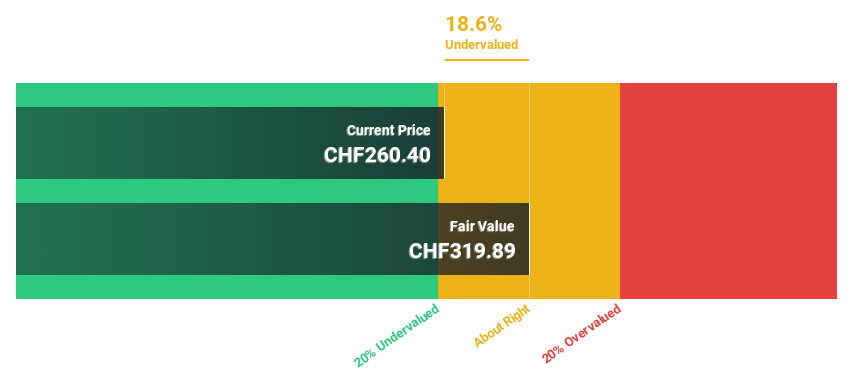

Sika

Overview: Sika AG is a specialty chemicals company that operates globally, offering products and systems for bonding, sealing, damping, reinforcing, and protecting in the building sector and automotive industry, with a market capitalization of approximately CHF 41.71 billion.

Operations: The company generates CHF 9.45 billion from its construction industry products and CHF 1.78 billion from industrial manufacturing products.

Estimated Discount To Fair Value: 18.9%

Sika, priced at CHF260, trades 18.9% below its estimated fair value of CHF320.77, reflecting a modest undervaluation based on discounted cash flows. While the company's debt level is high, it is poised for robust growth with earnings expected to increase by 12.53% annually and revenue forecasted to grow at 6.2% per year—both rates outpacing the Swiss market averages of 8.4% and 4.4%, respectively. Recent expansions in China and Peru underline Sika's strategic initiatives to enhance its global manufacturing footprint and product offerings in emerging markets.

According our earnings growth report, there's an indication that Sika might be ready to expand.

Dive into the specifics of Sika here with our thorough financial health report.

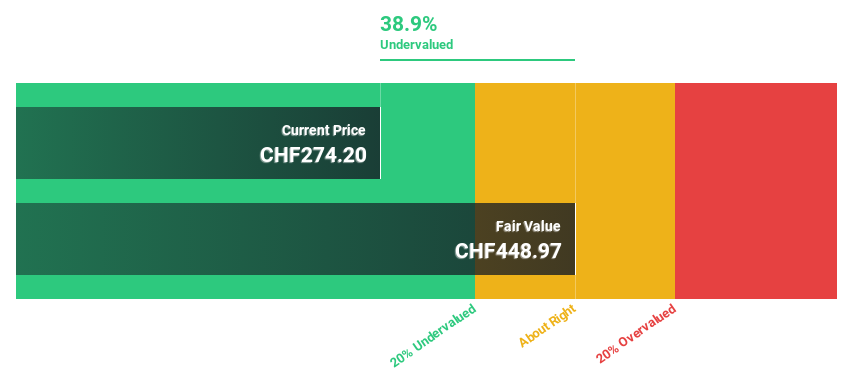

Sonova Holding

Overview: Sonova Holding AG is a company that produces and distributes hearing care solutions for adults and children across various global regions, with a market capitalization of approximately CHF 16.38 billion.

Operations: The company's revenue is primarily generated from two segments: Cochlear Implants, which contributed CHF 282.40 million, and Hearing Instruments, which brought in CHF 3.36 billion.

Estimated Discount To Fair Value: 38.8%

Sonova Holding, with a current price of CHF274.8, is valued significantly below our calculated fair value of CHF449.16, indicating a potential undervaluation. The company's earnings are expected to grow by 9.91% annually, outperforming the Swiss market prediction of 8.4%. Despite its high debt levels, Sonova's return on equity is anticipated to be strong at 26.2% in three years. Additionally, its revenue growth forecast at 7.1% yearly also exceeds the market average of 4.4%. Recent financial results showed robust performance with sales reaching CHF3.63 billion and net income at CHF609.5 million for the full year ended March 2024.

Turning Ideas Into Actions

Dive into all 13 of the Undervalued SIX Swiss Exchange Stocks Based On Cash Flows we have identified here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:MED SWX:SIKA and SWX:SOON.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance