June 2024 Insight Into High Insider Ownership Growth Stocks On The Indian Exchange

Over the past week, the Indian market has experienced a rise of 1.4%, building on a robust annual gain of 45%. With earnings projected to grow by 16% per annum, companies with high insider ownership might be particularly well-positioned to benefit in such promising market conditions.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.1% |

Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 38% | 22.9% |

Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 28.6% |

Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

Kirloskar Pneumatic (BSE:505283) | 30.6% | 27.7% |

Aether Industries (NSEI:AETHER) | 31.1% | 32% |

Pricol (NSEI:PRICOLLTD) | 25.5% | 26.9% |

Let's dive into some prime choices out of from the screener.

Five-Star Business Finance

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Five-Star Business Finance Limited, a non-banking financial company in India, has a market capitalization of approximately ₹216.59 billion.

Operations: The company generates its revenue primarily from MSME loans, housing loans, and property loans, totaling ₹16.59 billion.

Insider Ownership: 19.7%

Earnings Growth Forecast: 19.5% p.a.

Five-Star Business Finance, a growth-oriented company with substantial insider ownership, has demonstrated robust financial performance with a 38.5% earnings increase over the past year and revenues reaching IN₹21.95 billion, up from IN₹15.29 billion the previous year. Despite challenges like high debt not well covered by operating cash flow and recent executive resignations, its earnings are expected to grow by 19.46% annually. Analysts predict a significant potential stock price increase of 21.4%.

One97 Communications

Simply Wall St Growth Rating: ★★★★☆☆

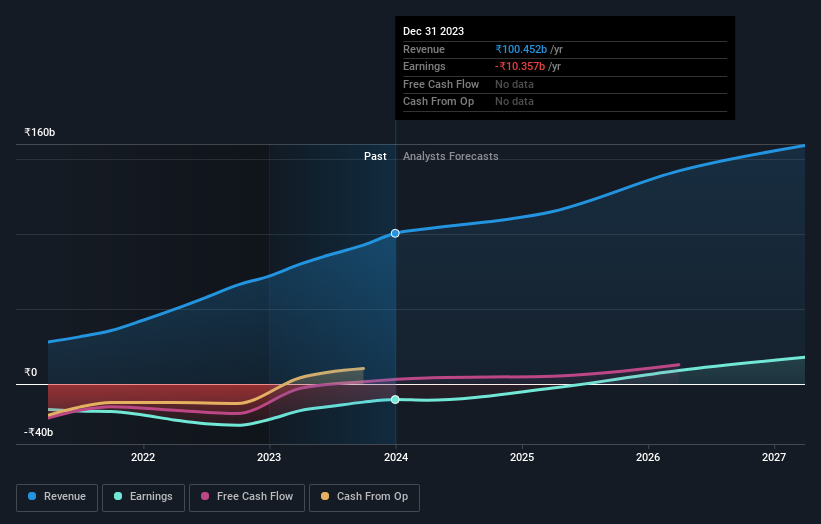

Overview: One97 Communications Limited, operating under the brand name Paytm, offers payment, commerce and cloud, and financial services in India with a market capitalization of approximately ₹227.23 billion.

Operations: The company generates revenue primarily through its data processing services, amounting to ₹99.78 billion.

Insider Ownership: 19.5%

Earnings Growth Forecast: 60.3% p.a.

One97 Communications, the parent of Paytm, led by CEO Vijay Shekhar Sharma with a 19% stake worth IN₹42.18 billion, is navigating through substantial losses as its Q4 earnings showed a net loss increase to IN₹5.496 billion from IN₹1.684 billion year-over-year. Despite these financial challenges, revenue grew to IN₹105.247 billion this fiscal year from IN₹84 billion the previous year, reflecting a potential turnaround guided by anticipated profitability within three years and ongoing discussions about strategic acquisitions with entities like Adani Group which could reshape its market stance significantly.

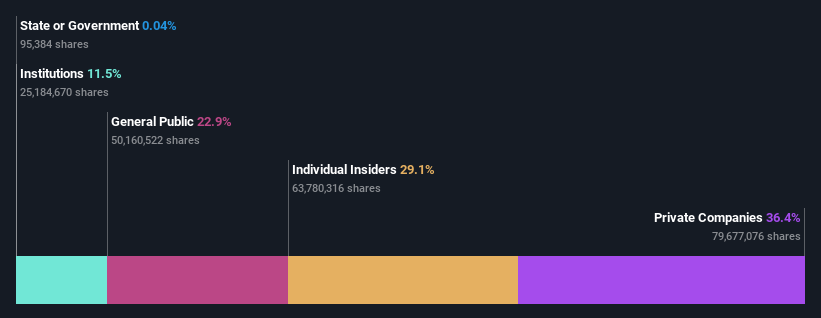

Triveni Engineering & Industries

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Triveni Engineering & Industries Limited operates in the sugar and engineering sectors both in India and globally, with a market capitalization of approximately ₹66.84 billion.

Operations: Triveni Engineering & Industries generates revenue from its engineering operations in water and power transmission, totaling ₹5.38 billion, and its sugar and allied businesses, including distillery and sugar production with co-generation, amounting to ₹60.63 billion.

Insider Ownership: 29.1%

Earnings Growth Forecast: 20.7% p.a.

Triveni Engineering & Industries, despite a challenging fiscal year with net income dropping to IN₹3.95 billion from IN₹17.92 billion, maintains a promising outlook with expected earnings growth of 20.7% annually. The company's recent dividend proposal and high insider ownership position it as a growth-oriented firm in India's market, though concerns about its financial leverage and lower profit margins compared to last year suggest areas for caution. Recent penalties related to GST violations also highlight potential regulatory challenges ahead.

Make It Happen

Click here to access our complete index of 83 Fast Growing Indian Companies With High Insider Ownership.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:FIVESTAR NSEI:PAYTM and NSEI:TRIVENI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance