July 2024 Insights Into ASX Stocks Estimated To Be Trading Below Value

In the past year, the Australian stock market has experienced a steady rise, increasing by 11%, despite remaining flat over the last week. With earnings forecasted to grow by 13% annually, stocks trading below their intrinsic value present potential opportunities for investors looking to capitalize on current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

Name | Current Price | Fair Value (Est) | Discount (Est) |

MaxiPARTS (ASX:MXI) | A$2.02 | A$3.99 | 49.4% |

Ansell (ASX:ANN) | A$25.37 | A$49.52 | 48.8% |

GTN (ASX:GTN) | A$0.435 | A$0.85 | 48.6% |

Elders (ASX:ELD) | A$8.53 | A$16.28 | 47.6% |

IPH (ASX:IPH) | A$6.15 | A$11.93 | 48.5% |

hipages Group Holdings (ASX:HPG) | A$1.07 | A$2.05 | 47.9% |

ReadyTech Holdings (ASX:RDY) | A$3.28 | A$6.22 | 47.3% |

Australian Clinical Labs (ASX:ACL) | A$2.50 | A$4.72 | 47.1% |

Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

SiteMinder (ASX:SDR) | A$5.24 | A$9.96 | 47.4% |

We're going to check out a few of the best picks from our screener tool

Lovisa Holdings

Overview: Lovisa Holdings Limited operates in the retail sale of fashion jewelry and accessories, with a market capitalization of approximately A$3.51 billion.

Operations: The company generates its revenue primarily from the retail sale of fashion jewelry and accessories, totaling A$653.997 million.

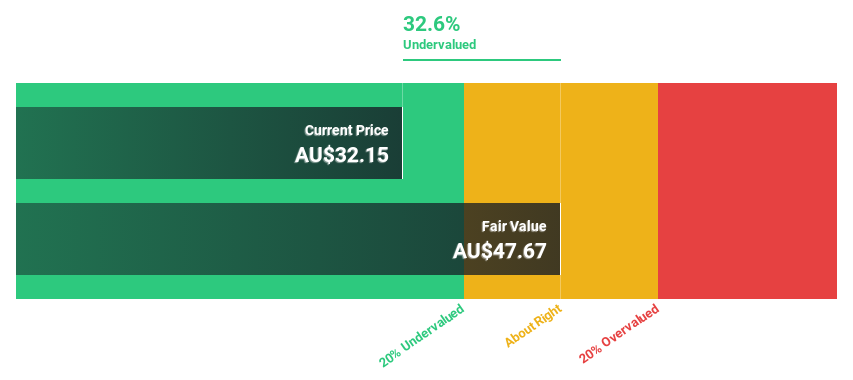

Estimated Discount To Fair Value: 37.1%

Lovisa Holdings is currently trading at A$32, significantly below the estimated fair value of A$50.86, indicating strong undervaluation based on discounted cash flows. Despite earnings growth of 5.8% last year, future earnings are expected to rise by 17.37% annually, outpacing the Australian market's forecast of 13.1%. However, revenue growth projections of 13.4% per year lag behind the more aggressive industry benchmark of 20%. Return on equity for Lovisa is anticipated to be very high in three years at 99.7%.

PolyNovo

Overview: PolyNovo Limited is a company that develops medical devices and operates across the United States, Australia, New Zealand, the United Kingdom, Ireland, Singapore, and other international markets with a market capitalization of approximately A$1.61 billion.

Operations: The company generates revenue primarily from the development, manufacturing, and commercialization of the NovoSorb technology, totaling A$83.47 million.

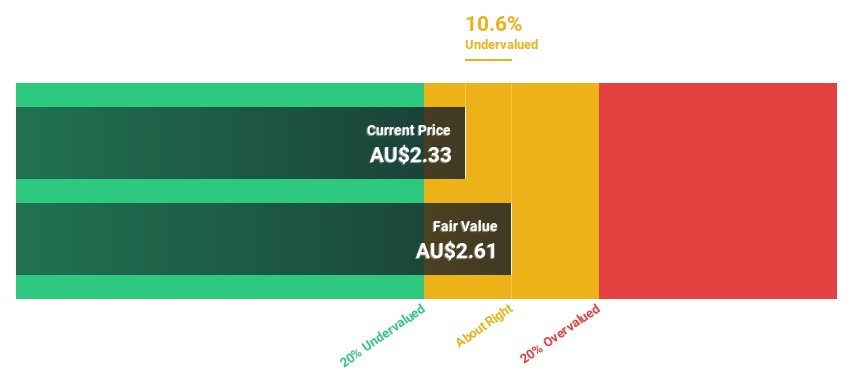

Estimated Discount To Fair Value: 10.6%

PolyNovo, priced at A$2.33, trades below its calculated fair value of A$2.61, suggesting mild undervaluation. Its earnings are projected to grow by 39.08% annually, significantly outpacing the Australian market's 13.1% growth expectation. Additionally, PolyNovo's revenue is expected to increase by 18% per year, surpassing the market average of 5.3%. This growth comes as PolyNovo supports Spectral AI’s entry into the Australian market through a recent MOU aimed at deploying medical systems in major hospitals.

The growth report we've compiled suggests that PolyNovo's future prospects could be on the up.

Navigate through the intricacies of PolyNovo with our comprehensive financial health report here.

SiteMinder

Overview: SiteMinder Limited, operating both in Australia and internationally, develops and markets an online guest acquisition platform and commerce solutions for accommodation providers, with a market capitalization of approximately A$1.45 billion.

Operations: The company generates revenue primarily through its software and programming segment, which brought in A$171.70 million.

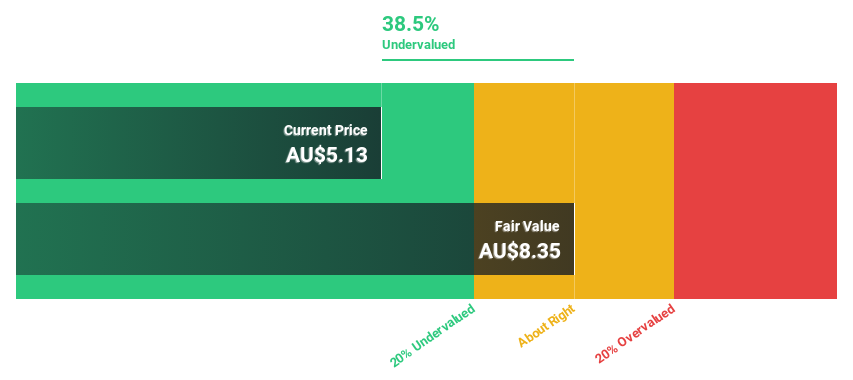

Estimated Discount To Fair Value: 47.4%

SiteMinder, with a current price of A$5.24, is perceived as undervalued against a fair value estimate of A$9.96 based on discounted cash flows. The company's earnings are expected to surge by 74.67% annually, and its revenue growth forecast at 19.1% annually outstrips the Australian market's 5.3%. Recent strategic partnership with Cloudbeds enhances SiteMinder’s platform capabilities, potentially boosting future revenue streams and operational efficiencies in the global hotel sector.

Unlock comprehensive insights into our analysis of SiteMinder stock in this financial health report.

Key Takeaways

Unlock more gems! Our Undervalued ASX Stocks Based On Cash Flows screener has unearthed 47 more companies for you to explore.Click here to unveil our expertly curated list of 50 Undervalued ASX Stocks Based On Cash Flows.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:LOV ASX:SDR and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance