July 2024 SGX Dividend Stocks Analysis

As the Singapore market navigates through evolving global financial landscapes, investors are keenly observing trends and performances across various sectors. In this context, understanding the attributes of resilient dividend stocks becomes crucial, especially in a climate marked by technological advancements and security enhancements in banking practices.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

BRC Asia (SGX:BEC) | 7.24% | ★★★★★☆ |

Multi-Chem (SGX:AWZ) | 8.53% | ★★★★★☆ |

China Sunsine Chemical Holdings (SGX:QES) | 6.34% | ★★★★★☆ |

Civmec (SGX:P9D) | 5.83% | ★★★★★☆ |

Singapore Exchange (SGX:S68) | 3.56% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.81% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.80% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.62% | ★★★★★☆ |

Singapore Airlines (SGX:C6L) | 6.95% | ★★★★★☆ |

Sing Investments & Finance (SGX:S35) | 6.03% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top SGX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Multi-Chem

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Multi-Chem Limited is an investment holding company that distributes information technology products across regions including Singapore, Greater China, Australia, and India, with a market capitalization of SGD 256.77 million.

Operations: Multi-Chem Limited generates revenue from its IT business in Singapore (SGD 372.78 million), Australia (SGD 54.60 million), India (SGD 40.56 million), Greater China (SGD 34.96 million), and other regions (SGD 153.93 million), alongside a smaller PCB business in Singapore contributing SGD 1.79 million.

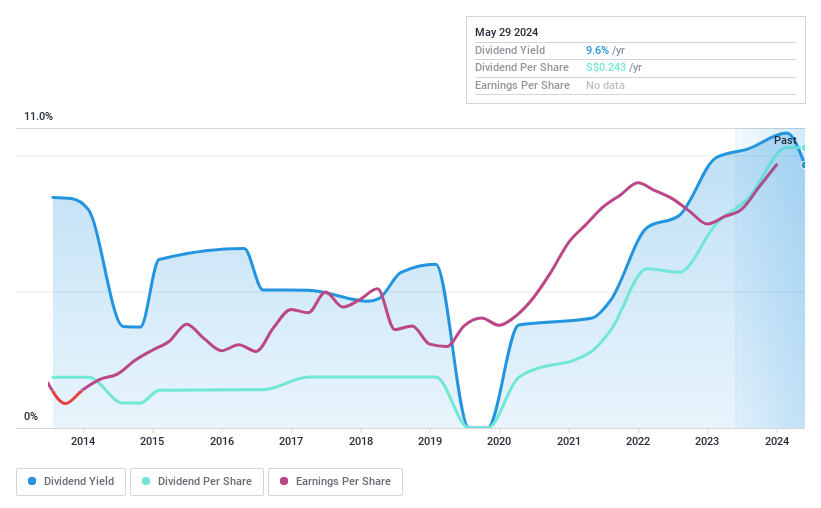

Dividend Yield: 8.5%

Multi-Chem Limited, a Singapore-based company, offers a dividend yield of 8.53%, ranking in the top 25% of SG market payers. Despite its high yield, the company's dividends have shown volatility over the past decade. Its payout ratio stands at 80.7%, with earnings adequately covering these payouts; however, cash flows are slightly tighter with an 88.1% cash payout ratio. Recent board changes include appointing Chong Teck Sin as Independent Non-Executive Director and Board Chairman effective April 30, 2024, signaling potential governance strengthening which could impact future dividend stability and growth strategies.

Dive into the specifics of Multi-Chem here with our thorough dividend report.

Our valuation report unveils the possibility Multi-Chem's shares may be trading at a discount.

BRC Asia

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BRC Asia Limited operates in the prefabrication of steel reinforcement for concrete, serving markets including Singapore, Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, India, and more globally with a market capitalization of SGD 606.31 million.

Operations: BRC Asia Limited generates its revenue primarily from two segments: Trading, which brought in SGD 319.71 million, and Fabrication and Manufacturing, contributing SGD 1.35 billion.

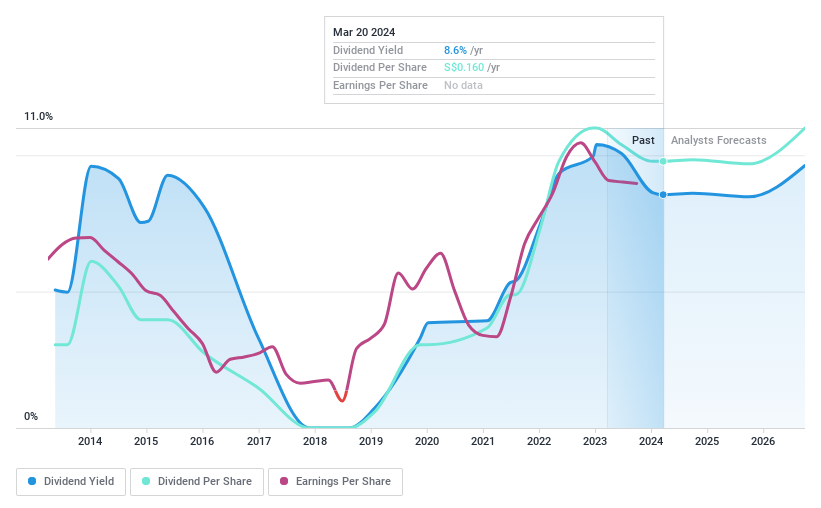

Dividend Yield: 7.2%

BRC Asia Limited, while trading at 57.5% below its estimated fair value, exhibits a mixed dividend profile. Its dividends have shown volatility over the past decade, yet recent increases signal potential stability. The company's dividends are well-covered by earnings with a payout ratio of 35.9%, and cash flows with an 85.3% cash payout ratio, supporting ongoing payments despite past inconsistencies. Recent financials indicate robust growth with net income rising to SGD 38.53 million from SGD 26.24 million year-over-year, reflecting positive momentum.

DBS Group Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DBS Group Holdings Ltd is a major provider of commercial banking and financial services across Singapore, Hong Kong, Greater China, South and Southeast Asia, and internationally, with a market capitalization of approximately SGD 107.96 billion.

Operations: DBS Group Holdings Ltd generates its revenue primarily from commercial banking and financial services across diverse regions including Singapore, Hong Kong, Greater China, South and Southeast Asia.

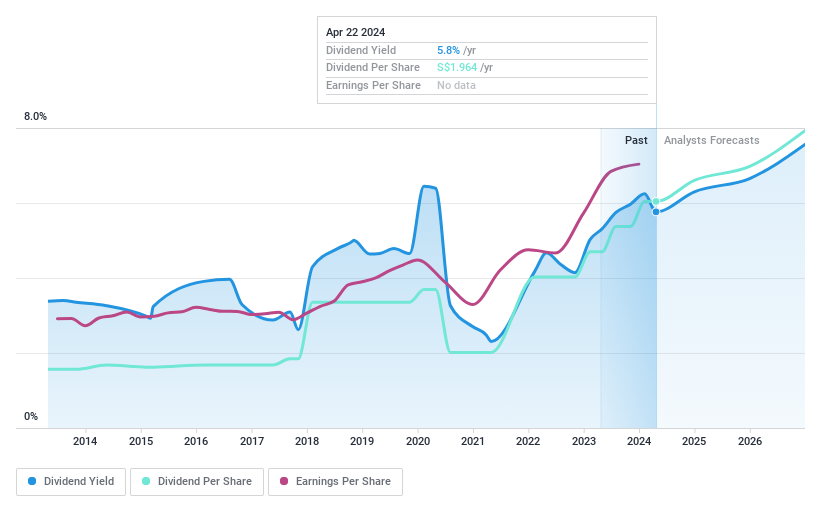

Dividend Yield: 5.2%

DBS Group Holdings, despite a lower dividend yield of 5.17% compared to the market's top quartile, shows a commitment to maintaining payouts with a solid coverage by earnings at a 50.8% payout ratio. However, dividends have been inconsistent over the past decade, reflecting some volatility in payments. Recent leadership changes aim to enhance operational stability following technical disruptions, potentially supporting future dividend reliability. The company's net income increased to SGD 2.96 billion from SGD 2.57 billion year-over-year, indicating strong financial performance which could underpin continued dividend payments.

Key Takeaways

Unlock more gems! Our Top SGX Dividend Stocks screener has unearthed 17 more companies for you to explore.Click here to unveil our expertly curated list of 20 Top SGX Dividend Stocks.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:AWZ SGX:BECSGX:D05.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance