June 2024 Insight Into High Insider Ownership Growth Stocks On The Japanese Exchange

Amid a backdrop of mixed performance in global markets, Japan's stock market has shown resilience, with the Nikkei 225 Index registering modest gains. This stability makes it an opportune time to explore growth companies with high insider ownership on the Japanese exchange, as these entities often exhibit robust alignment between management and shareholder interests, potentially leading to prudent long-term growth strategies.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.4% | 26.8% |

Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

Hottolink (TSE:3680) | 27% | 57.3% |

Medley (TSE:4480) | 34% | 28.7% |

Micronics Japan (TSE:6871) | 15.3% | 39.7% |

Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 44.6% |

ExaWizards (TSE:4259) | 24.8% | 91.1% |

Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

Soracom (TSE:147A) | 17.2% | 54.1% |

freee K.K (TSE:4478) | 24% | 80.9% |

Let's dive into some prime choices out of from the screener.

CyberAgent

Simply Wall St Growth Rating: ★★★★☆☆

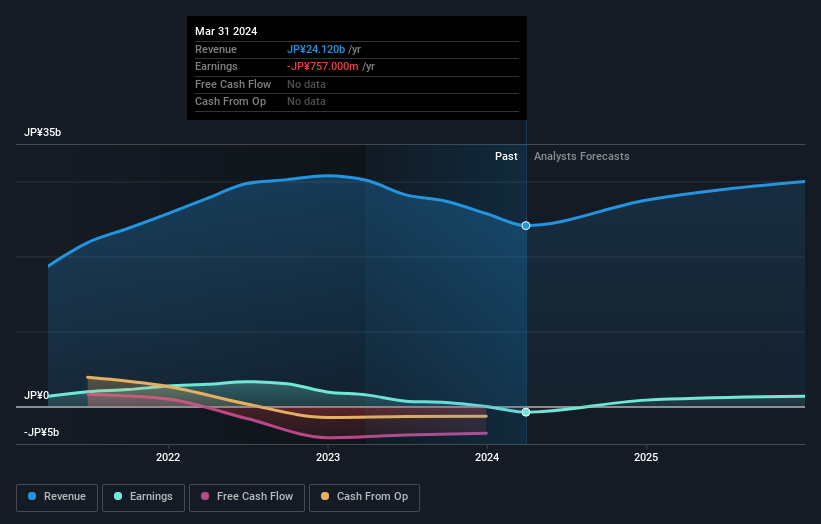

Overview: CyberAgent, Inc., primarily operating in Japan, focuses on media, internet advertising, game development, and investment businesses with a market capitalization of approximately ¥489.22 billion.

Operations: The company generates revenue primarily from media, internet advertising, and game development sectors.

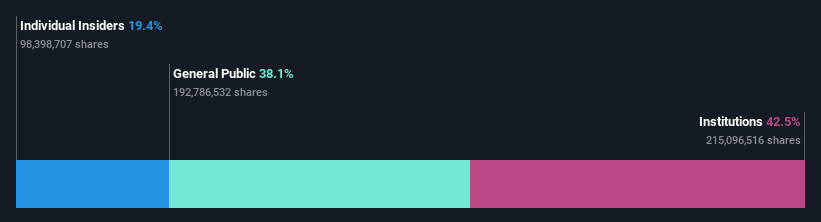

Insider Ownership: 19.4%

Earnings Growth Forecast: 21.3% p.a.

CyberAgent, a company in Japan with high insider ownership, is poised for significant earnings growth over the next three years. However, its forecasted annual revenue growth of 6.5% is moderate compared to some market peers but still outpaces the Japanese market average of 4.1%. The firm's Return on Equity is expected to remain low at 14.2%, indicating potential challenges in effectively leveraging shareholder equity. Recent discussions during their Q2 2024 Earnings Call highlighted these financial dynamics without revealing any major strategic shifts.

Take a closer look at CyberAgent's potential here in our earnings growth report.

Our valuation report here indicates CyberAgent may be overvalued.

Rakuten Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rakuten Group, Inc. operates globally, offering a diverse range of services including e-commerce, fintech, digital content, and communications with a market capitalization of approximately ¥1.78 trillion.

Operations: The company generates revenue through its diverse operations in e-commerce, fintech, digital content, and communications sectors.

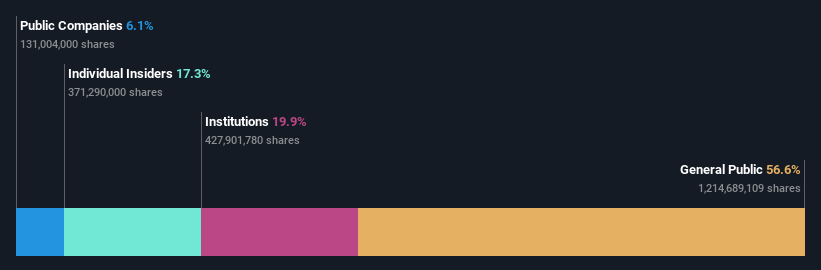

Insider Ownership: 17.3%

Earnings Growth Forecast: 84.2% p.a.

Rakuten Group, with high insider ownership, is on a path to profitability within three years amidst a challenging financial landscape. Recent corporate guidance forecasts double-digit growth in 2024 revenue, excluding its volatile securities business. Despite slower expected annual revenue growth at 7.4%, it surpasses the Japanese market's average of 4.1%. However, its projected Return on Equity remains modest at 8.8%, reflecting some efficiency concerns in capital utilization.

Snow Peak

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Snow Peak, Inc. is a company that develops, manufactures, and sells outdoor and apparel products both in Japan and internationally, with a market capitalization of ¥47.15 billion.

Operations: Snow Peak generates its revenue from the development, manufacturing, and international sales of outdoor and apparel products.

Insider Ownership: 28.7%

Earnings Growth Forecast: 118.6% p.a.

Snow Peak, a Japanese company with significant insider ownership, recently saw a major shift as BCJ-79 Co., Ltd. acquired a 59% stake for ¥28 billion, financed through contributions and loans from prominent banks. This transaction completed on April 12, 2024, following an initial offer in February. Despite this substantial internal change, Snow Peak faces financial challenges as its debt is poorly covered by operating cash flow. This scenario raises concerns about its financial stability amidst these significant ownership changes.

Unlock comprehensive insights into our analysis of Snow Peak stock in this growth report.

The valuation report we've compiled suggests that Snow Peak's current price could be inflated.

Next Steps

Reveal the 100 hidden gems among our Fast Growing Japanese Companies With High Insider Ownership screener with a single click here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:4751 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance