June 2024 Insight On Growth Stocks With High Insider Ownership

As global markets continue to navigate through a mixed landscape of economic signals, with the S&P 500 reaching new highs and sectors like manufacturing showing robust growth, investors are keenly watching for opportunities that align with these evolving conditions. In this context, growth companies with high insider ownership can be particularly compelling, as significant insider stakes often signal confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Cettire (ASX:CTT) | 28.7% | 26.7% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

Gaming Innovation Group (OB:GIG) | 25.7% | 36.9% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

Vow (OB:VOW) | 31.8% | 97.6% |

Adocia (ENXTPA:ADOC) | 12.1% | 104.5% |

We'll examine a selection from our screener results.

Jalles Machado S/A

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jalles Machado S/A, operating in the production, marketing, and exportation of sugar, ethanol, and other sugarcane by-products, has a market capitalization of approximately R$2.02 billion.

Operations: Jalles Machado S/A generates revenue primarily through its AED Goiás segment, which brought in R$1.41 billion, followed by the AED Minas Gerais and Energy segments with revenues of R$406.08 million and R$97.11 million respectively.

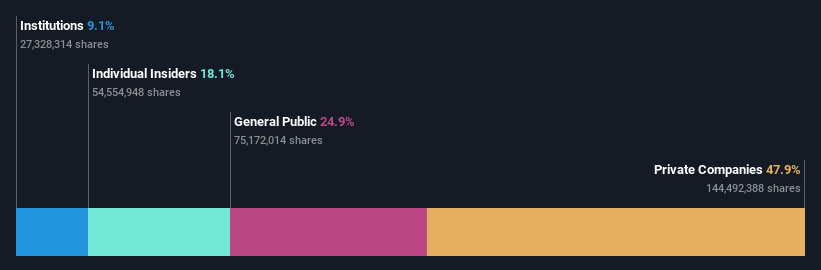

Insider Ownership: 18.1%

Earnings Growth Forecast: 58.1% p.a.

Jalles Machado S/A has demonstrated a dynamic growth trajectory with earnings expected to increase significantly, forecasted at 58.1% annually, outpacing the Brazilian market's average. However, recent financials show a substantial decline in net income from BRL 692.33 million to BRL 85.12 million year-over-year, with profit margins also dropping sharply from 40.5% to 4.5%. Additionally, shareholder value has been diluted over the past year, and dividends are poorly covered by earnings and cash flows, raising concerns about financial sustainability despite high insider ownership.

MRV Engenharia e Participações

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MRV Engenharia e Participações S.A., along with its subsidiaries, functions as a real estate developer primarily in Brazil and the United States, with a market capitalization of approximately R$3.79 billion.

Operations: The company's revenue is generated through three main segments: Luggo with R$4.00 million, Urba at R$160.55 million, and MRV contributing the largest share with R$7.23 billion; it also has a presence in the U.S. market through its Resia segment which earned R$31.11 million.

Insider Ownership: 32.4%

Earnings Growth Forecast: 71.5% p.a.

MRV Engenharia e Participações is trading at a significant discount, priced 61.2% below its estimated fair value, signaling potential undervaluation. Expected to turn profitable within three years, MRV's forecasted revenue growth at 7.7% annually is slightly above the Brazilian market prediction of 7.3%. However, challenges include a low forecasted return on equity of 13.4% and earnings barely covering interest payments, indicating financial strain despite recent efforts like a BRL 300 million unsecured debenture issue to strengthen its capital structure.

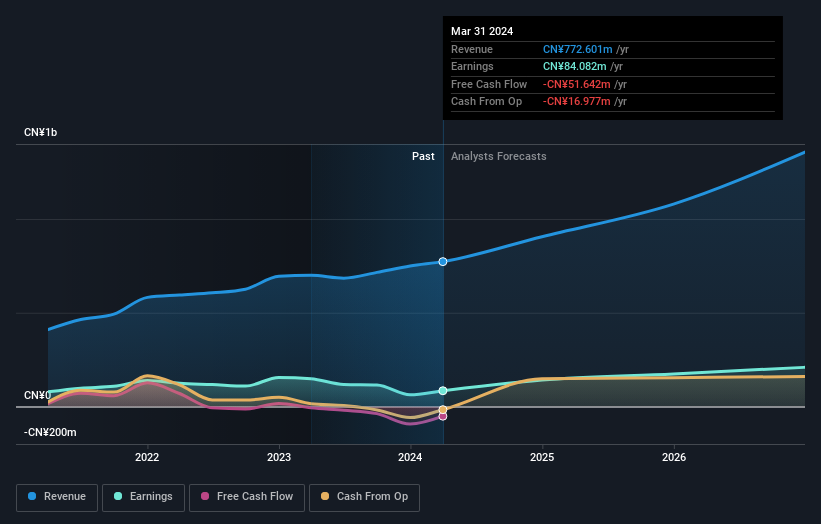

Pansoft

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pansoft Company Limited specializes in offering enterprise management information solutions and IT integrated services across China, with a market capitalization of approximately CN¥3.06 billion.

Operations: The firm specializes in enterprise management information solutions and IT integrated services, achieving a market capitalization of approximately CN¥3.06 billion.

Insider Ownership: 34.8%

Earnings Growth Forecast: 29.5% p.a.

Pansoft, a company with high insider ownership, has shown mixed performance recently. While its revenue is forecasted to grow at 19.6% annually, outpacing the Chinese market's 13.7%, its profit margins have declined from last year's 21.2% to 10.9%. Despite a lower Price-To-Earnings ratio of 36.4x compared to the industry average of 57.9x, challenges such as recent drops from major indexes and reduced dividends signal potential concerns for investors looking for stable growth avenues in growth-oriented companies with substantial insider stakes.

Click here to discover the nuances of Pansoft with our detailed analytical future growth report.

Our valuation report unveils the possibility Pansoft's shares may be trading at a premium.

Where To Now?

Click here to access our complete index of 1458 Fast Growing Companies With High Insider Ownership.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include BOVESPA:JALL3BOVESPA:MRVE3 and SZSE:300996

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance