July 2024 Insights Into Japanese Exchange Stocks Estimated Below Intrinsic Value

Amid a week of notable gains for Japan’s stock markets, with the Nikkei 225 and TOPIX indices rising sharply due to a historically weak yen boosting export-heavy industries, investors are keenly observing opportunities within this vibrant market landscape. In such an environment, identifying stocks that appear undervalued relative to their intrinsic value could be particularly compelling, offering potential for discerning investors.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

Name | Current Price | Fair Value (Est) | Discount (Est) |

Link and Motivation (TSE:2170) | ¥479.00 | ¥923.53 | 48.1% |

Mimaki Engineering (TSE:6638) | ¥1962.00 | ¥3878.93 | 49.4% |

Hamee (TSE:3134) | ¥1125.00 | ¥2156.24 | 47.8% |

Cyber Security Cloud (TSE:4493) | ¥2300.00 | ¥4355.24 | 47.2% |

Sumco (TSE:3436) | ¥2462.00 | ¥4590.57 | 46.4% |

S-Pool (TSE:2471) | ¥322.00 | ¥623.96 | 48.4% |

Macromill (TSE:3978) | ¥872.00 | ¥1679.80 | 48.1% |

Bushiroad (TSE:7803) | ¥387.00 | ¥720.91 | 46.3% |

Money Forward (TSE:3994) | ¥5212.00 | ¥10435.23 | 50.1% |

LibertaLtd (TSE:4935) | ¥514.00 | ¥985.57 | 47.8% |

Below we spotlight a couple of our favorites from our exclusive screener

Sumco

Overview: Sumco Corporation, with a market cap of ¥860.93 billion, operates globally in manufacturing and selling silicon wafers for the semiconductor industry across Japan, the United States, China, Taiwan, and Korea.

Operations: The company generates its revenues by manufacturing and selling silicon wafers, primarily serving the semiconductor industry across various global markets including Japan, the United States, China, Taiwan, and Korea.

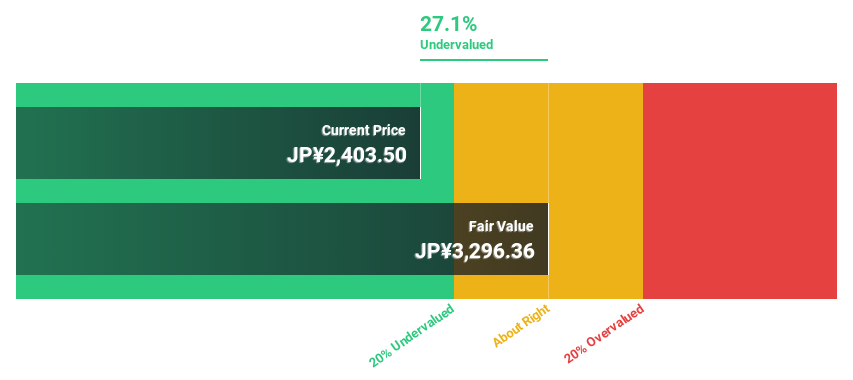

Estimated Discount To Fair Value: 46.4%

Sumco, currently trading at ¥2462, is significantly undervalued by over 20% against a fair value estimate of ¥4546.04. Despite a recent dividend cut to ¥10 per share and an unstable dividend outlook for the end of 2024, Sumco's earnings are expected to grow robustly at 24.2% annually. However, its profit margins have declined from last year's 20.6% to 7.6%, and the dividends are not well supported by cash flows, reflecting potential financial stress or strategic shifts in capital allocation.

Our growth report here indicates Sumco may be poised for an improving outlook.

Click to explore a detailed breakdown of our findings in Sumco's balance sheet health report.

Tokuyama

Overview: Tokuyama Corporation, operating in Japan, engages in the production and sale of a diverse range of chemical products with a market capitalization of approximately ¥214.98 billion.

Operations: The firm operates primarily in the chemical sector, focusing on the manufacture and distribution of a variety of chemical products.

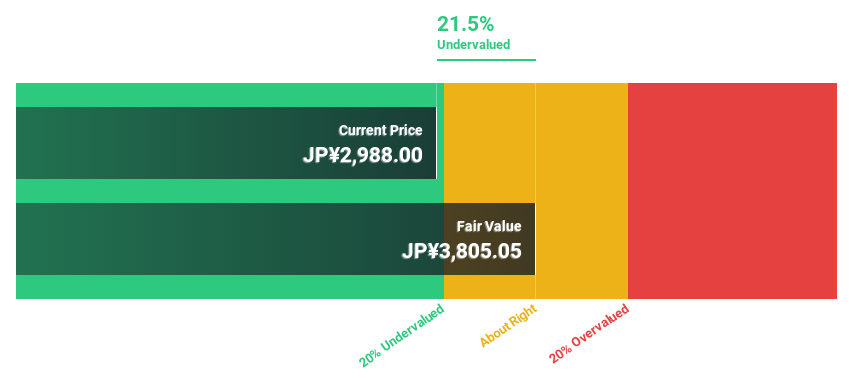

Estimated Discount To Fair Value: 21.5%

Tokuyama is trading at ¥2988, below the estimated fair value of ¥3795.43, indicating a potential undervaluation of over 20%. While the company's revenue growth at 4.7% per year slightly exceeds Japan's market average, its earnings are expected to increase significantly by 20.4% annually. However, concerns include a low forecasted return on equity at 11.6% in three years and an unstable dividend history despite recent increases to JPY 50 per share for FY2025 from JPY 45 last year.

SCREEN Holdings

Overview: SCREEN Holdings Co., Ltd. is a Japanese company that specializes in developing, manufacturing, selling, and maintaining semiconductor production equipment, with a market capitalization of approximately ¥1.51 trillion.

Operations: The firm specializes in the semiconductor production equipment sector.

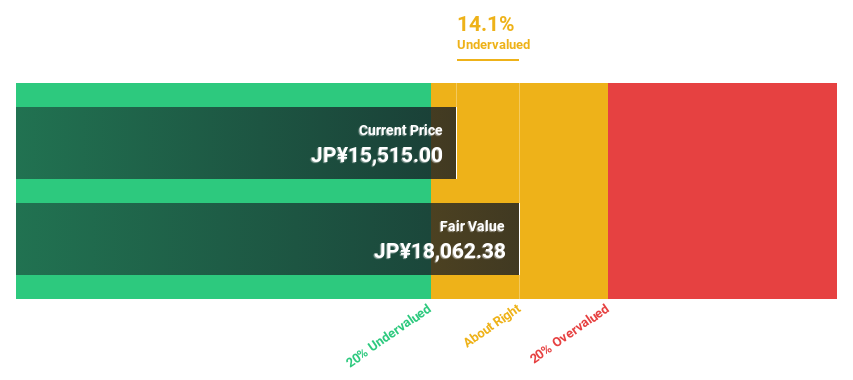

Estimated Discount To Fair Value: 14.1%

SCREEN Holdings, priced at ¥15515, is considered undervalued against a fair value of ¥18058.32. The company's revenue growth is projected at 8.6% annually, outpacing the Japanese market average of 4.2%. Despite this, its earnings growth forecast of 9.7% per year only modestly exceeds the broader market expectation of 8.8%. Recent index changes and a dividend cut from JPY 167 to JPY 124 per share reflect some operational and market challenges, adding layers to its investment profile amidst notable volatility in share price.

Key Takeaways

Investigate our full lineup of 94 Undervalued Japanese Stocks Based On Cash Flows right here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:3436 TSE:4043 and TSE:7735.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance